GBP/USD had a tense week amid tense Brexit negotiations but came out on top. The upcoming week features top-tier inflation and jobs indicators, as well as the BOE decision. Here are the key events and an updated technical analysis for GBP/USD.

The pound enjoyed the talk about a soft Brexit, but perhaps more importantly, a weak US dollar. UK data helped as well: house prices are on the rise once again, according to the Halifax HPI. The trade deficit is narrower and PMIs are OK, not falling.

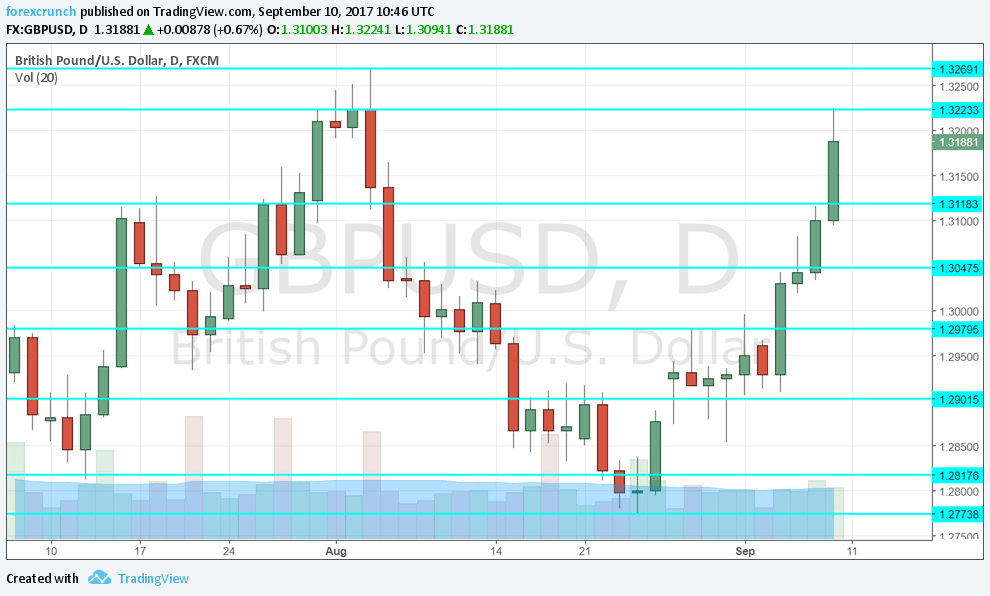

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD daily chart with resistance and support lines on it. Click to enlarge:

- Inflation report: Tuesday, 8:30. After a few months of accelerated rises, the Consumer Price Index dropped to an annual level of 2.6%. This is still higher than the rise in wages, implying a drop in standards of living, but not too alarming for the BOE to raise interest rates. Core CPI also moderated to 2.4%. The Retail Price Index (RPI) stood at 3.6%. PPI output also surprised to the downside by remaining flat m/m in July. We now get all the figures for August, just in time for Mark Carney’s decision. Headline CPI is expected to rise to 2.8% and core CPI to 2.5%. The RPI carries expectations for 3.7%.

- Jobs report: Wednesday, 8:30. Jobs are aplenty but wages are not going anywhere fast. Jobless claims (claimant count change) dropped by 4.2K in Jul, better than had been expected. The unemployment rate was also looking good at 4.4% in June, yet another drop down. Wages rose by 2.1%, better than in May, but still lower than the levels seen last year and lower than inflation. Wages are projected to recover and rise to a pace of 2.3%. The unemployment rate is predicted to remain unchanged at 4.4%.

- RICS House Price Balance: Wednesday, 23:01. This measure of housing sector was positive, indicating high demand, but it has fallen quite sharply in recent months, reaching only 1% after seeing double-digit levels for a very long time. Will it turn negative this time? This could be depressing. Expectations stand at 0%.

- BOE decision: Thursday, 11:00. The Bank of England is set to leave all its policy measures unchanged: an interest rate of 0.25% and the QE program at a total of 435 billion pounds. As always, the accompanying minutes of the meeting will be eyed. Back in August, six members voted to leave the policy unchanged while two voted for a rate hike. This ongoing vast majority for the doves depressed the pound at the time. Given more signs of an economic slowdown, it has to see the BOE raising rates despite the still-high inflation and the booming credit market. The tone of the document will also be watched for hints. The Monetary Policy Committee probably prefers a higher exchange rate to lower inflation but is unlikely to accompany this desire with an interest rate hike.

- BOE Quarterly Bulletin: Friday, 11:00. If the rate decision and the minutes are not enough, the BOE publishes this long-form document that details monetary policy operations and current market conditions. It could include further views on the economy.

- CB Leading Index: Friday, 13:30. Friday, 13:30. This composite index of 7 leading economic indicators provides another outlook on the economy.

GBP/USD Technical Analysis

Pound/dollar had an upbeat week, After stabilizing above the 1.29 level (mentioned last week), the pair shot up and reached a peak of 1.3225.

Technical lines from top to bottom:

1.35 was the post-Brexit high and remains the top level. It is followed by 1.3370 which capped the pair several times in 2016.

The 2017 high (so far) of 1.3270 is the next barrier. 1.3225 was the high point of September.

It is followed by 1.3180, which capped the pair in July. 1.3120 served as resistance twice in the summer of 2017 and remains important.

Below, 1.3050 is a double top as seen during the spring of 2017. 1.2975 awaits on the lower side of 1.30.

Further below, 1.2890 separated ranges on the way down. It is followed by 1.2820 and 1.2775.

I am neutral on GBP/USD

The upcoming set of economic indicators will probably serve as a reminder to the not-so-enticing state of the UK economy. This balances out with the weakness of the US dollar, that stems from the Fed and politics rather than the economy at this point.

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!