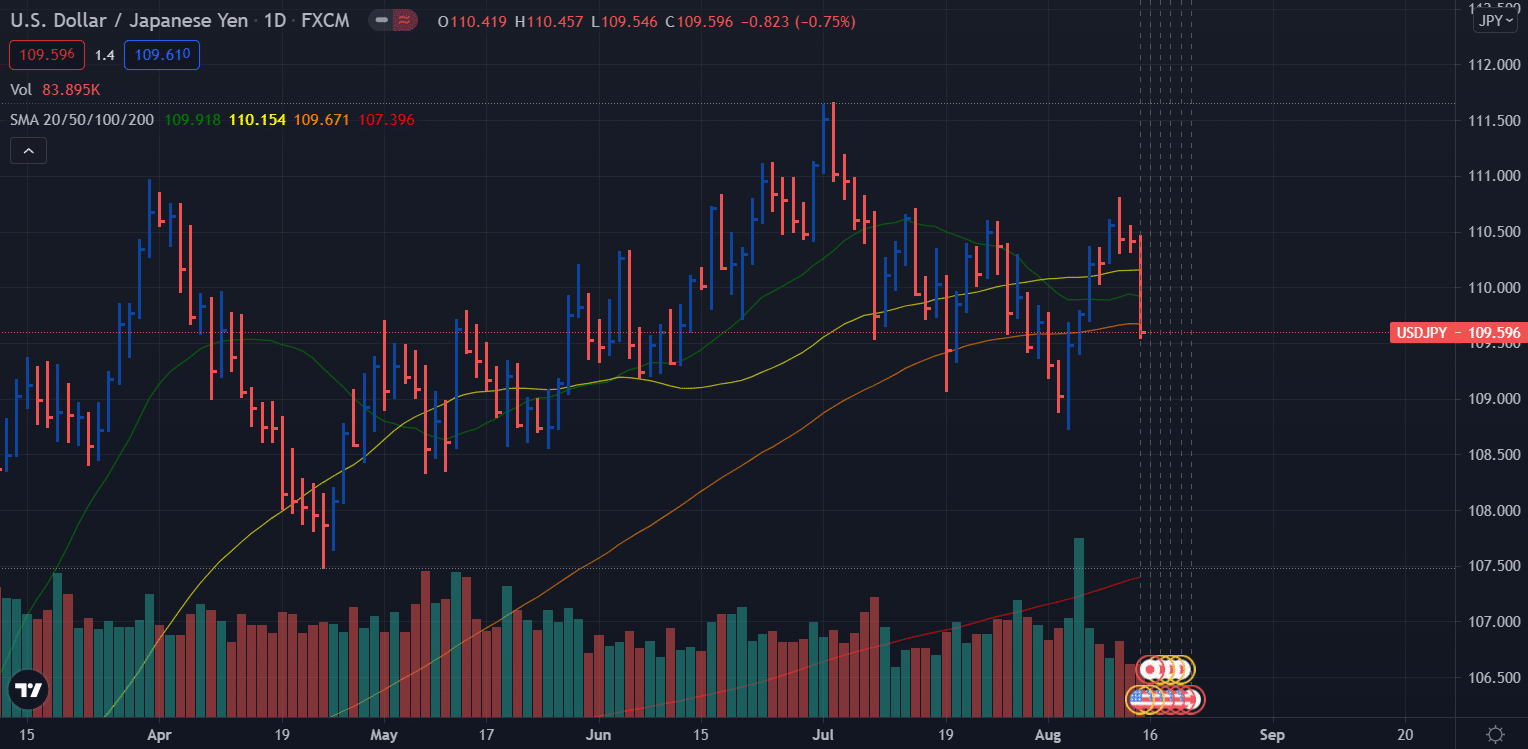

- USD/JPY closed the week near the lows under 110.00.

- Mixed data concerns and Fed’s unclear stance weighed on the pair.

- Treasury yields have grown lower, putting more weight on the US Dollar.

- Bearish momentum is likely to continue next week.

The weekly forecast for the USD/JPY remains broadly bearish as the week closed with an aggressive sell-off in the US Dollar across the board.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

On Wednesday, the USD/JPY reached its highest level since July at 110.80. US inflation data showed a slight weakening in growth. After the release, the subsequent rapid decline through the 110.65-70 support band highlighted the difficulty of breaking through the serious resistance to 111.00 without changing the fundamental picture.

On Thursday, US July Producer Price Index (PPI) turned inflation upside down, setting an annualized growth rate of 7.8% for a single month, but the pair fell far short of its high, reaching only 110.55.

On Monday, USD/JPY opened at 110.27 and closed at 109.60 on Friday. Unexpectedly weak Michigan consumer sentiment data for August pushed the pair towards 110.00.

It is unclear what policy the Federal Reserve will take. Richard Clarida, vice chairman of the bank, has hinted that bond purchases may be approaching. It remains to be seen whether the Jackson Hole Conclave will reach a consensus at the FOMC meeting a month later on the Fed’s claim that inflation has risen suddenly.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

Nevertheless, political events could restrict travel during the August holidays in Europe and the United States.

The US Treasury market was lower. On Friday, the 10-year bond yield lost a weekly gain after the Michigan Consumer Sentiment Index fell below its previous pandemic low in August.

As long as inflation is uncertain in the US, a global pandemic is uncertain, and the Fed has not indicated its direction, USD/JPY could remain sluggish for several weeks within the range of the past two months.

What’s next?

The next two weeks are likely to be dominated by the factors holding up USD/JPY.

The Fed will put its policy on hold until the Jackson Hole meeting on August 26-28 or the FOMC meeting on September 21-22.

At present, the consequences of the pandemic wave in Japan and the United States are largely unknown. However, what will impact the economy, and will this lead to blocks and lower restrictions? As the virus spreads, the business outlook in Japan appears to be deteriorating.

Japan’s important data during Aug 16 – 20

In Japan, imports and exports are the most likely to influence the market on Monday, as domestic activity is less likely to spur a recovery. Friday’s CPI is likely to post the second month of positive growth after eight months of deflation.

America’s important data during Aug 16 – 20

In June’s wake of unexpectedly strong results, US retail data centers will likely chill on Tuesday. Here, a significant amount will provide dollar support. Industrial production is expected to be unchanged in July as compared to June.

USD/JPY weekly technical forecast: Bears to roar next week

The USD/JPY price dropped on Friday and closed below the 20, 50 and 100 moving averages. As a result, the pair lost all the weekly gains on Friday, closing near the fresh weekly lows at 109.60. The USD/JPY has posted a widespread down bar that may find some upside retracement on Monday and Tuesday. However, the bearish trend prevails, and the next week can be dominated by a broader downside move. Immediate support lies at 109.10 ahead of 108.75. On the upside, 110.00 remains a strong resistance for the pair.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.