Economic indicators coming out of Australia look positive. Yet contrary to conditions in Australia, it’s midsummer in the Northern Hemisphere and markets is not going anywhere fast.

With upbeat data, does the Australian dollar have reasons to rise?

Some data points to consider:

- The NAB business confidence measure climbs to 12 points in July from 9 in June, a significant move forward. Higher confidence implies more investment.

- The DHL Export Barometer shows that exporter confidence is at the highest levels since 2011 with 67% expecting increased sales. A majority also expect to raise wages and employ more staff.

- Australian consumer confidence remains high at 113.7. This is below the very highs seen in the previous week by the ANZ Roy Morgan survey, but well above previous levels.

On the downside, Chinese import growth came out at 14.7% y/y, a rapid clip but below expectations. Does this hurt the Aussie?

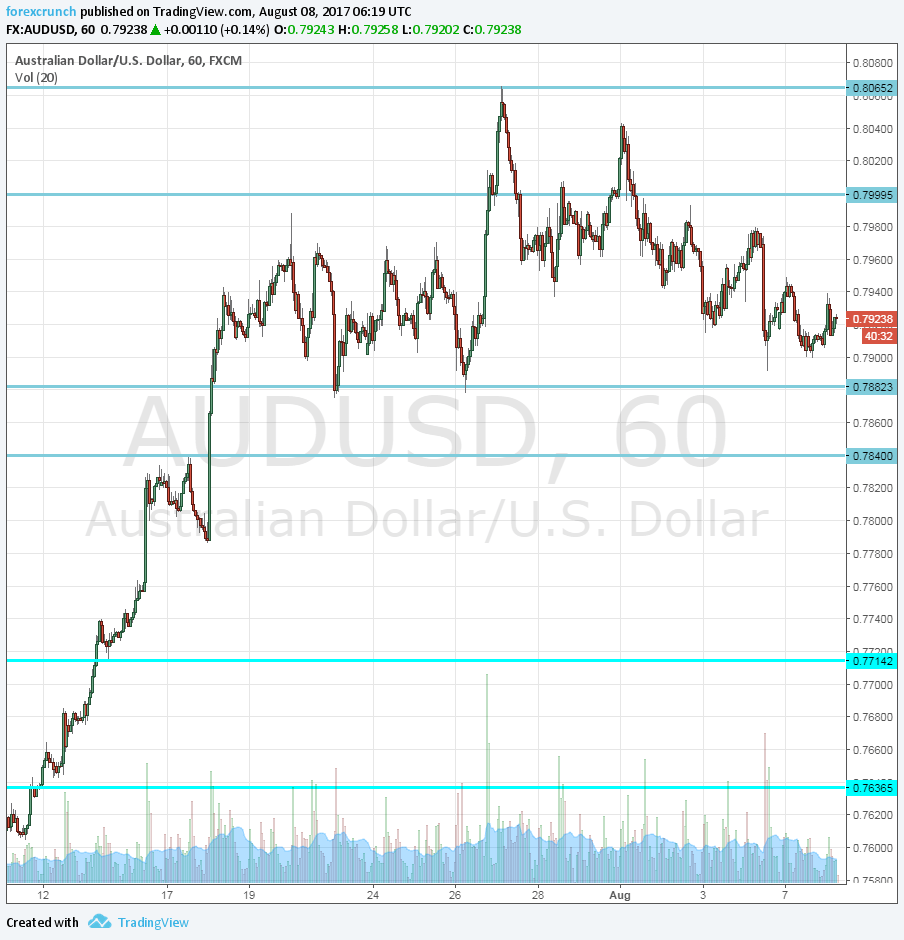

AUD/USD trades at 0.7925, slightly higher on the day. However, it maintains a safe distance from the round 0.80 level it had a hard time reaching. 0.80 remains a hard cap, followed by 0.8065. Support awaits at 0.7835.