The Australian dollar drifted lower on risk aversion but hasn’t collapsed. The meeting minutes and the jobs report stand out in the upcoming week. Here are the highlights of the week and an updated technical analysis for AUD/USD.

Data has been mixed: the NAB business confidence advanced to 12 points, but home loans hardly increased in Australia: only 0.5%. Chinese data was also uninspiring. Yet the biggest driver to the downside came from North Korea. The heightened tensions with the US triggered a “risk off” sentiment that does not do any favors to the Australian dollar, a “risk currency”.

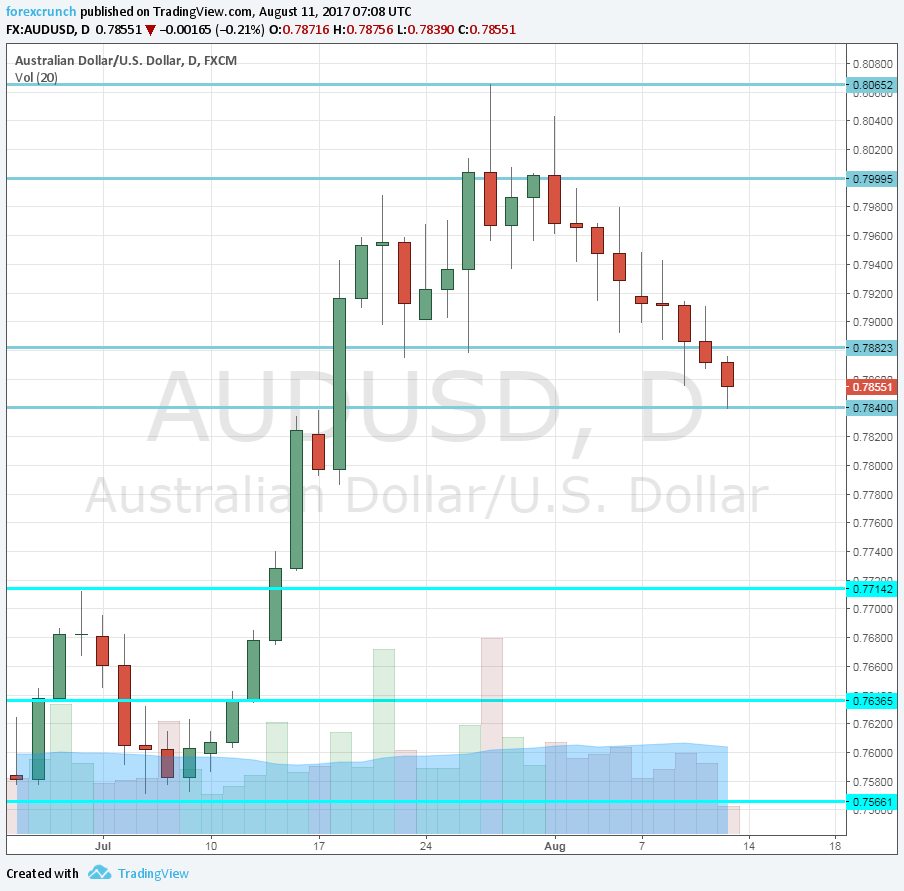

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- Christopher Kent talks: Sunday, 23:35. The Assistant Governor of the RBA, Christopher Kent speaks in Sydney and may provide hints about future monetary policy. Kent does not make too many public appearances.

- Chinese industrial output: Monday, 2:00. Australia’s No. 1 trading partner enjoyed robust growth in its industrial output in June: 7.6%. A growth rate of 7.2% is projected now.

- Monetary Policy Meeting Minutes: Tuesday, 1:30. The minutes from the July meeting sent a hawkish message, contradicting the dovish tone from the statement. Will this repeat itself now in August? Or will the RBA maintain its stable stance?

- New Motor Vehicle Sales: Tuesday, 1:30. Monthly sales of vehicles serve as another gauge for the wider economy. The volume of sales increased in the past four months, with a rise of 1.2% in June.

- MI Leading Index: Wednesday, 00:30. The Melbourne Institute takes nine economic indicators into its calculation which has been very stable of late, dropping 0.1% in July. A similar number could be seen now.

- Wage Price Index: Wednesday, 1:30. Contrary to jobs, changes in wages are published only on a quarterly basis. Rises in wages are necessary for core inflation to advance and rates to rise.

- Australian jobs report: Thursday, 1:30. Australia enjoyed a strong start to 2017, with big job gains. However, June’s report already showed a more modest rise of 14K jobs, as expected. The unemployment rate stood at 5.6%. Note the changes in full-time and part-time jobs.

AUD/USD Technical Analysis

The Australian dollar remained capped under 0.80 (mentioned last week). It then gradually dropped, hitting support at 0.7835.

Technical lines from top to bottom:

0.83 was a swing high seen in early 2015 and is our top line. 0.8165 was another swing high, back in May 2015.

0.8065 is the most recent high seen in 2017. It is followed by the psychological round level of 0.80.

0.7920 was the low point the pair reached after the pair moved to the highs. 0.7835 remains important as the previous cycle high, seen in April 2016.

Below, we find 0.7740, that was a high point in June 2017 and also beforehand. 0.7635 was a stepping stone on the way up, also in June.

Even lower, we find 0.7565 was a low point before the pair shot higher in July. The last line, for now, is 0.7515.

I am bullish on AUD/USD

The Australian dollar consolidated and has room to rise.

Our latest podcast is titled Draghi Dud and the Petrol Pendulum

Follow us on Sticher or iTunes

Safe trading!