The missile that the North Korea fired was in the air for around 40 minutes, a very long time. This is not the first missile test and probably not the last. What is different now is the announcement coming out of Pyongyang, saying that it was an Intercontinental Ballistic Missile (ICBM), ordered by Kim Jong Un.

Thr authorities in the autocratic country say the missile reached a maximum altitude of 2800 kilometers and that it could reach any place in the world. Experts say it could reach Alaska if it is fired in a different angle. Can it reach the West Coast of the US? In any case, the level of threat is higher.

The timing is quite provocative: the 4th of July, America’s Independence Day. President Trump already warned the North Koreans. Will we see an escalation? It also comes after a meeting between Chinese President Xi Jinping and his Russian counterpart Vladimir Putin. Both countries have borders with the country.

USD/JPY falls – risk off

The Japanese yen enjoys flows in times of trouble, regardless of where the trouble comes from. In this case, the issues come from Japan’s neighborhood. While the news is that the ICBM could reach Alaska, Japan is much closer to the line of fire.

However, money flows into Japan and strengthens the yen. That is how markets work.

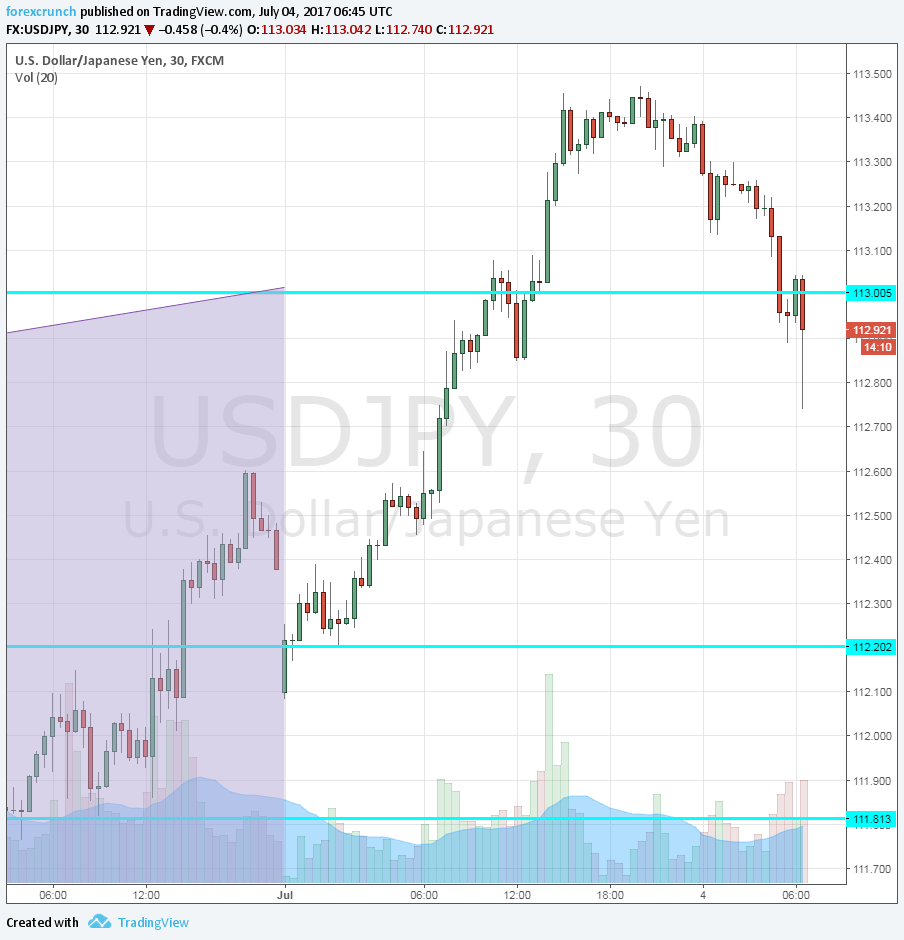

UDS/JPY is trading at 112.80, after reaching a low of 112.74. The pair erased its previous gain. The optimism that had prevailed in markets and the strong US data sent dollar/yen all the way to 113.47 yesterday.

Here is the chart, showing the big reversal: