- AUD/USD has gained after RBA’s QE tapering plan.

- The pair ran higher but stalled near 0.7600.

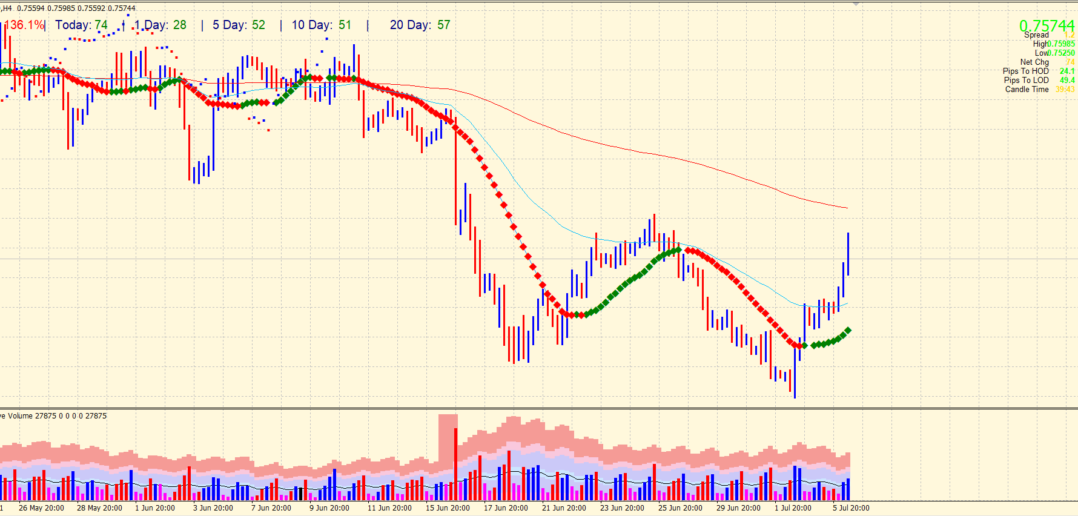

- The pair is now undecided near the 200-day moving average.

- Volume is encouraging for bulls.

The Australian Dollar has found some strength after the update of the recent RBA’s policy. It lent some support to the AUD/USD pair to move beyond a 200-day moving average and stalls near 0.7600 resistance. We can expect the continuation of bids in Aussie after RBA’s statement. However, US Dollar can end its correction on Friday, and it can weigh on the Aussie bulls.

QE taper plan by RBA

The Reserve Bank of Australia has announced that it will start tapering the quantitative easing program from September. This is because the officials believe that the Australian economy has recovered stronger than expected, and the outlook is positive through the weekly purchased amount.

The RBA will probably review further in November, and the board will be allowed to respond to the economic conditions at that time. The RBA’s announcement of QE tapering was more hawkish than anticipated. However, RBA has made the purchases in the future more flexible depending on the economic conditions.

However, the RBA’s dovish decision (holding policy rates until 2024) has been overshadowed by the hawkish QE policy. RBA said it will hold the cash rates until they reach an inflation target of 2 – 3 per cent. This can weigh on short-term yields in parallel to the RBA’s yield curve control.

The recent guidance from RBA tells that the bond for April 2024 will retain the yield target at 0.10%. Overall, the Australian Dollar will find more bids in the short term. It seems like the asset is already undervalued in the context of yield spreads and current fundamental factors.

AUD/USD technical view: Will bulls hold or retrace?

Although the pair found bids after the RBA meeting, AUD/USD has pared off gains coming back to the 200-day moving average.

On the 4-hour chart, the price seems like returning to where it started. However, the recent bar is still bullish. It indicates that the bulls may have run out of steam near the swing high of 0.7600 area. However, the volume favors bulls, and further action can be decided during the NY session when US Dollar will show its strength or weakness.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.