GBP/USD had a bad week, succumbing to the strength of the US dollar and as the UK government made compromises on the Brexit Bill. What’s next? The focus is on the BOE’s rate decision and the Mansion House speech by Mark Carney. Here are the key events and an updated technical analysis for GBP/USD.

The UK government had to reach a compromise with the pro-Remain rebels in order to secure a victory in Parliament over the amendments suggested by the House of Lords. This could lead to a softer Brexit, but other factors complicated the picture. UK inflation disappointed with 2.4% y/y, weighing on Sterling. The jobs report was mixed with unimpressive salaries but a drop in jobless claims, while retail sales beat expectations. In the US, the Fed raised interest rates and signaled two additional moves. The hawkish hike took time to materialize in markets and the greenback exploded only after American retail sales beat expectations. GBP/USD fell sharply.

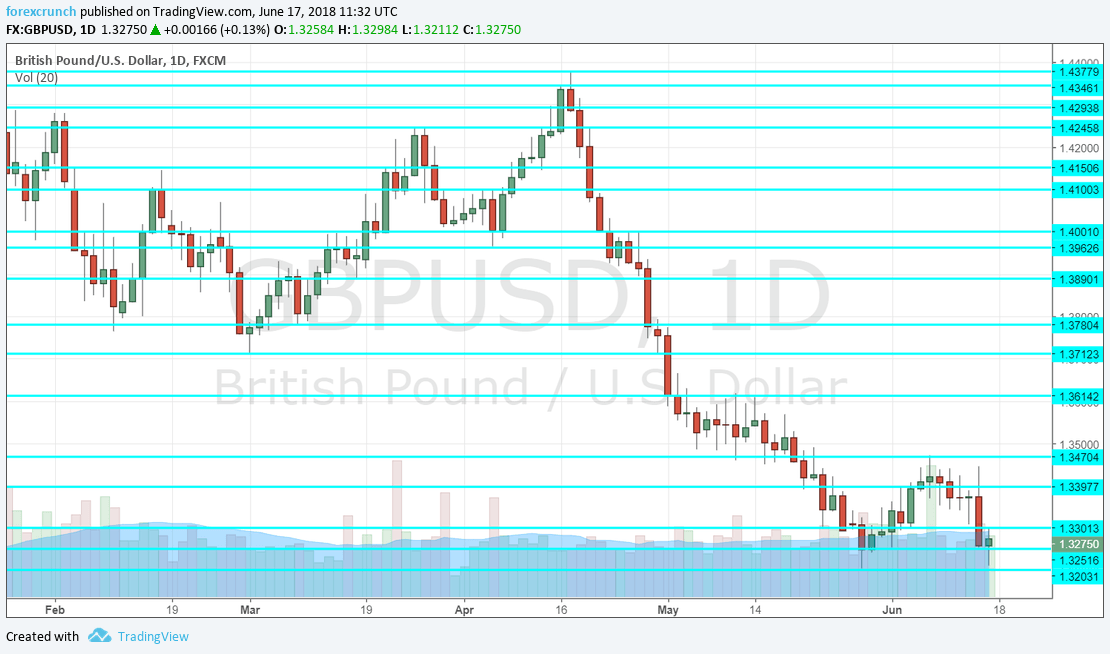

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Rightmove HPI: Sunday, 23:01. House prices advanced by 0.8% in April according to Rightmove, showing some resilience in a sector that struggled earlier in the year. A more modest increase is likely now.

- CBI Industrial Order Expectations: Wednesday, 10:10. Britain’s industry is suffering from hiccups as this measure of orders has shown. A drop of -3 was seen last time. The A bounce back to positive ground, 1 point, is on the cards this time.

- Public Sector Net Borrowing: Thursday, 8:30. The British government borrowed a total of 6.2 billion pounds, within normal ranges. A small squeeze in public lending is likely now: 5.1 billion.

- UK rate decision: Thursday, 11:00. The Bank of England left the interest rate unchanged in May, changing its intentions after data came out worse than expected. The BOE is expected to leave its policy unchanged once again in this meeting which does not include the publication of the Quarterly Inflation Report nor a press conference. The Bank also publishes its meeting minutes at the same time and this will reveal the voting pattern. Back in May, two members voted to raise rates while seven, including Governor Carney, voted to leave it unchanged. The same pattern is on the cards now. The reaction may be relatively muted as the Governor speaks later in the day.

- Mark Carney talks: Thursday, 20:15. The Governor of the BOE will deliver an important speech at Mansion House. In the past, he used the occasion to signals changes in monetary policy, sometimes not in line with the thoughts of other members. Any hawkish twist may be treated with suspicion but could still move the pound. Carney speaks at a time when liquidity is low, so any surprise could have an outsized impact.

- BOE Quarterly Bulletin: Friday, 11:00. The Bank of England’s quarterly report is not as important as the Quarterly Inflation Report. Nevertheless, an updated view on the economy may impact markets. It will be of interest to see if the BOE remains optimistic about a Spring recovery as we enter the Summer.

* All times are GMT

GBP/USD Technical analysis

Pound/dollar made an initial move to the upside, getting close to 1.3470 (mentioned last week). It then plunged and closed below 1.33.

Technical lines from top to bottom:

1.3780 was a line of support in March and 1.3710 was the lowest point since early in the year.

Below, 1.3615 capped the pair in late 2017. 1.3470 was a swing high in early June.

The round number of 1.34 could provide further support. Further down, 1.33, which supported the pair in December, is still relevant.

1.3250 was a swing low in early June. Even lower, 1.3205 was the low point in late May. 1.3080 served as support back in November 2017. The ultimate line is 1.3000.

I remain bearish on GBP/USD

While hopes of a softer Brexit support the pound, the BOE is not close to raising rates, especially as trade issues loom. The US Dollar could gain further strength.

Our latest podcast is titled Truce in trade and dollar domination

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!