- The US Dollar is on the decline, giving support to the Australian Dollar.

- More US related economic data will impact the currency pair.

- RBA meeting and interest rate can significantly impact the pair.

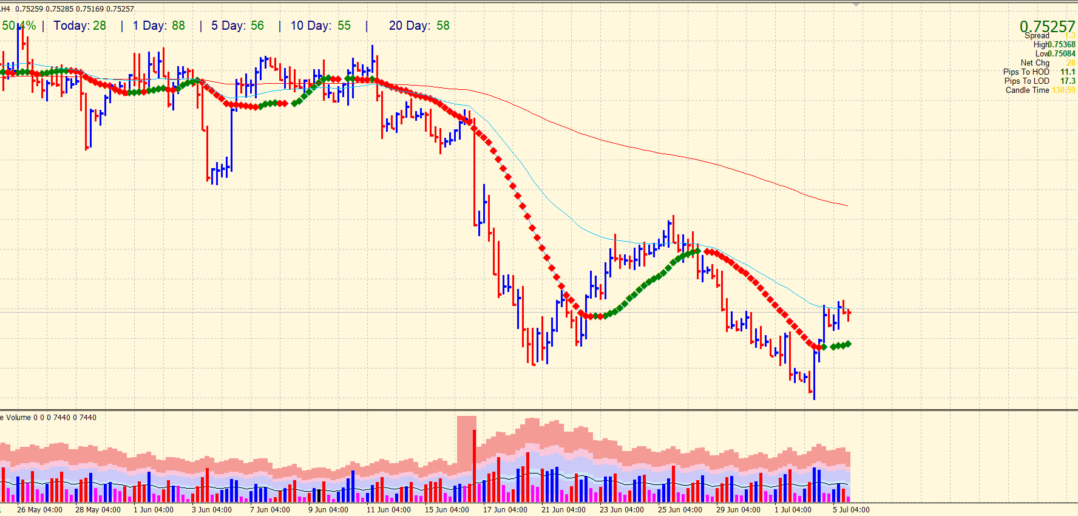

- The price is capped by 50-period SMA on the 4-hour chart.

The start of the new week comes with a decline in the DXY Dollar Index and a brief rise in the AUD/USD. As of this writing, the DXY is trading at 92.30, 45 pips below its high hit last Friday after the NFP was posted. Data from the US Department of Labor show that hiring is accelerating as the economy continues to open up. However, these data do not signal that the Fed is facing the need to start curtailing its stimulus policy shortly. Unemployment in the US was expected to fall to 5.6% in June from 5.8%, but, on the contrary, rose to 5.9%.

Thus, it is still premature to talk about the final breakdown of the Dollar’s downward dynamics, although it is also not worth talking about its deeper decline. Nevertheless, inflation, which has shown record growth rates over the past 29 years, will sooner or later force the Fed to start considering the issue of curtailing its stimulating policy.

Macro data coming from the US, which indicates a significant acceleration of the US economic recovery, strengthen market participants’ optimism about the Dollar’s outlook. It is also receiving support from Joe Biden’s new plan to modernize US infrastructure, approved by the US Congress last month.

Today the US financial markets are closed for the Independence Day celebrations. As a result, the publication of important macro statistics for the second half of the trading day is also not scheduled.

RBA meeting and interest rate

Of the upcoming events that may increase volatility, attention should be paid to tomorrow’s RBA meeting on monetary policy issues.

At its June meeting, the Australian Central Bank decided to keep the key interest rate and the target level of yield on 3-year government bonds at a record low of 0.10%. However, in the accompanying comments, it was said that the Central Bank would not raise the rate until the actual inflation is stable in the range of 2% -3%, which is unlikely to happen before 2024. In July, the bank will consider the issue of further purchases of bonds.

Meanwhile, some economists expect the RBA to undertake A$50 billion in asset purchases over the next six months (up from the current A $ 100 billion in monthly purchases). In fact, this is the beginning of the curtailment of the stimulating policy. Suppose the RBA really decides to reduce the volume of purchases on the national bond market at its July meeting. In that case, it will mean a reduction in the volume of liquidity and a strengthening the Australian Dollar.

The Australian Dollar and the pair AUD/USD, which is trading near 0.7535 at the time of this publication, rallied earlier this week, supported by the weakening US dollar and rising commodity prices.

The RBA’s decision on the interest rate will be published on Tuesday at 04:30 (GMT), and at 06:00 the speech by the head of the RBA, Philip Lowy, will begin, who will assess the current situation in the Australian economy and comment on the bank’s decision on monetary policy.

Any signals from him regarding a change in the RBA’s monetary policy plans will cause a sharp increase in volatility in the AUD quotes and the Australian stock market.

AUD/USD technical view: Will bulls sustain?

Although the AUD/USD pair maintains bids above 2-SMA on the 4-hour chart, the 50-SMA is capping more gains. Any break beyond the 50-SMA (0.7530) will signal a continuation of bullish rally towards the swing high and 200-SMA at 0.7600-0.7625. On the flip side, the 0.7500 round number serves as interim support ahead of 0.7470 and then 0.7440.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.