GBP/USD eventually closed the week on lower ground after reaching new 2018 lows. No progress on Brexit and a small dovish turn in the BOE hurt the pound. The upcoming week features PMI data and a speech by Carney. Here are the key events and an updated technical analysis for GBP/USD.

Brexit was on the sidelines on the EU Summit and there is basically little progress. In addition, Haskel, a dove, is joining the BOE instead of McCafferty, a hawk. They both spoke at the same event and the stark contrast weighed on the pound. UK GDP for Q1 was upgraded to 0.2% q/q in the last read, giving some respite to the pound. In the US, fears of trade wars were slightly lower as Trump refrained from taking the toughest possible action against Chinese investment. US data was mixed.

Update: the Manufacturing and Construction PMI’s beat expectations, somewhat supporting the pound. More importantly, the market mood is calmer. UK services PMI beat expectations with 55.1 points, providing an uplift for the pound. It added to the good mood after England secured its place in the quarter-finals. The UK government is gearing up to an all important meeting about the future relations with the EU. Ahead of the Chequers meeting, it seemed that PM Theresa May is pushing for a softer version of a Hard Brexit. The pound also enjoyed a better mood in markets. Markets reacted with a shrug to the US tariffs on China and the counter-duties by the world’s second-largest economy.

Join a live coverage of the US NFP.

[do action=”autoupdate” tag=”GBPUSDUpdate”/]

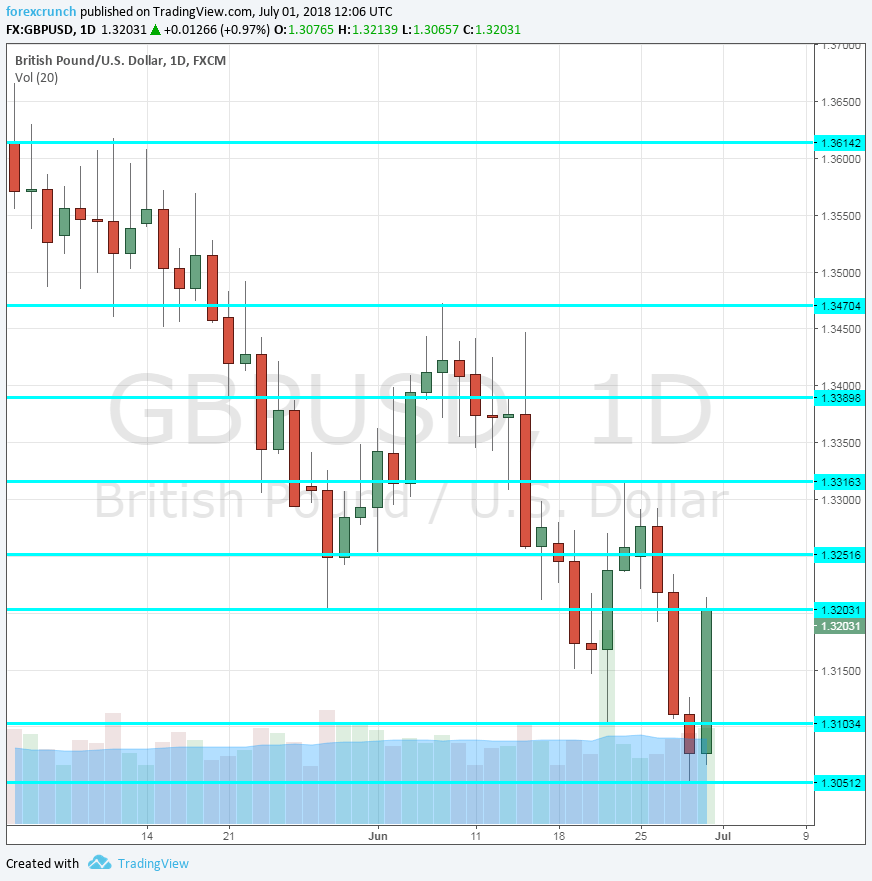

GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Manufacturing PMI: Monday, 8:30. The manufacturing sector is growing at an OK pace. The score stood at 54.4 in May and is now expected to tick down to 54.1 points. The sector enjoyed a weaker pound for its exports.

- Construction PMI: Tuesday, 8:30. The construction sector has been the weaker link in the economy and the PMI even dipped into contraction territory at some point. A score of 52.6 is on the cards in June after 52.5 in May.

- BRC Shop Price Index: Tuesday, 23:01. This gauge of inflation at the British Retail Consortium’s stores has dropped by 1.1% y/y in June. We will now get the figures for June.

- Services PMI: Wednesday, 8:30. The third and last of the purchasing managers’ indices in the US is for the services sector, the largest and most important one. The forward-looking survey stood at 54 points in May and is expected to tick down to 53.9 points in the read for June. A pick up in growth during the spring could boost the indicator and the pound, while concerns about Brexit could push it down.

- Housing Equity Withdrawal: Thursday, 8:30. This measure of lending in the housing sector stood at 6.7 billion in Q4 2018. Expectations stand on 7.3 billion for Q1 2018, a broader withdrawal rate.

- Mark Carney talks Thursday, 10:00. The Governor of the BOE will speak in Newcastle and has the opportunity to respond to recent economic data and his thoughts about inflation.

- Halifax HPI: Friday, 7:30. This highly regarded gauge of house prices jumped by an encouraging 1.5% in May and is expected to moderate to an increase of 0.4% in June. There is quite a divergence between different regions of the UK.

* All times are GMT

GBP/USD Technical analysis

Pound/dollar dropped sharply, reaching the 1.30 handle and eventually closed just around 1.3205, mentioned last week.

Technical lines from top to bottom:

1.3615 capped the pair in late 2017. 1.3470 was a swing high in early June.

The round number of 1.34 could provide further support. Further down, 1.3315 was a swing high in late June.

1.3250 was a swing low in early June. Even lower, 1.3205 was the low point in late May. 1.3100 was a swing low in mid-June and 1.3050 is the latest 2018 low. The round number of 1.3000 awaits below

I remain bearish on GBP/USD

The small upgrade in UK GDP is unlikely to change the broader picture for the pound. And that picture is that Brexit Day is nearing without an agreement. In addition, the US Dollar enjoys the occasional risk-off sentiment related to trade.

Our latest podcast is titled Festive Fed, Dovish Draghi, and a global trade war

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!