The Australian dollar enjoys a “risk-on” sentiment and it has reasons to rise. The pair eyeing high resistance.

The relative dovishness expressed by the RBA seems to have been forgotten. Yellen’s relative caution replaced it. The Fed Chair said they are “closely monitoring” inflation. developments despite her optimism and sense that the current weakness is due to temporary factors.

The response to Yellen’s comments was somewhat hesitant, but now the Aussie begins taking advantage of it. Australia’s No. 1 trading partner released its trade balance figures. These showed that the world’s No. 2 economy has increased its imports by 17.2% in USD terms, above 14.5% expected. Also, exports are higher than predicted: 11.3% instead of 8.9%.

The enhanced economic activity is good news for the world and Australia in particular.

More: AUD: Domestic Vs External Drivers: Where To Target? – Barclays

AUD/USD on the move

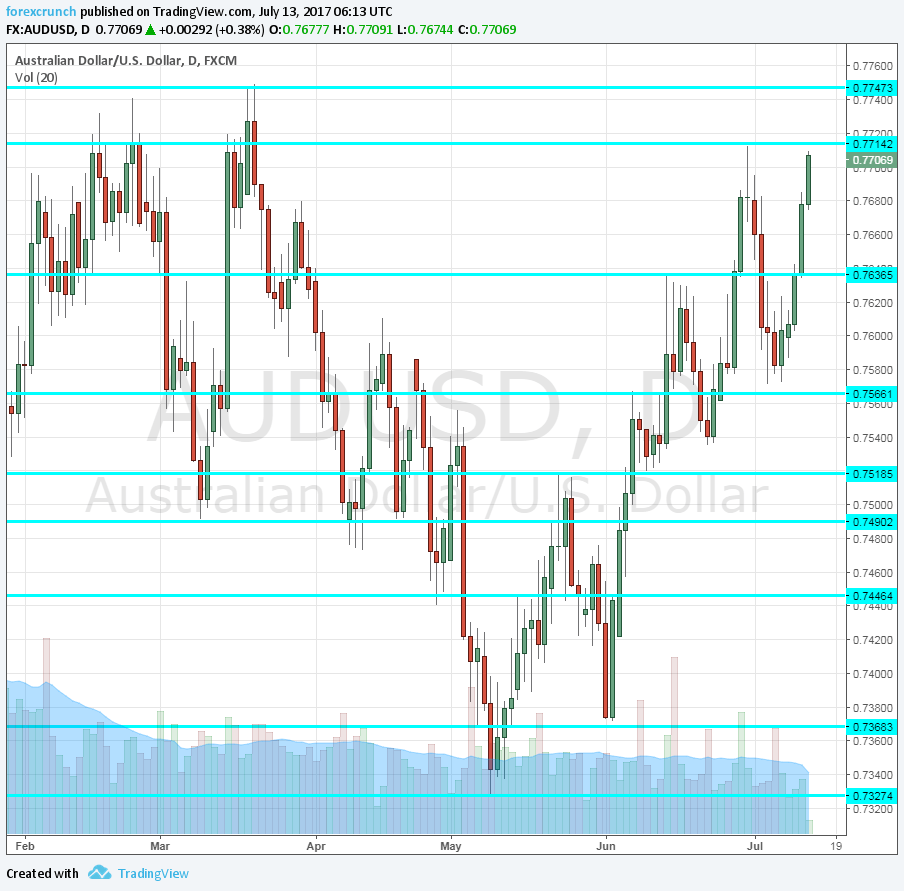

Aussie/USD currently trades around 0.7707, just under the recent high of 0.7715 that serves as resistance. The next cap is at 0.7750, the March high. Even higher, 0.7840 is a key level of resistance.

Support awaits at 0.7680, followed by 0.7565.

Here is the daily AUD/USD chart: