GBP/USD had an OK week, gradually climbing up from the lows on upbeat data. What’s next? Inflation, jobs and retail sales will all shake the pound, as well as a vote in Parliament on the Brexit withdrawal bill. Here are the key events and an updated technical analysis for GBP/USD.

UK data was upbeat with both the construction and services PMI’s coming out above expectations. Other data were also positive. However, the UK’s ideas around the Irish border were swiftly rejected by the EU and this weighed on the pair. In the US, data was good with the ISM Non-Manufacturing PMI coming out above projections. The growing tensions between the US and its allies on trade weighed towards the end of the week.

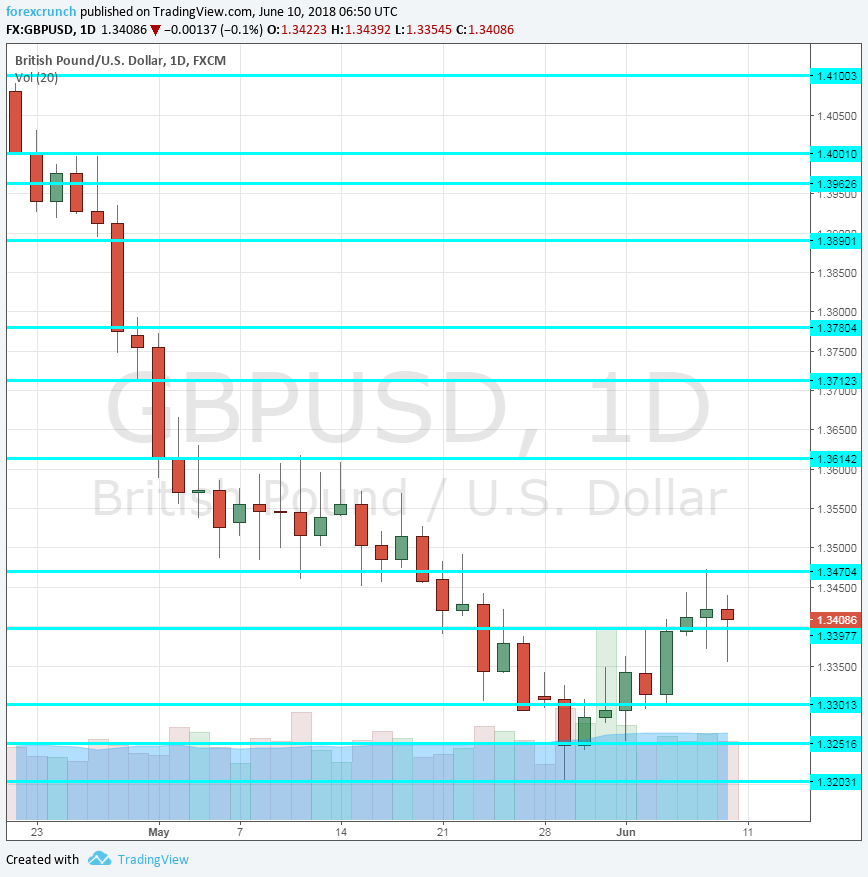

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Manufacturing Production: Monday, 8:30. Output in the manufacturing sector disappointed in March with a drop of 0.1%, the second consecutive fall. April is expected to see a bounce with +0.3%. The wider industrial output figure is projected to show an increase of 0.1%, repeating the previous month’s gain.

- Goods Trade Balance: Monday, 8:30. The UK has a long-term trade deficit. It ballooned to 12.3 billion in March and is now expected to squeeze to 11.5 billion in the report for April.

- Construction Output: Monday, 8:30. This volatile measure showed a fall of 2.3% in construction back in March and a spring bounce is on the cards for April: 2.4%.

- Vote in Parliament: Tuesday. The House of Commons will convene to hold a marathon session on the government’s Brexit withdrawal bill. The House of Lords approved 15 amendments to the government’s proposal, dealing a blow to the not-so-stable government. There is a chance that a few members of Theresa May’s Conservatives will rebel and vote with the opposition to reject the proposal, exposing the weakness and complicating matters. The long session is devised to prevent such a case. A win for May will help the pound.

- Jobs report Tuesday, 8:30. The previous jobs report was a disappointment due to a jump in the number of jobless claims: the Claimant Count Change rose by 31.2K in April. An increase of 11.2K is on the cards now. More importantly, Average Hourly Earnings stood at 2.6% in March, showing that wages stood at 2.6%. A pickup in salaries is needed for the BOE to raise interest rates but expectations are for a deceleration to 2.5%. The unemployment rate stood at 4.2% in March and is expected to remain unchanged.

- Inflation data: Wednesday, 8:30. The Bank of England may raise rates in August, but only if inflation rises. After slowing down to 2.4% in April, headline CPI is projected to repeat the same rate in May. Core CPI is also forecast to repeat the previous level that stood at 2.1% while PPI Input is predicted to jump by 1.8% after 0.4% last time.

- RICS House Price Balance: Wednesday, 23:01. the balance between increases and decreases in house prices turned negative in April, falling to -8% and serves as a warning sign. An improvement is expected now: -5%.

- Retail Sales: Thursday, 8:30. After the winter came to an end, retail sales jumped by no less than 1.6% in April, helping Sterling. Another increase is expected now: 0.5% in the month of May. The publication tends to have a strong, yet a short-lived impact on the pound.

* All times are GMT

GBP/USD Technical analysis

Pound/dollar climbed off the lows of 1.33 (mentioned last week) and reached a peak of 1.3470 before settling.

Technical lines from top to bottom:

1.3780 was a line of support in March and 1.3710 was the lowest point since early in the year.

Below, 1.3615 capped the pair in late 2017. 1.3470 was a swing high in early June.

The round number of 1.34 could provide further support. Further down, 1.33, which supported the pair in December, is still relevant.

1.3250 was a swing low in early June.Even lower, was the low point in late May. 1.3080 served as support back in November 2017. The ultimate line is 1.3000.

I remain bearish on GBP/USD

Even if the data improve and Parliament smoothly approves the withdrawal bill, the disagreements around Brexit weigh on markets. In addition, a risk-off atmosphere will likely settle after the G-7 Summit ended without a statement.

Our latest podcast is titled Truce in trade and dollar domination

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!