- Japanese authorities have shown reluctance to intervene.

- Increased expectations of a Fed pause caused the dollar to weaken.

- US job growth surpassed forecasts.

The USD/JPY weekly forecast is slightly bearish as the US labor market and economy at large are slowly easing.

Ups and downs of USD/JPY

USD/JPY had a volatile week that ended with the price nearly flat. Investors remained cautious about the possibility of a yen intervention. However, Japanese authorities have shown reluctance to intervene.

–Are you interested to learn more about MT5 brokers? Check our detailed guide-

Notably, the pair started the week lower as the dollar weakened on downbeat economic data. The data led to an increase in expectations of a Fed pause, causing the dollar to weaken and giving a boost to the yen.

Later in the week, investors received data on US employment. Private employment in the US declined. However, a mixed report initially caused the dollar to drop on Friday before rebounding. US job growth surpassed forecasts. Nevertheless, the unemployment rate surged, indicating signs of a labor market slowdown.

Next week’s key events for USD/JPY

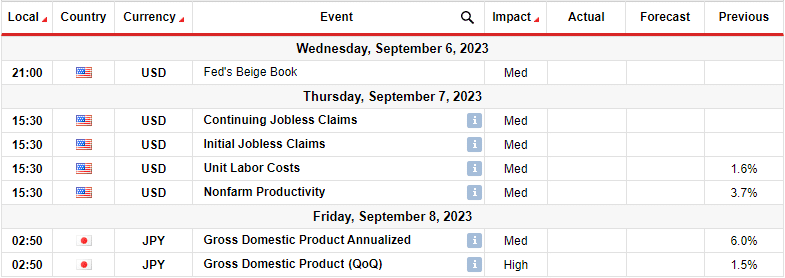

Investors do not expect much in the coming week regarding key economic releases. The US will release its weekly employment data showing initial jobless claims. On the other hand, Japan will release its Gross Domestic Product report.

On Friday, the dollar strengthened against the Japanese yen. This happened because the August jobs report revealed a robust labor market despite some indications of decline. It was a mixed report showing some easing in the labor market, especially with the unemployment rate. If the jobless claims rise, it would further support the views of a deteriorating labor market.

USD/JPY weekly technical forecast: Bullish Momentum Wanes.

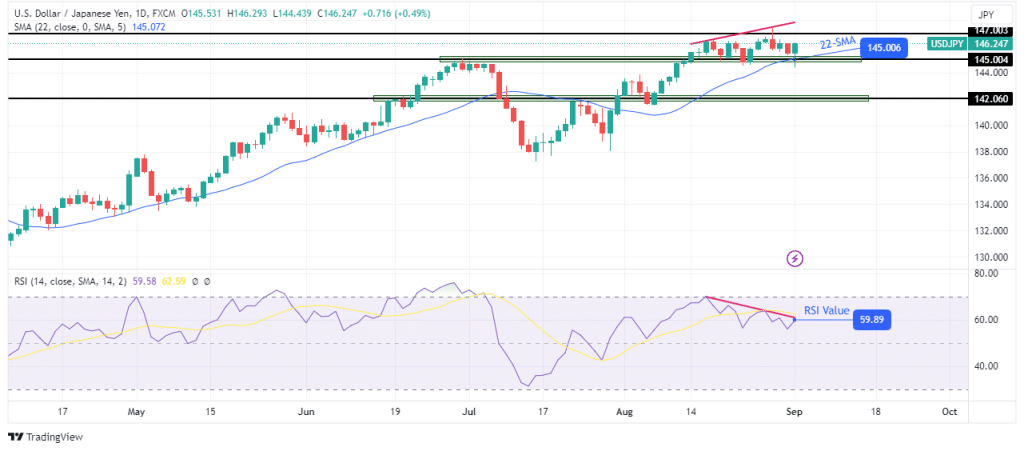

USD/JPY has a bullish bias on the daily chart. The price has made strong swings away from the 22-SMA, a sign that the bulls are in the lead. Furthermore, the RSI supports bullish momentum, trading above 50.

–Are you interested to learn more about Australian forex brokers? Check our detailed guide-

Bulls made a bold step when the price broke above the 145.00 key resistance level. However, they have yet to make any significant swings away from this key level. The price has been moving sideways, with support at 145.00 and resistance at 147.00. This shows that bulls have weakened.

Moreover, the RSI has made a bearish divergence with the price, further confirming weakness in the uptrend. If this divergence plays out, the price will likely break below the 22-SMA to retest the 142.00 support.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.