Has EUR/USD ended its correction to the downside? A lot depends on the Non-Farm Payrolls, but the euro has its own reasons to rise. The ECB released its meeting minutes and it shows they discussed removing the easing bias.

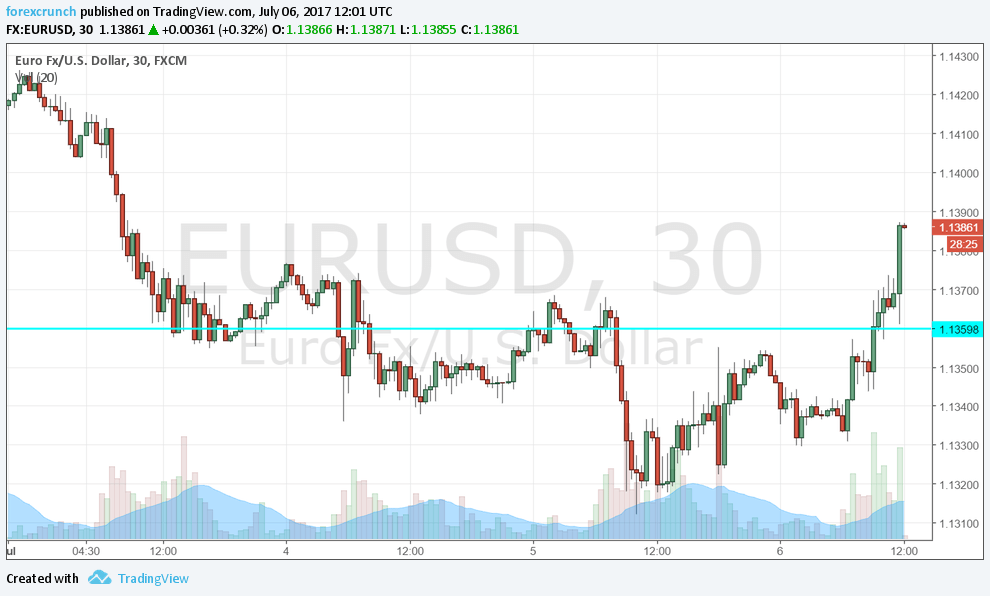

This was enough to send EUR/USD to 1.1386, already more than 50% of the correction from the peak of 1.1445 to 1.1312.

Update: The US ADP NFP missed expectations, EUR/USD almost touches 1.14.

These are minutes from the June meeting. At the time, the ECB removed the “downside risks” and shifted to balanced risks. They also removed the reference to even lower rates. However, Draghi did express concern about inflation, saying that core CPI hasn’t basically changed too much. In addition, the forecasts showed lower inflation in the future.

Since then, Draghi made his more optimistic Sintra speech, where he talked about gradually removing stimulus. Draghi’s words were later downplayed by the ECB, saying he wanted to strike a balance and not express optimism.

Also the minutes reveal that the ECB is somewhat worried about any changes in communications. They want their confidence to help the economies but do not want a stronger euro.

More: EUR/USD short-term model still shows a correction – BTMU

Here is how the recent move looks on the 30-minute chart. The meeting minutes sent German bund yields higher and also the euro is enjoying this relief rally, after many days under pressure. 1.1445 is still far.