The Australian dollar struggled with the highs but did not give up on these levels, despite RBA pressure. Where next? The upcoming week features speeches from central bankers as well as important surveys. Here are the highlights of the week and an updated technical analysis for AUD/USD.

The Reserve Bank of Australia left its forecasts unchanged despite the economic improvements and this hurt the Aussie. Economic indicators were mostly positive: retail sales beat expectations while the trade balance surplus unexpectedly squeezed. In the US, the chaos in the White House weighed on the greenback that extended its downfall. Economic data were mixed throughout most of the week, but a good Non-Farm Payrolls report triggered a comeback of the US dollar. The Aussie weathered most of the storm.

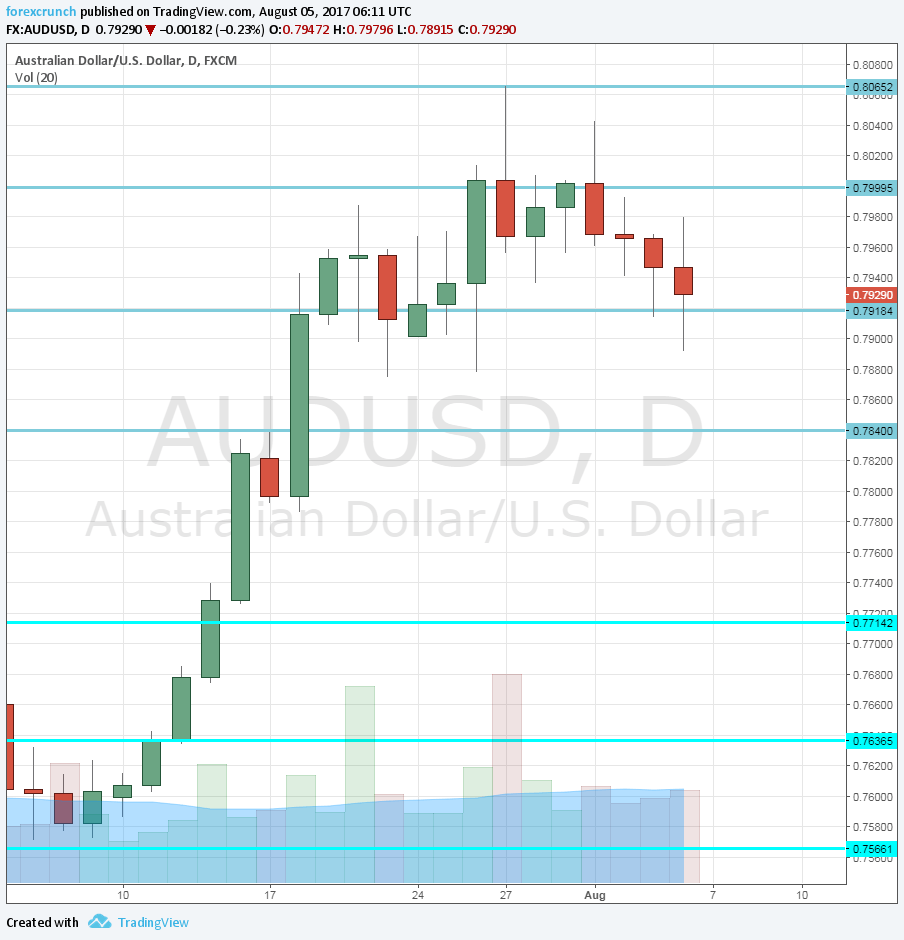

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

- AIG Construction Index: Sunday, 23:30. This 200-strong survey by the Australian Industry Group has been on the high ground in the past two months, above 56, reflecting robust growth in the sector.

- ANZ Job Advertisements: Monday, 1:30. The Australia New Zealand Bank measures job ads as a measure for the jobs market. After a few mediocre months, June saw a big jump in ads: 2.7%. Will we see a slide this time?

- NAB Business Confidence: Tuesday, 1:30. The survey has been above 0 for long months, representing improving conditions. Back in June, the indicator ticked up to 9 points. This is under the peak, but still positive.

- Chinese trade balance: Tuesday, 2:00. China is Australia’s No. 1 trade partner. A rise in China’s imports implies an increase in Australian exports. China enjoys a significant surplus. In Chinese yuan terms, the surplus is expected to slip from 294K to 292K. In US dollars, the surplus is predicted to widen from 42.8 billion to 45.3 billion.

- Christopher Kent talks: Tuesday, 22:35.Kent is the RBA Assistant Governor and he speaks in Sydney. The RBA had quite a few opportunities to talk down the currency but was unsuccessful so far. Kent might try to shed some light on the economic situation and perhaps try to talk the currency down.

- Westpac Consumer Sentiment: Wednesday, 00:30. The Westpac Banking Corporation has shown an improvement in July after three consecutive slides in previous months. The 0.4% seen in this 1200-strong consumer survey could be followed by another one.

- Home Loans: Wednesday, 1:30. This official measure of the housing market has disappointed in the past four months, rising only 1% in May. The figure for June could show another rise, but will it meet expectations? A rise of 1.6% is ont eh cards.

- Chinese inflation data: Wednesday, 1:30. Rises in Chinese prices imply growth, thus moving the Australian dollar. Producer prices were up 5.5% y/y in June are now expected to accelerate to 5.6%. Consumer prices are predicted to remain unchanged at 1.5%. Australian commodity prices are also reflected in producer prices.

- MI Inflation Expectations: Thursday, 1:00. With the government publishing official inflation data only once per quarter, this measure of inflation expectations by the Melbourne Insititute provides more up-to-date data. In June, inflation expectations accelerated to 4.4%. We could see a slide now.

- Philip Lowe talks: Thursday, 23:30. The Governor of the RBA makes an official testimony in Melbourne. Will he try to talk down the Aussie? And if so, will he succeed? This is the most important event of the week. Views about Chinese demand, internal consumption, and the housing market will be eyed.

AUD/USD Technical Analysis

The Australian dollar had a narrower trading range than in the previous week and did not reach new highs. Nevertheless, the pair consolidated its gains.

Technical lines from top to bottom:

0.83 was a swing high seen in early 2015 and is our top line. 0.8165 was another swing high, back in May 2015.

0.8065 is the most recent high seen in 2017. It is followed by the psychological round level of 0.80.

0.7920 was the low point the pair reached after the pair moved to the highs. 0.7835 remains important as the previous cycle high, seen in April 2016.

Below, we find 0.7740, that was a high point in June 2017 and also beforehand. 0.7635 was a stepping stone on the way up, also in June.

Even lower, we find 0.7565 was a low point before the pair shot higher in July. The last line, for now, is 0.7515.

I am bullish on AUD/USD

The Australian economy is doing well, on another growth cycle in China and healthy local demand. The RBA seems helpless in its efforts to halt the rise. The US dollar remains on the back foot on a mix of political chaos and a hesitant Fed.

Our latest podcast is titled Draghi Dud and the Petrol Pendulum

Follow us on Sticher or iTunes

Safe trading!