GBP/USD dropped sharply last week, dropping 230 points. The pair closed at 1.2781, its lowest weekly close in four weeks. This week’s key events are Manufacturing and Construction PMIs. Here is an outlook for the highlights of this week and an updated technical analysis for GBP/USD.

The bombing in Manchester has thrown a wrench into the British election, as the Conservatives’ lead has been cut sharply. Although Theresa May is expected to form a majority government, the pound plunged in response to the latest opinion polls. Over in the US, the Fed rate statement was more cautious than expected, which weighed on the US dollar. In the US, revised GDP report posted a respectable gain of 1.2%, beating the estimate.

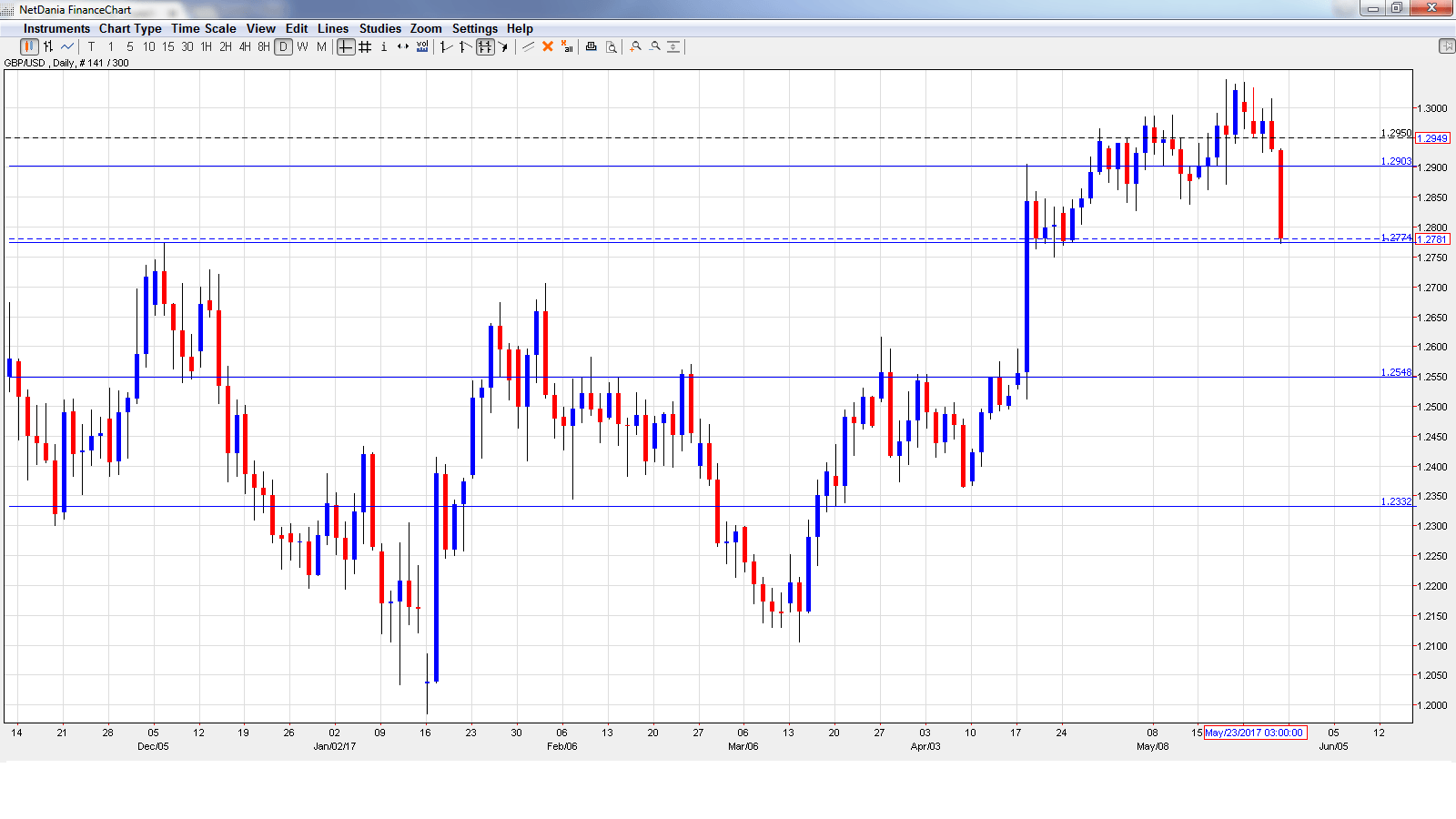

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD graph with support and resistance lines on it. Click to enlarge:

- BRC Shop Price Index: Tuesday, 23:01. This consumer inflation report continues to post declines, but the rate of decline has been lower over the past three readings. In April, the index came in at -0.5%. Will we see a reading in positive territory in May?

- GfK Consumer Confidence: Tuesday, 23:01. The British consumer remains pessimistic about the economy according to this indicator, which continues to record readings below zero. The estimate for May stands at -8 points.

- Net Lending to Individuals: Wednesday, 8:30. Borrowing levels are closely watched, as they are linked to consumer spending levels. The indicator dipped to GBP 4.7 billion in March, but this beat the estimate of GBP 4.5 billion. The downward trend is expected to continue, with an estimate of GBP 4.5 billion.

- Nationwide HPI: Thursday, 6:00. This housing price index is a useful gauge of the level of activity in the housing sector. The indicator has recorded two consecutive declines, missing expectations on both occasions. The markets are expecting better news in May, with an estimate of 0.2%.

- Manufacturing PMI: Thursday, 8:30. The index continues to point to expansion in the manufacturing sector, and the March reading of 57.3 beat expectations. The forecast for April stands at 56.5 points.

- 10-y Bond Auction: Thursday, Tentative. The yield on 10-year bonds dropped to 1.13%, its lowest since October 2016. Will we see a higher yield in the May release?

- Construction PMI: Friday, 8:30. The PMI has been fairly steady, pointing to modest expansion in the construction sector. The March reading of 53.1 beat the estimate of 52.1 points. The markets are expecting a slight dip in April, with an estimate of 52.7 points.

*All times are GMT

GBP/USD Technical Analysis

GBP/USD opened the week at 1.3009 and quickly hit a high of 1.3043. The pair dropped sharply late in the week, hitting a low of 1.2773, testing support at 1.2775 (discussed last week). The pair closed the week at 1.2781.

Technical lines from top to bottom

With the pound posting sharp losses last week, we begin at lower levels:

1.3247 has held in resistance since September 2016.

1.3112 marked a low point in June 2016 as the pound crashed after the Brexit vote.

1.3020 is protecting the symbolic 1.30 level.

1.2902 is next.

1.2775 is providing weak support. It could see action early in the week.

1.2548 is next.

1.2332 has provided support since March. It is the final support level for now.

I am bearish on GBP/USD.

Britain remains shaken from the Manchester attack, and the political uncertainty over the election as well as Brexit jitters could sour investors on the pound.

Our latest podcast is titled Poking holes in the FOMC and OPEC

Follow us on Sticher or iTunes

Safe trading!

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the kiwi, see the NZD/USD forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the Canadian dollar (loonie), check out the USD to CAD forecast.