Euro/dollar is enjoying a massive rally. While the trend has been to the upside since the beginning of the year, the rally has recently accelerated. The pair is trading at the highest levels since early 2015, around 1500 pips above the trough.

Here is a quick summary of the pair’s drivers and the major levels to the upside:

- Trump troubles: The Trump train has reached its fastest speed just before Donald Trump got into office. But already in early January, there were doubts he could fulfill all the promises. The most recent issues with Don Junior, the chaos with White House personnel and yet another failure of the healthcare bill has sent the greenback tumbling down.

- Draghi doesn’t do dovishness: The ECB wants a weaker euro and tries telling us that nothing has been decided. However, it is clear that we are at the beginning of the end of QE. This is the main driver of the euro. Draghi was unable to stop it.

- The direction of inflation: US inflation is stronger than European inflation. However, price rises are ticking up in the euro-zone, especially core inflation which is gaining a better footing. In the US, things are still stuck, casting doubts about the Fed’s next hike.

- The direction of growth: While US GDP growth has recovered in Q2 to 2.6% annualized, it is only enough to match the growth rate of the euro-zone, which is at this rate for two consecutive quarters. This factor was stronger earlier in the year but remains relevant.

- European politics: The eurozone seems united in Brexit talks and far more stable than in the past. The biggest event of the year so far was the election of Emmanuel Macron as President, but the biggest country in Europe also seems very stable. Merkel commands an 18% gap in the polls ahead of the elections in September. And even if her opponent Schulz wins, he is also pro-European. Another grand coalition would be positive for the euro-area. Here, we come full circle to the first item: Trump’s troubles. The contrast is clear to see.

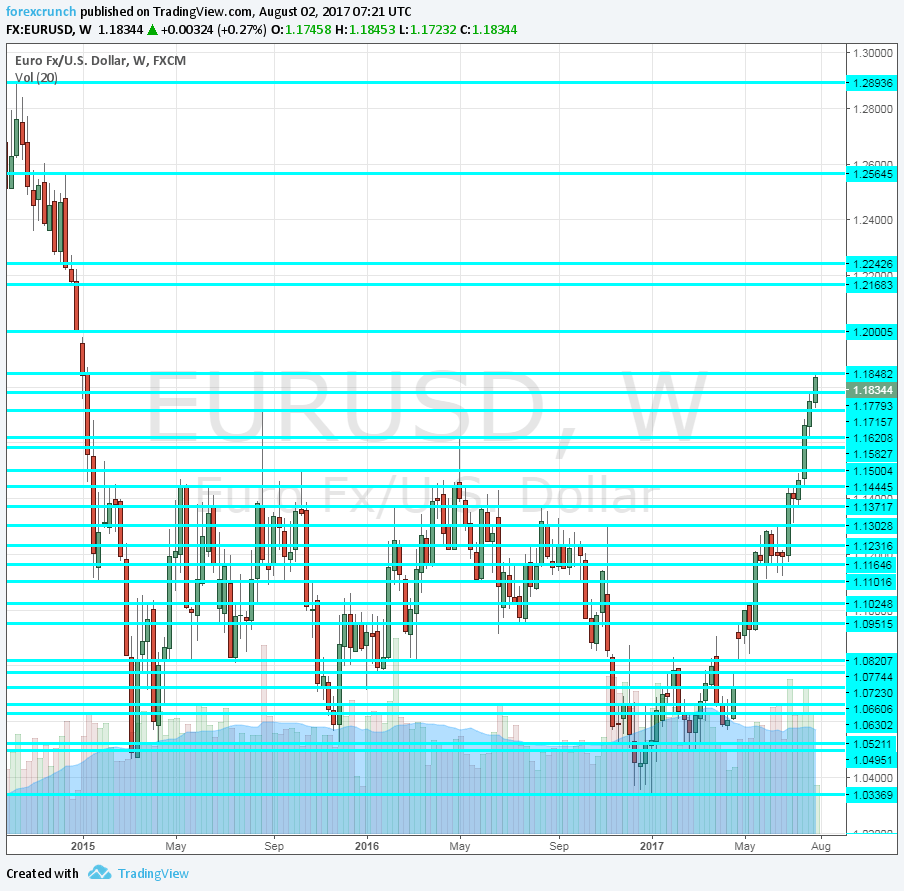

EUR/USD levels

€/$ has already surpassed the post ECB QE high of 1.1712 and is trading around 1.1830. The next level to the upside is 1.1850, which is the (current) high for 2017.

The next level is clear: 1.20. IT is not only a round number but also a gap on the chart, seen in late 2014. It is a level eyed by many.

Further above, we find 1.2170, a level that was a stepping stone on the way down. Another stepping stone is 1.12240, quite close by.

Even higher, we find 1.2565, a cap on the pair from 2014 and 1.27 looms far above.

Looking down, we find familiar levels: 1.1712, 1.1620 and 1.15 were highs seen recently, all of them were broken quite quickly.

Here are more opinions: EUR/USD looking to the sky – what’s next?