The Canadian dollar ticked lower last week, as USD/CAD closing at 1.3462. There are just two events on the calendar this week. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

Canada added 54.5 thousand jobs in May, crushing the estimate of 11.5 thousand. In the US, the markets are increasingly skeptical about Trump, underscored by Trump’s failure to pass any health-care or tax reform. The “dovish hike“ is unlikely to excite the markets and send the greenback higher.

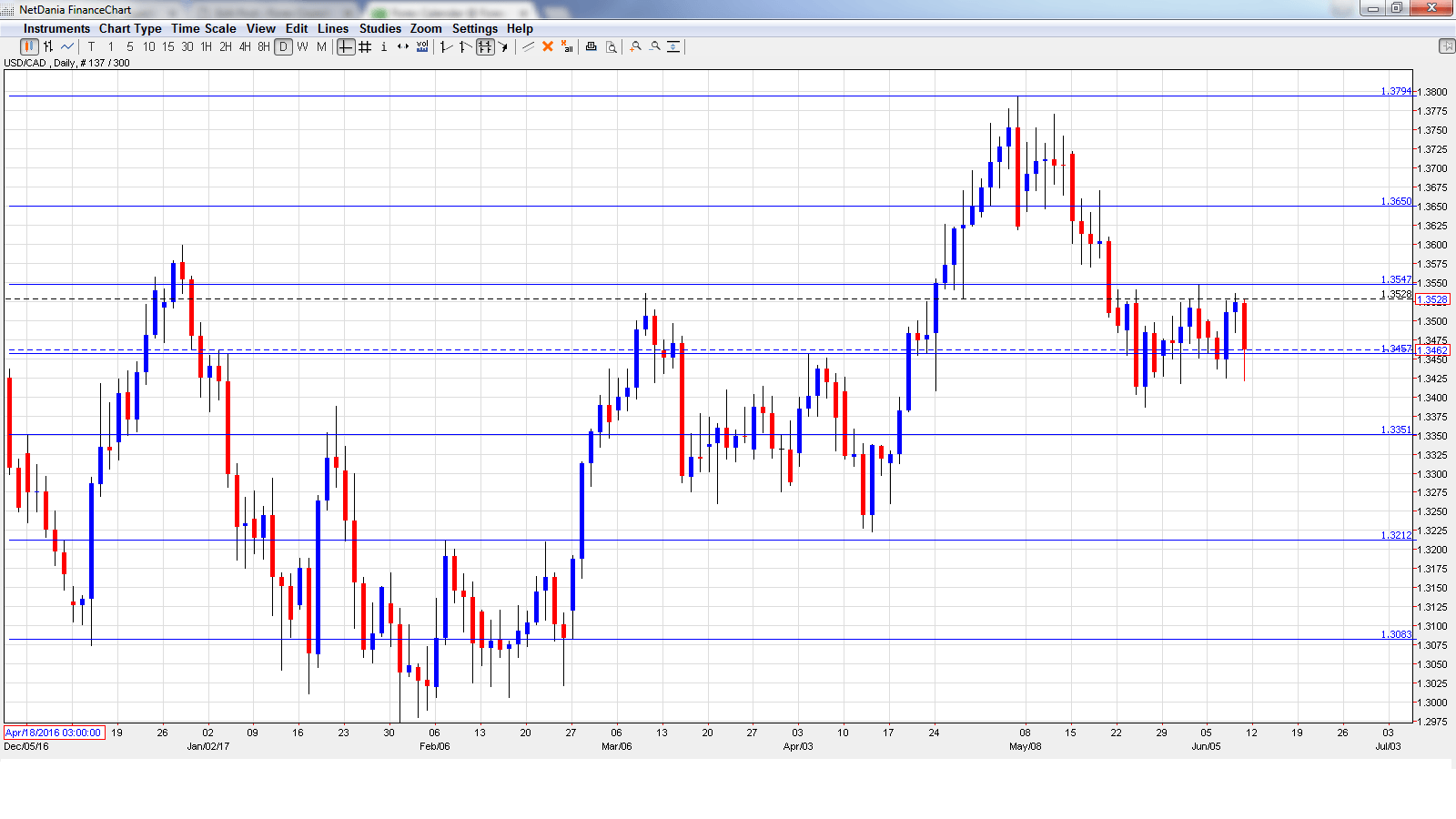

[do action=”autoupdate” tag=”USDCADUpdate”/]USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- Manufacturing Sales: Tuesday, 8:30. The indicator rebounded in March with a strong gain of 1.1%. This was just shy of the forecast of 1.1%. The estimate for April stands at 0.9%.

- Foreign Securities Purchases: Thursday, 8:30. The indicator dropped to C$15.13 billion in March, short of the estimate of C$17.23 billion. The downswing is expected to continue in April, with an estimate of C$12.14 billion.

USD/CAD Technical Analysis

USD/CAD opened the week at 1.3499 and touched a high of 1.3536 late in the week, as resistance held firm at 1.3551 (discussed last week). The pair was unable to consolidate at these levels and dropped to a low of 1.3421. USD/CAD closed the week at 1.3480.

Technical lines, from top to bottom

We start with resistance at the round number of 1.39.

1.3794 was the high for the month of May.

1.3648 is next.

1.3551 held firm for a second straight week as USD/CAD posted gains late in the week before retracting.

1.3457 was a high point in September 2015.

1.3351 has held in support since mid-April.

1.3212 is next.

1.3083 is the final support level for now.

I am neutral on USD/CAD

The BoC is unlikely to raise rates anytime soon, as there is plenty of slack in the economy. The markets have priced in a rate hike next week, and ongoing political turmoil in the US could weigh on the US dollar.

Our latest podcast is titled US labor market and UK’s Labour comeback

Follow us on Sticher or iTunes

Safe trading!

Further reading:

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the kiwi, see the NZDUSD forecast.