The President of the ECB gives a keynote speech in Sintra, Portugal and sounds more optimistic about the recovery. While laying out potential reasons for inflation, Draghi said that the accommodative policy will gradually be withdrawn. He did not provide any details but this is the beginning of the end of money printing.

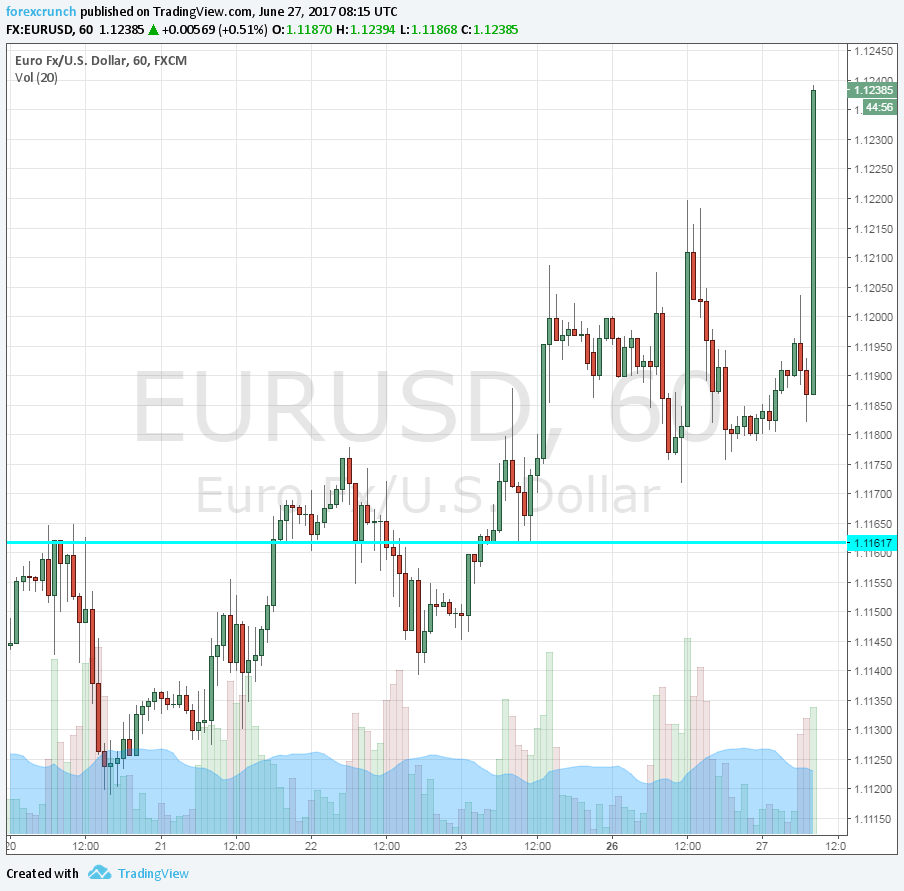

EUR/USD rises in range, reaching 1.1215. Update, EUR/USD has reached 1.1245, breaking resistance at 1.1230.

More: EUR/USD could reach 1.15 in Q3– ING

Among the key points:

- Growth is firming in the euro-zone

- Inflation is more muted than one would expect given growth

- Adjusting policy parameters will need to be gradual – at least he is talking about tapering

- Our steps have helped loans

- Spending has been rising while indebtedness has been falling

- This is a sign of a good recovery

- ECB needs persistence in monetary policy.

- We can look through supply-driven lower oil prices.

- Lower oil and food prices are behind the downgrade of our inflation forecasts.

- Falling import prices explain the lower core inflation.

- Changes in commodity prices feed into products used with high energy intensity and also services.

- This shows us that core inflation does not always give us a full picture.

- Global factors impact the path of inflation

- As the recovery broadens, the supply of labor is rising too.

- We also see evidence that labor supply is more elastic due to immigration, in places like Germany.

- The participation rate rose by 1.5% while it is falling in the US.

- Past reforms have also fed through

- The level of underemployment fell as well.

- U-6 is around 18%

- Phillips curve models that use U-6 are better in predicting inflation.

- New ECB analysis shows little evidence that the impact of global inflation has more impact on the euro-zone than in other places.

- The gap between unemployment measures opens up in crises and squeezes on recoveries.

- Expectations for lower growth feed into wages

- Our measures were effective in preventing deflation

- Wage indexation weigh on inflation, around 0.25% each year between 2014 and 2016

- Backward-looking wage indexation is mixed

- This phenomenon causes inertia but doesn’t counter the trends.

- We see temporary forces in work, but these do not change the bigger trends

- A few years ago, we had a risk of lower inflation becoming entrenched

- There was a risk of permanent damage to the economy due to hysteresis.

- Thins are looking better now.

Analysis: Can EUR/USD break above 1.13 after Draghi? Levels

Here is how the leap looks in the chart. Click to see the full image: