- GBP/USD is recovering after the worst fall in June.

- BoE is maintaining a dovish tone that can hamper the rise.

- Delta variant can also weigh on the pair.

June being the worst month of the last nine, the GBP/USD is gradually recovering. It would seem that after the Fed stopped ignoring the acceleration of inflation, the implementation of the Bloomberg experts’ consensus forecast for GBP/USD of 1.42 at the end of 2021 can be forgotten.

Still, the mixed statistics on the US labor market convinced that it was too early to do this. Yes, nonfarm employment showed the best dynamics in the last 10 months, but the unemployment and average wages were disappointing. So, does this allow the Fed to wait with the withdrawal of monetary stimulus?

Dovish tone of Bank of England

It seems that, unlike the Fed, which is tired of being peaceful, the Bank of England, on the contrary, is ready to allow the economy to overheat. BoE head, Andrew Bailey, entered into a correspondence dispute with retiring chief economist Andy Haldane. The latter predicted an acceleration of inflation to 4% by the end of 2021 and advised not to delay the normalization of monetary policy. Bailey responded that starting early monetary expansion could slow down GDP growth.

According to the head of BoE, the economy of Foggy Albion, after a temporary surge due to the exit from lockdowns, will gradually return to the lower baseline growth rates that took place after the 2008 crisis.

Such dovish speeches mean that the Bank of England is ready to turn a blind eye to the acceleration of inflation to 3%, which it predicts by the end of this year. Approximately the same was said by the FRS until mid-June, which caused the US Dollar to fall.

GBP/USD in pandemic

Low volatility plays on the side of sterling, allowing foreign investors to invest in financial markets and the economy of Foggy Albion and thus finance the negative current account balance and the reaction of the population to the spread of the Delta variant of COVID-19. Despite the increase in the number of infected to the highest levels since February, the number of hospitalizations and deaths does not increase. This shows that vaccines, which are already fully vaccinated by almost 50% of the population, are working!

The problem is that data on the pandemic situation are coming in with delays, so the next one or two weeks will be decisive for the Pound and Britain. If coronavirus vaccinations do not work against its Delta variant, the chances of a normalization of monetary policy by the Bank of England will significantly decrease. The markets are currently citing August 2022 as the most likely date for a repo rate hike.

Thus, BoE and the Fed have essentially changed places. The former has become less aggressive, the latter has become more, but the GBP/USD quotes are rising. I believe that we are talking about profit-taking on shorts after the publication of statistics on the US labor market for June. Soon the situation will stabilize, and the bears will return.

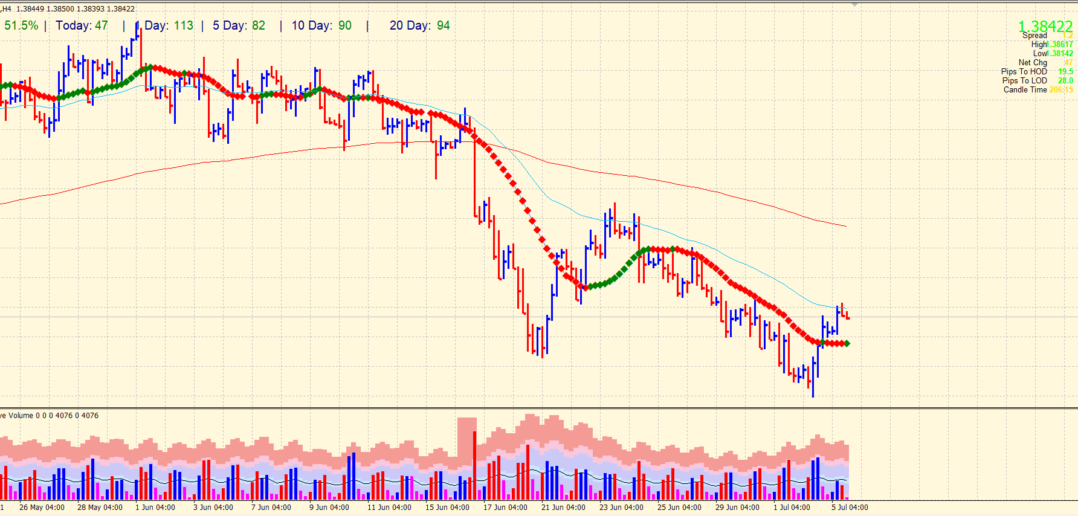

GBP/USD technical view: Sell on strength

Technically, the further fate of GBP/USD depends on resistance tests in the form of moving averages. Right now, the 50-SMA on the 4-hour chart caps further gains for the pair.

A rebound from levels 1.388, 1.393 and 1.399 will be a reason for selling.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.