AUD/USD was unchanged last week, closing at 0.7439. This week’s key events are Private Capital Expenditures and Retail Sales. Here is an outlook on the major market-movers and an updated technical analysis for AUD/USD.

Australian Retail Sales posted a strong gain of 1.0%, easily beating the estimate. In the US, Nonfarm Payrolls was dismal, as the gain of 138 thousand was well below expectations. This weak reading allowed the Aussie to recover and hold its own against the US dollar last week.

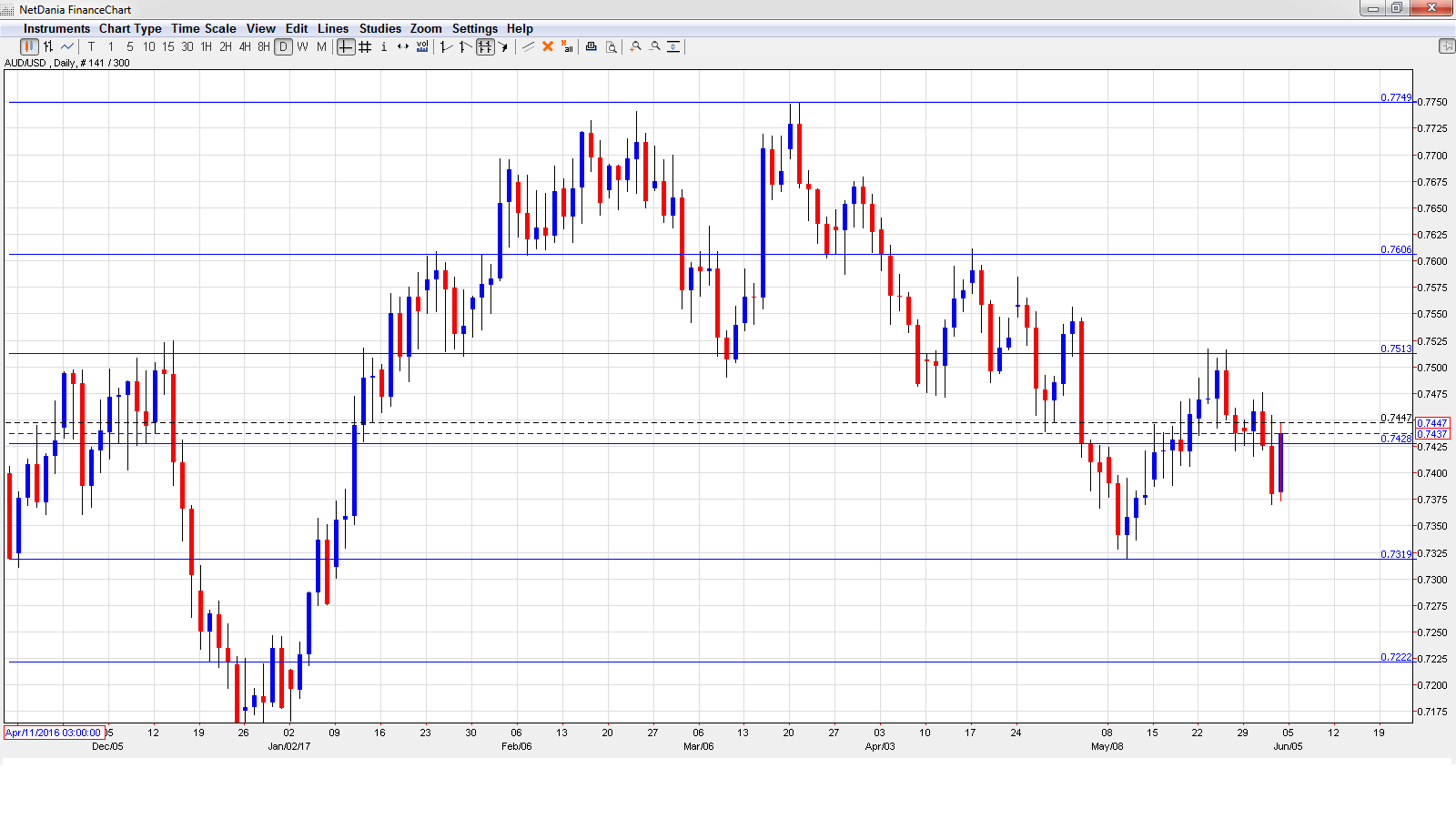

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- AIG Services Index: Sunday, 23:30. The services sector showed slight expansion in April, improving to 53.0. Will we see stronger expansion in the May report?

- MI Inflation Gauge: Monday, 1:00. This monthly indicator helps analysts gauge CPI, which is released each quarter. In April, the indicator improved to 0.5%, its strongest gain in three months.

- Company Operating Profits: Monday, 1:30. This indicator is an important gauge of the strength of the business sector. In Q4, the indicator jumped to 20.1%, well above the estimate of 8.0%. The markets are expecting a softer reading in Q1, with a forecast of 5.1%.

- Current Account: Tuesday, 1:30. Australia’s current account deficit narrowed sharply in Q4, falling to A$3.9 billion, within expectations. The positive trend is expected to continue, with a forecast of A$0.5 billion.

- RBA Rate Statement: Tuesday, 4:30. The RBA has held rates at 1.50% since August 2016. Although the economy has received a boost from stronger global demand, no change in monetary policy is expected in the June rate statement.

- AIG Construction Index: Tuesday, 23:30. The index remains stagnant, with the past two readings only slightly above the 50-point level, which separate contraction from expansion. Will we see an improvement in the April release?

- GDP: Wednesday, 1:30. GDP is one of the most important indicators, and should be treated as a market-mover. The news was positive in Q4, with a strong gain of 1.1%, above the forecast of 0.7%. The markets are expecting a weaker reading in Q1, with a forecast of 0.3%.

- Trade Balance: Thursday, 1:30. Australia’s trade surplus dipped to $3.11 billion, short of the estimate of $3.33 billion. The surplus is expected to continue to narrow, with an estimate of $1.99 billion.

- Chinese Trade Balance: Thursday, 1:30. China is Australia’s number one trading partner, so key Chinese releases can have a strong impact on the movement of AUD/USD. In April, the indicator jumped to $262 billion, well above expectations. The upward swing is expected to continue in May, with a forecast of $336 billion.

- Home Loans: Friday, 1:30. This indicator provides a snapshot of the strength of the housing sector. The indicator has posted two straight declines, and another soft reading is expected in April, with an estimate of -0.9%.

AUD/USD Technical Analysis

AUD/USD opened the week at 0.7442 and climbed to a high of 0.7476, as resistance held at 0.7513 (discussed last week). The pair then reversed directions and dropped to a low of 0.7370 late in the week. The pair closed the week at 0.7437.

Technical lines from top to bottom

0.7835 was the high point in April 2016.

0.7749 was a cap in March.

0.7605 is next.

0.7513 held in resistance as AUD/USD moved higher before retracting.

0.7429 remains an immediate support line.

0.7319 was the low point in May.

0.7223 is the next support line.

0.7105 has held since March 2016.

0.6998 is the final support level for now.

I am neutral on AUD/USD

Central banks will be on center stage this week, as the RBA and the Federal Reserve release rate statements. The RBA is expected to hold rates, and the markets have priced in a quarter-point increase by the Fed.

Our latest podcast is titled US labor market and UK’s Labour comeback

Follow us on Sticher or iTunes

Safe trading!

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast.