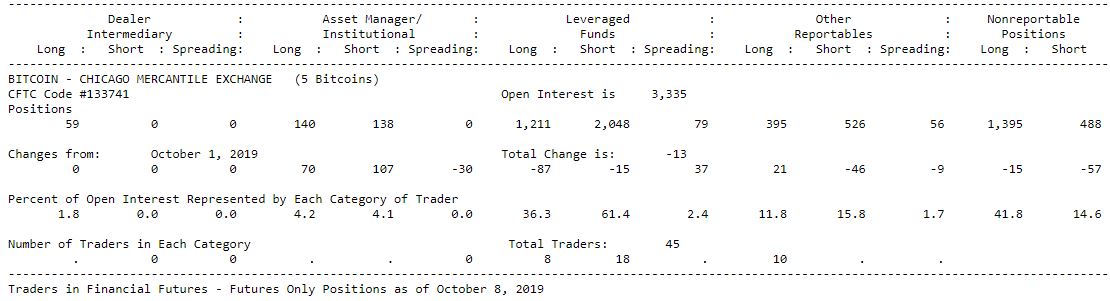

- Asset managers are still holding more longs than shorts 140 vs 138.

- Leveraged funds hold more shorts than longs 2,048 vs 1,211.

The CoT report this week does not make for good reading for the bulls this week.

The bears have increase their shorts more in the asset managers pile and in the leveraged fund’s section the bears let go of fewer contracts.

This would suggest as of 8th October sentiment in the futures market is still soft and in favour of the bears.

Looking at price action it seems that the market action has confirmed this. Price had a fake break to the upside yesterday and has now moved back below 8,780 consolidation zone.

This week the SEC decision to reject the Bitwise ETF was the key to the bearishness. Since the decision was annouce there has been weakness across the board.