GBP/USD rebounded last week, gaining 150 points. The pair closed at 1.3028. This week’s key events are the Inflation Hearings and Secondary Estimate GDP. Here is an outlook for the highlights of this week and an updated technical analysis for GBP/USD.

The pound took full advantage as investors soured on the dollar, due to scandals surrounding the Trump administration Trump has been accused of interfering in an investigation by FBI director James Comey, raising suspicion of obstruction of justice by Trump. The US dollar fell on market concerns that growth-friendly policies such as tax reform and increased fiscal spending could be stalled. As well, US construction numbers were soft. Strong consumer data in the UK also boosted the pound, as both CPI and retail sales beat estimates.

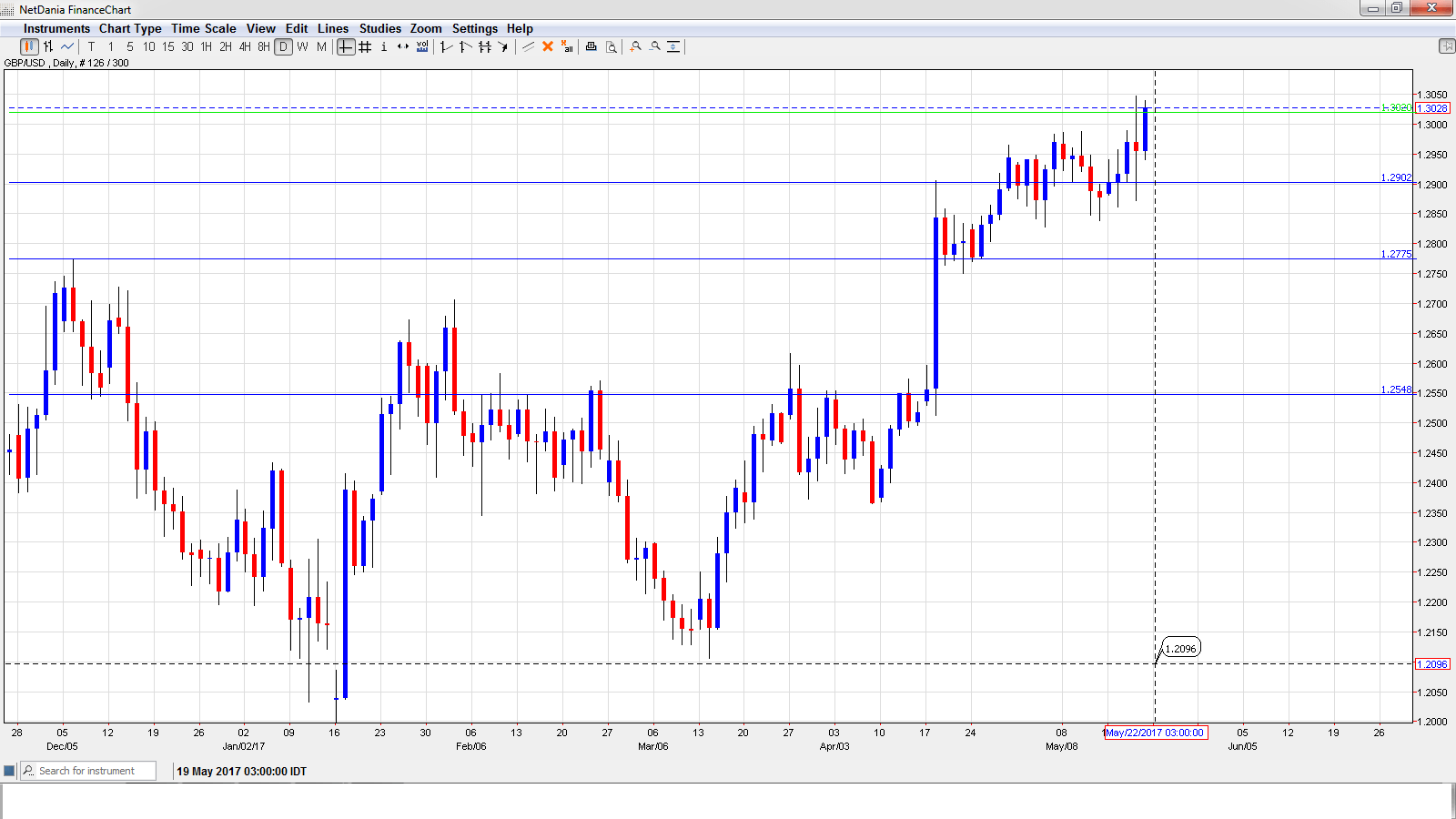

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD graph with support and resistance lines on it. Click to enlarge:

- Rightmove HPI: Sunday, 23:01. This house inflation report helps analysts gauge the strength of the housing sector. The indicator continued to soften in April, with a reading of 1.1%. Will the indicator rebound with a stronger reading for May?

- Public Sector Net Borrowing: Tuesday, 8:30. The UK deficit ballooned to GBP 4.4 billion in March, larger than the estimate of GBP 2.6 billion. Will we see an improvement in the April release?

- Inflation Report Hearings: Tuesday, 9:00. BoE Governor Mark Carney will testify before a parliamentary committee. Lawmakers will be keen to know if the BoE is considering raising interest rates due to rising inflation. This event should be treated as a market-mover.

- CBI Realized Sales: Tuesday, 10:00. Sales volume for retailers and wholesalers sparkled in April, jumping to 38 points. This figure crushed the estimate of 6 points. Will the indicator repeat with another strong reading?

- Second Estimate GDP: Thursday, 8:30: Preliminary GDP posted a gain of 0.3%, shy of the forecast of 0.4%. The markets are expecting an upwards revision of this figure, with Second Estimate GDP expected at 0.4%.

- Preliminary Business Investment: Thursday, 8:30.Business investment is a key driver of economic growth, and the quarterly release magnifies the impact of each reading. In Q4, the indicator declined 1.0%, short of the estimate of 0.0%. Will the indicator rebound in Q1?

*All times are GMT

GBP/USD Technical Analysis

GBP/USD opened the week at 1.2883. The pair quickly touched a low of 1.2862. The pair then reversed directions and climbed to a high of 1.3047, breaking resistance at 1.3020 (discussed last week). The pair closed the week at 1.3028.

Technical lines from top to bottom

We begin with resistance at 1.3444.

1.3347 has held in resistance since September 2016.

1.3247 is next.

1.3112 marked a low point in June 2016 as the pound crashed after the Brexit vote.

1.3020 has switched to a support level. It is a weak line.

1.2902 is next.

1.2775 is providing support.

1.2548 is the final support level for now.

I am neutral on GBP/USD.

Trump’s woes have hurt the dollar, but the US economy remains solid. There are growing concerns about the British economy, with the BoE warning that living standards will drop as a result of Brexit, Still, the pound is back above the symbolic 1.30 level, and any hints of an interest rate hike from the BoE would likely boost the pound.

Our latest podcast is titled Fading political risk, constructive on crude

Follow us on Sticher or iTunes

Safe trading!

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the kiwi, see the NZD/USD forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the Canadian dollar (loonie), check out the USD to CAD forecast.