EUR/USD took Macron’s victory with a stride, having priced in the election from the outset. GDP and inflation data stand out in the third week of May. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

Emmanuel Macron is the next French president. The young centrist still has the bigger task of governing but for markets, his victory is a big relief. German GDP met expectations and reached 0.6%, a robust level. In the US, President Trump has fired FBI Director James Comey. The controversial move triggered speculation that it will be harder for the Administration to enact tax reform. The dollar dropped but the worries were shrugged off quickly.

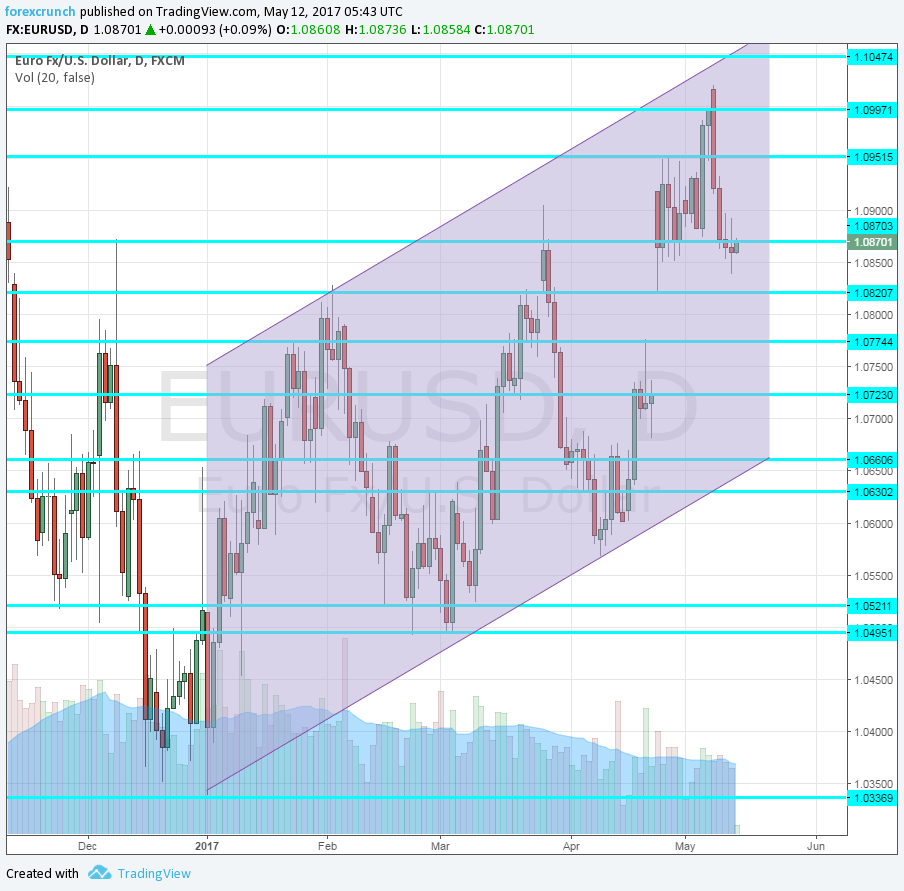

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- French CPI (final): Tuesday, 6:45. According to the preliminary data, prices rose in France by 0.1% in April. The final read will likely confirm it.

- Italian GDP: Tuesday, 8:00. Italy’s third-largest economy suffers from subdued growth in comparison to the other big economies in the euro-zone. After 0.2% in Q4 2016, the exact same rate is predicted now.

- GDP: Tuesday, 9:00. According to the initial GDP read for Q1 2017, the euro-zone economy grew by 0.5% q/q. This updated figure already takes the Italian and the German number into its calculations and could change. However, a repeat is predicted.

- German ZEW Economic Sentiment: Tuesday, 9:00. ZEW releases its business survey early in the month. Back in April, economic sentiment advanced to 19.5 points, above early projections. Another upbeat number could follow: 22.3 is predicted. The all-European figure is also predicted to advance: from 26.3 to 29.1 points.

- Trade Balance: Tuesday, 9:00. The euro-zone enjoys a trade surplus thanks to Germany’s exports. Back in February, trade stood at 19.2 billion. A similar figure is on the cards now: 18.8 billion.

- CPI (final): Wednesday, 9:00. The preliminary inflation estimates showed a pickup in inflation in April: 1.9% on the headline and a surprisingly strong jump in core inflation at 1.2%. The final read should confirm these early assessments.

- German PPI: Friday, 6:00. Producer prices feed into the prices paid by consumers. Prices remained flat in March. April could see PPI picking up: +0.2%.

- Current Account: Friday, 8:00. Similar to the narrower trade balance figure, also the current account is positive. In February, this surplus ballooned to 37.9 billion. It is now forecast to dip to 32.3 billion.

- Consumer Confidence: Friday, 14:00. The 2300-strong survey is showing an improvement, but the figure still remains negative, reflecting pessimism. A score of -4 was seen in April and a small rise to -3 is forecast now.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar started off the week just above the 1.10 level (mentioned last week).

Technical lines from top to bottom:

1.13 is the top line seen in November before the collapse. 1.1120 was a support line beforehand.

The round number of 1.10 is a key psychological level. 1.0950 is close by, and the most recent 2017 high.

The swing high of 1.0870 is the swing high in December and remains fierce resistance. 1.0820 was the post French elections low.

1.0775 capped the pair in January and remains of importance. 1.0720 was also a high in January.

The pair was unable to crack 1.0660 in February and it remains the high end of the range. 1.0630 is the next level, holding back the pair in February and March.

Uptrend channel stays intact

EUR/USD has had three significant and rising lows in 2017: 1.0340 in the wake of the year, 1.0490 in March and 1.0565 in April. Also on the topside, we can see higher highs. If this is the case, there is more room to the upside than to the downside.

I remain bullish on EUR/USD

While the euro suffered some “buy the rumor, sell the fact” on Macron’s victory and is now set to enjoy the upbeat economic news from the old continent. In the US, there are doubts about a rate hike in June.

Our latest podcast is titled Brexit bites the BOE, volatility evaporates

Follow us on Sticher or iTunes

Safe trading!