- Gold price initially fell from the key $1818 level.

- The US CPI came better than expected that weighed on the gold.

- US bonds and Delta variant are keeping the gold underpinned.

- The 200-SMA (4-hour) presents an important level for bulls to break.

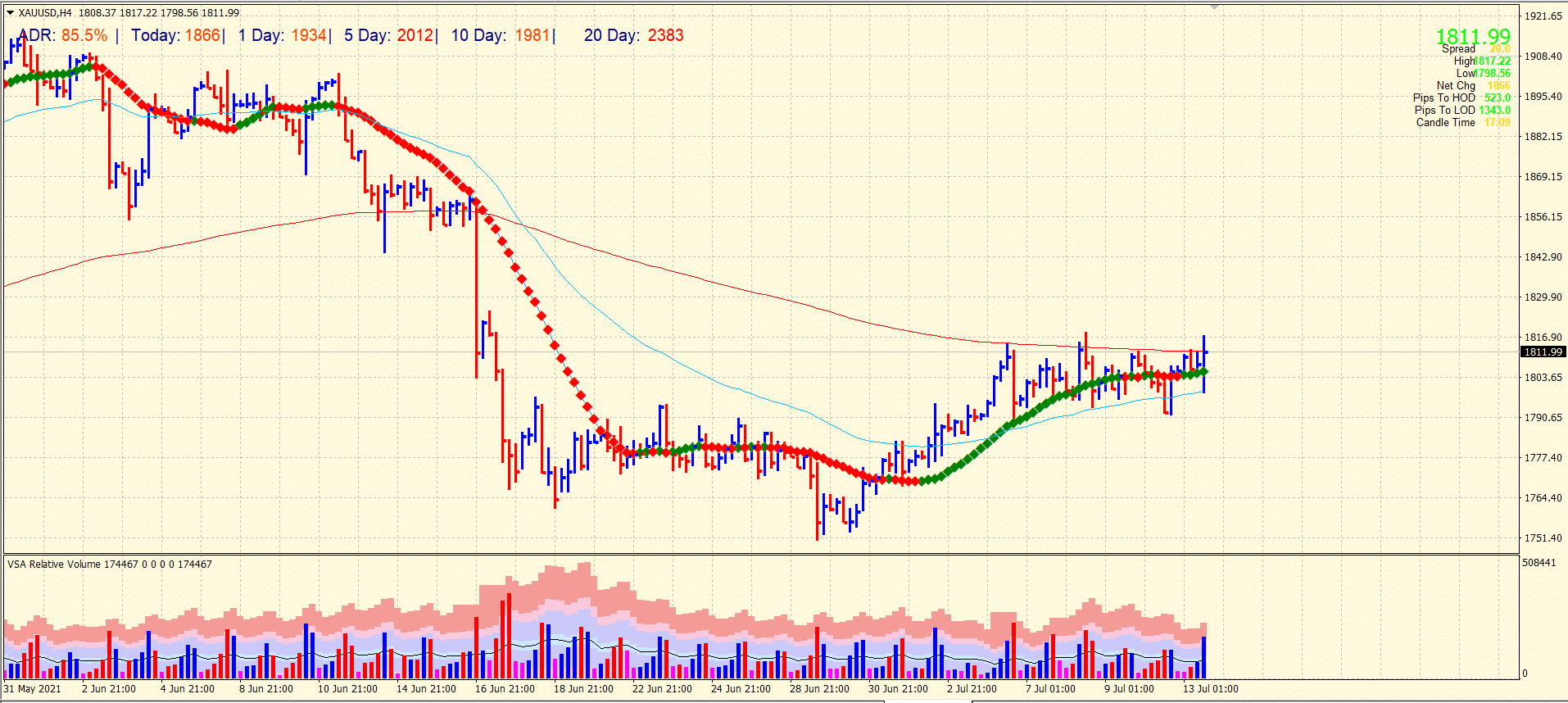

Gold price tested the key level of $1816-18 today, just ahead of the US core inflation data release. The price found a hard rejection near the key zone and retreated back again. However, the US Dollar has sharply returned in the game after the US CPI figures came better than expected. The US Dollar gained across the board and sent all the major currencies down for 40-50 pips. But gold prices have not yet found any plummet. The precious metal remains well supported above the $1800 key support.

-Are you interested in making money in forex? Check our detailed guide-

The Greenback found fresh bids during the earlier New York session as the US CPI figures came at 5.4% y/y in June, smashing the market expectations. The core CPI also jumped to 4.5% y/y during the reported month.

The recent US CPI figures can fuel the market with the speculation that the Fede will tighten the monetary policy sooner than expected and may provide additional buying momentum in the US Dollar.

US bond yields have been lowering this week, creating confusion among the investors, resulting in the gold prices. Lower returns on the US Treasuries are keeping the demand for gold underpinned as a safe haven asset. However, the correlation between the US Dollar and the bonds is somewhat eroded.

The fear of the Delta variant of the coronavirus is keeping the optimism of global economic recovery overshadowed. The hopes of recovery are damped temporarily, though.

-Are you looking for automated trading? Check our detailed guide-

Gold price technical view: What’s more to come?

The gold price has returned back, paring off the majority of post-US CPI losses. However, the key level of $1816-18 still remains unbroken. The band of 50 and 200 SMAs on the 4-hour chart is squeezing, indicating a breakdown under preparation. The recent 4-hour bar has seen a huge volume even though it has more than three hours left to complete. We can see a meaningful recovery in the coming three hours or later. Still, the key is to break above the 200-SMA and stay above the level.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.