- The Canadian economy experienced its third consecutive month of sluggish performance.

- Canada’s annual inflation rate stayed at 3.1% in November.

- US prices experienced their first decline in over 3 1/2 years in November.

The outlook takes a bearish turn in the USD/CAD weekly forecast as the Bank of Canada urges caution, deeming it premature to anticipate rate cuts. Meanwhile, in the US, traders expect rate cuts in 2024 against the backdrop of softer inflation.

–Are you interested to learn more about forex options trading? Check our detailed guide-

Ups and downs of USD/CAD

The pair had a bearish week as the Canadian dollar strengthened with oil prices amid supply concerns. Moreover, the currency weakened due to a decline in the dollar after the core PCE index report.

In November, US prices experienced their first decline in over 31/2 years. This downturn increased expectations of an interest rate cut by the Federal Reserve in March.

Meanwhile, the Canadian economy experienced its third consecutive month of sluggish performance in October. Moreover, economists predict a modest growth outlook for November. The central bank asserts that it’s premature to anticipate rate cuts. However, financial markets expect a decline in interest rates starting in April.

Elsewhere, Canada’s annual inflation rate stayed at 3.1% in November, surpassing the central bank’s 2% target.

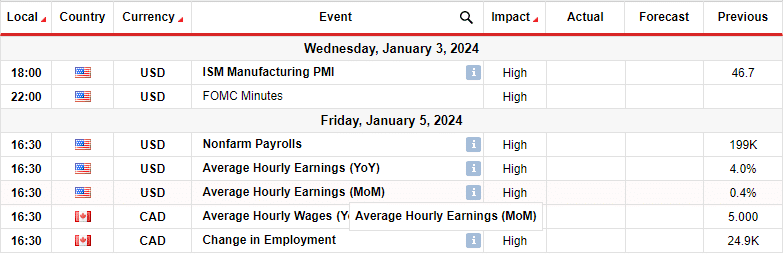

Next week’s key events for USD/CAD

There are no key events next week as markets will be closed for Christmas. Therefore, investors will prepare for next year.

The new year will start with major reports from the US, including the FOMC meeting minutes and the monthly employment report. Similarly, Canada will release data on employment change.

Traders will be keen on the FOMC meeting minutes as they might contain clues on the Fed’s policy outlook.

Meanwhile, the employment reports from the US and Canada will influence decisions at the next Fed and BoC policy meetings.

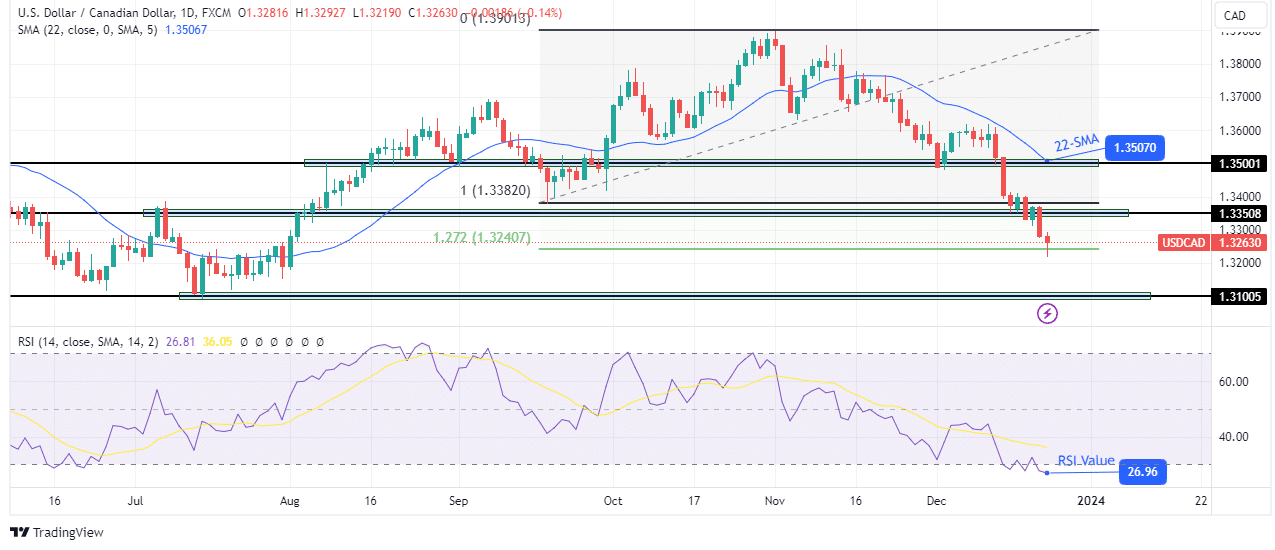

USD/CAD weekly technical forecast: Decline pauses at the 1.27 fib extension level

The USD/CAD price has broken below major support levels, strengthening the bearish bias. After respecting the 22-SMA as resistance, the price fell through the 1.3500 and 1.3350 support levels. At the same time, it fell well below the SMA, showing a steep and robust bearish move. Meanwhile, the RSI dipped into oversold territory, supporting solid bearish momentum.

–Are you interested to learn more about forex tools? Check our detailed guide-

However, the price has also extended to a strong fib support level at 1.27. Therefore, bulls might get the chance to push the price off this support level to retest the 1.3350 key level or the 22-SMA. However, the price will then likely continue lower with the next target at the 1.3100 support.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.