- Federal Reserve meeting minutes indicated the possibility of further rate hikes.

- The yen reached the significant 145 level last Friday for the first time in approximately nine months.

- Investors expect inflation data from Tokyo, a leading indicator of Japan’s inflation.

The USD/JPY weekly forecast is slightly bearish as investors are getting more cautious amid apprehensions of intervention.

Ups and downs of USD/JPY

The dollar fell against the yen but remained close to a two-month peak on Thursday and Friday. This followed Federal Reserve meeting minutes that indicated the possibility of further rate hikes.

–Are you interested to learn about forex bonuses? Check our detailed guide-

Meanwhile, investors are closely monitoring the Japanese yen, which reached the significant 145 level last Friday for the first time in approximately nine months. This level previously prompted interventions by Japanese authorities in September and October of the prior year.

Kathy Lien, managing editor of 60 Second Investor, noted, “We may not be at the intervention point for dollar-yen just yet, but it’s likely around 150.”

Next week’s key events for USD/JPY

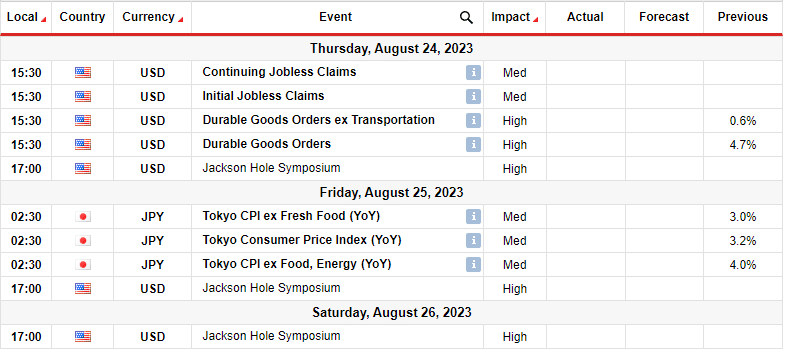

Next week will have very little data from the US and Japan. In fact, most of the important reports will come out towards the end of the week. The market focus will be on employment data from the US and inflation data from Japan.

Moreover, a speech from Fed Chair Powell during the Jackson Hole Symposium will cause volatility. Investors will look for clues on future policy moves.

The initial jobless claims report from the US will highlight the state of the labor market. On the other hand, inflation data from Tokyo is important as it is a leading indicator of Japan’s inflation.

USD/JPY weekly technical forecast: Price revisits 145.00 key level.

On the daily chart, USD/JPY is bullish as the price has made a higher high above the 145.00 key level. This is a continuation of the previous bullish trend. Bears tried to take control by pushing the price below the 22-SMA. However, they could not start a bearish trend by making lower lows and highs. This allowed bulls to return stronger.

–Are you interested to learn more about forex options trading? Check our detailed guide-

Bulls are showing commitment and enthusiasm to push the price higher. This is seen in the 30-SMA, which trades well below the price and the RSI, near the overbought region. The price has now pulled back to retest the 145.00 key level. If it holds firm, bulls will be revisiting the 148.00 resistance level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.