- A set of PMI figures revealed a significant drop in business activity in the Eurozone.

- US unemployment claims dropped, indicating tight labor market conditions.

- US inflation increased by 0.1% compared to estimates of a 0.2% increase.

The EUR/USD weekly forecast shows a neutral bias as the Eurozone economy weakens and Fed rate cut bets soar.

Ups and downs of EUR/USD

The EUR/USD fluctuated this week and ended nearly flat amid a mix of US and Eurozone data. When the week began, a set of PMI figures revealed a significant drop in business activity in the Eurozone. This raised pressure on the ECB to continue cutting interest rates, weighing on the euro.

–Are you interested in learning more about Canada forex brokers? Check our detailed guide-

Meanwhile, US business activity held steady as the economy remained resilient despite high interest rates. Moreover, unemployment claims dropped, indicating tight labor market conditions.

However, the dollar weakened on Friday after the core PCE report revealed cooler-than-expected inflation. Price pressures increased by 0.1% compared to estimates of a 0.2% increase, raising the likelihood of another massive rate cut in November.

Next week’s key events for EUR/USD

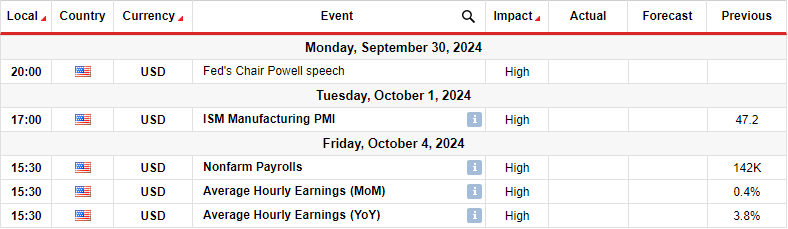

Next week, market participants will pay attention to key US reports, including manufacturing business activity and the nonfarm payrolls report. Moreover, Federal Reserve Chair Jerome Powell will speak on Monday.

The focus for the week will be the monthly employment report. Notably, the Fed is paying close attention to the labor market for any weakness. At the last meeting, the central bank cut rates by 50-bps, saying it was meant to keep the unemployment rate low. Therefore, traders will watch job growth and unemployment in September for clues on the Fed’s next policy move. Economists expect the economy to add 144,000 jobs in September.

EUR/USD weekly technical forecast: Bulls show weakness at the 1.1175 resistance

On the technical side, the EUR/USD price has revisited the 1.1175 resistance level, where it has paused. At the same time, the RSI has made a bearish divergence, indicating fading bullish momentum. The price has remained in a bullish trend, making higher highs and lows. However, the RSI showed weakness in the most recent move.

–Are you interested in learning more about social trading platforms? Check our detailed guide-

Therefore, there is a chance the price might reverse to challenge the 22-SMA and the bullish trendline. A break below these levels would clear the path to the 1.1000 support level. Here, bears will fight to break the previous low and start making lower highs and lows. Such a move would confirm the start of a bearish trend.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money