The US services sector is growing at an accelerated speed: a score of 57.4 points, better than 56.5 expected. The expansion is seen in a strong order index, a robust business activity component and a recovery of prices from contraction to expansion territory.

However, this is not necessarily a positive sign for the Non-Farm Payrolls tomorrow. The employment component is actually down from 57.8 to 55.8 points.

This points to less hiring.

The US dollar is marginally stronger, halting its losses seen after the disappointing ADP NFP. However, the gains are very limited.

So far, the soft data looks strong: both ISM PMIs came out better than expected. Also Markit’s services PMI came out above expectations: 54.2 in the final read against the initial 53 point read. However, the hard data is soft: the ADP number which points to what actually happened, is down.

NFP Preview: jobs distraction could be an opportunity to trade the wage data

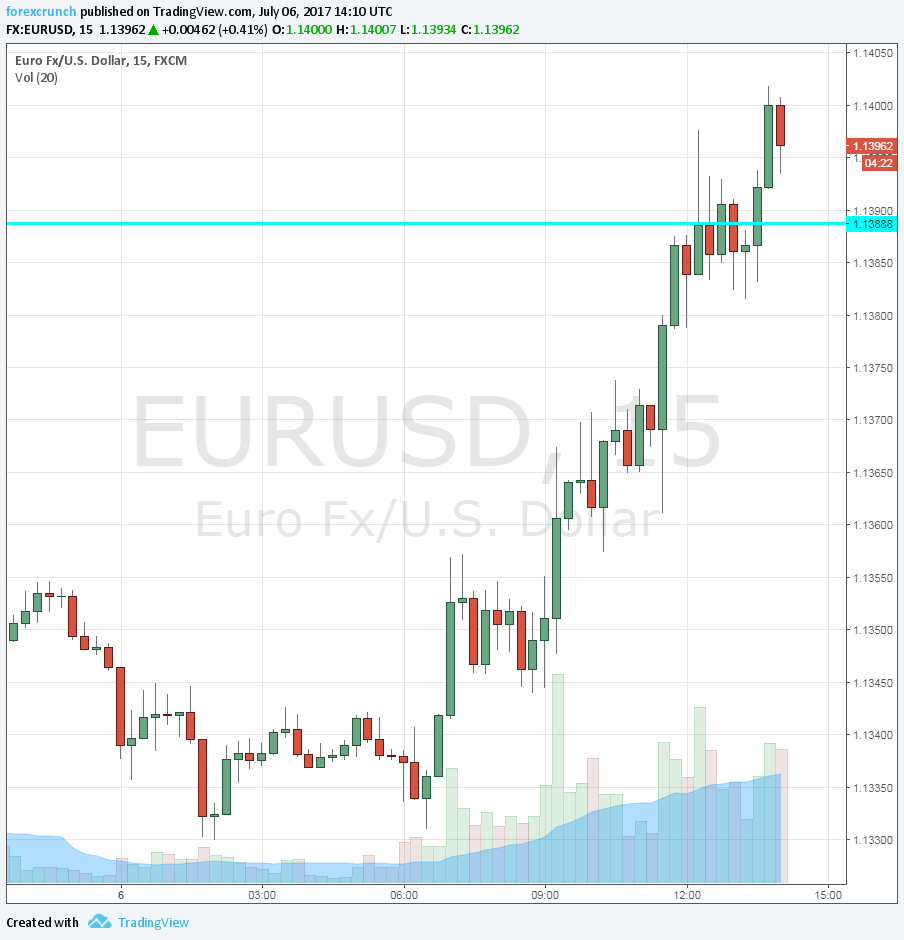

EUR/USD is only consolidating its gains following the report, not really retreating. The pair received a boost from the ECB meeting minutes earlier.

Here is the EUR/USD chart: the downfall looks quite symbolical. The high so far has been 1.1401.