Dollar/CAD moved higher as the Canadian dollar suffered from setbacks and as the greenback lifted its head. What’s next? Testimonies from Poloz stand out this week. Here are the highlights and an updated technical analysis for USD/CAD.

The Bank of Canada is somewhat more cautious on the economy, seeing a potential for further growth. This hurt the loonie. Then, the disappointing inflation figures showed that also on this front, there is a lot of progress that needs to be made. Oil prices continued rising and this supported the loonie. In the US, data was mostly positive and the Fed seems keener to raise rates, as Williams made very optimistic noises. Eventually, US yields began moving higher and the USD followed suit. A lot depends on NAFTA as well: negotiations continue in Washington.

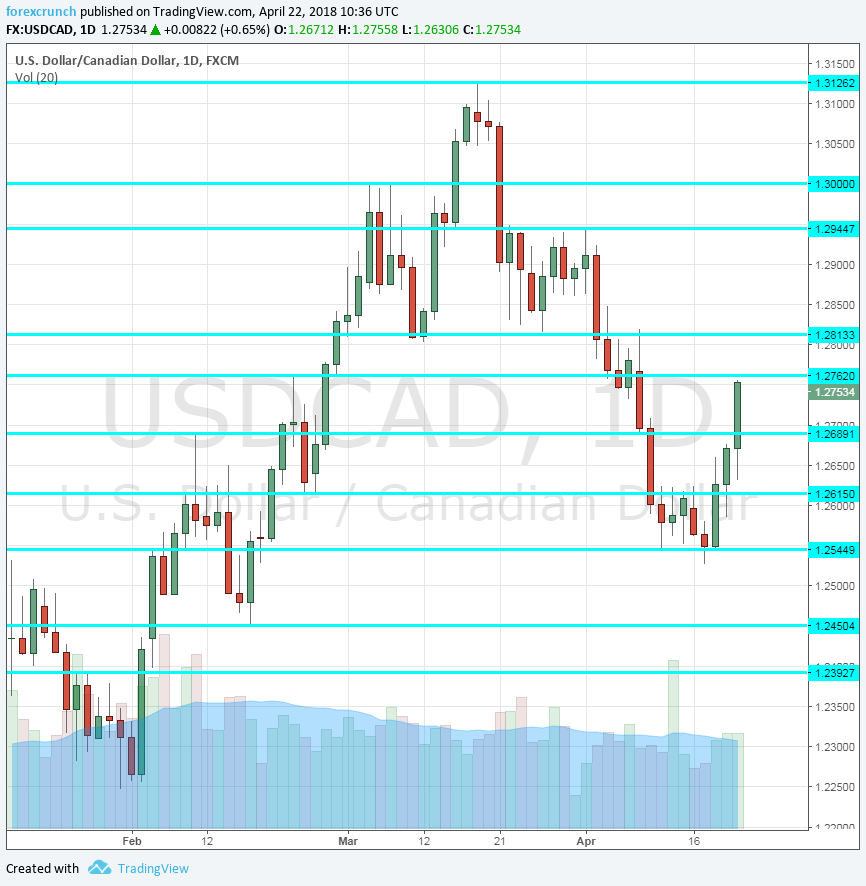

[do action=”autoupdate” tag=”EURUSDUpdate”/]USD/CAD daily graph with support and resistance lines on it. Click to enlarge:

- Wholesale Sales: Monday, 12:30. Sales at the wholesale level serve as an indicator to those at the retail level. After a rise of 0.1% in January, a faster increase of 0.3% is on the cards for February.

- Stephen Poloz testifies Monday 19:30 and Wednesday at 20:15. The Governor of the Bank of Canada testifies along Senior Deputy Governor Carolyn Wilkins in front of two separate committees in Parliament. In these two appearances, they will have the opportunity to get into further details about the economic situation and also about their policy. While they both spoke out recently, after the rate decision, this event is longer and also comes out after the inflation and retail sales reports. Commentary about NAFTA and oil will also be of interest.

*All times are GMT

USD/CAD Technical Analysis

Dollar/CAD made another U-turn, this time to the upside. The pair stopped only at the 1.2760 level discussed last week.

Technical lines from top to bottom:

1.3180 was a support line in 2017 and now turns into resistance. 1.3125 is the high point for 2018 so far.

1.30 is a round number that is eyed by many. 1.2945 capped the pair in early April.

1.2810 provided support in late March. 1.2760 was a swing high in late February.

1.2665 was a was a double-bottom in November and works as strong support. It is followed by 1.2615, which provided support in November.

Further below, we find 1.2545, the low point in mid-April. Another round of selling may send the pair towards 1.2450, a swing low in mid-February and 1.2290 is next.

I am bearish on USD/CAD

While the economic data has not been convincing, prices of oil are set to remain elevated. In addition, a deal on NAFTA is getting close and it could boost the Canadian dollar.

Our latest podcast is titled Is inflation rearing its ugly head? Oil is on fire

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – projections for the Aussie dollar.

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!