- Inflation in Canada came in higher than expected, dashing hopes for early rate cuts by the BoC.

- The US economy remained resilient, with robust retail sales.

- The Canadian dollar strengthened as oil prices surged.

The USD/CAD weekly forecast paints a slightly bearish picture, with the Canadian dollar riding the wave amid surging oil prices.

Ups and downs of USD/CAD

The pair had a bullish week. However, it closed well below its highs. During the week, investors got to assess data from the US and Canada. Inflation in Canada came in higher than expected, dashing hopes for early rate cuts by the BoC. Meanwhile, the US economy remained resilient, with robust retail sales and a significant drop in initial jobless claims.

-Are you interested in learning about the forex signals telegram group? Click here for details-

However, the main driver for the pair towards the end of the week was the rally in oil prices. The Canadian dollar strengthened with oil, leading to a lower close for the pair.

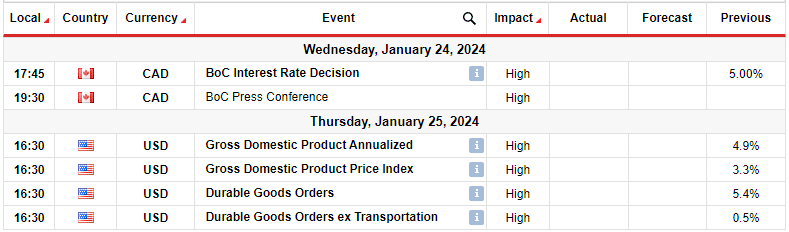

Next week’s key events for USD/CAD

The consensus among economists is that the Bank of Canada will maintain its overnight key interest rate at 5.00% on January 24 and March. Additionally, most economists expect the Bank of Canada to delay any key interest rate cuts until at least June.

Meanwhile, in the US, investors still struggle to predict when the Fed will start rate cuts. The US economy is still strong, and GDP and core durable goods data next week will shed more light on the economy.

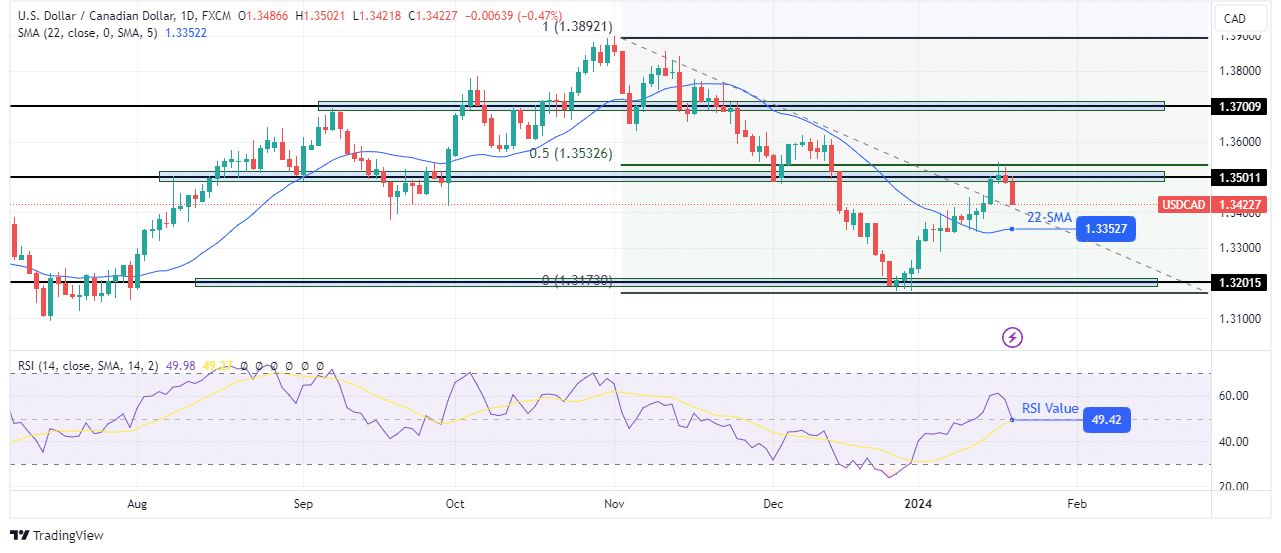

USD/CAD weekly technical forecast: Pullback eyes 22-SMA support

On the technical side, USD/CAD is retreating after meeting a strong resistance zone. However, the bias is bullish because buyers managed to push the price above the 22-SMA. They took over when the downtrend stopped at the 1.3201 support level.

–Are you interested in learning more about making money with forex? Check our detailed guide-

However, the new bullish move has paused at a resistance zone comprising the 0.5 fib level and the 1.3501 resistance level. Consequently, there is a pullback that might reach the 22-SMA support in the coming week. This will allow sellers to test the new bullish trend. If buyers are ready to push the price beyond the 1.3501 level, then the price will respect the 22-SMA support.

However, if this was a deep retracement in the downtrend, then bears might resume the downtrend next week. In this case, the price would break below the 22-SMA to retest the 1.3201 support.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.