- Gold bulls retreated from the $1,800 level as the US yields rose after positive US data.

- Greenback may remain strong amid the slow growth rate in China.

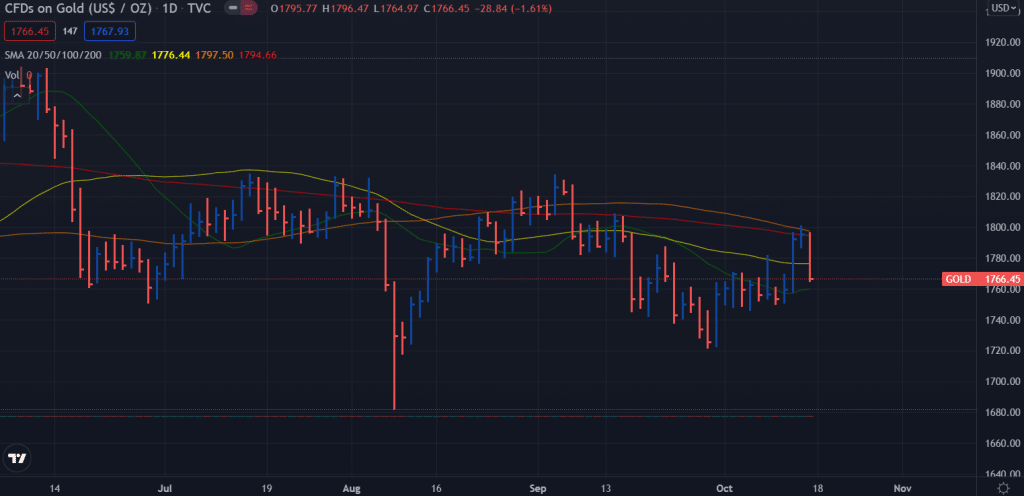

- Technically, the bears may test the swing low of $1,720 if the 20-day SMA does not hold.

The gold price weekly forecast is bearish as the price could not break the $1,800 level while rising US yields may continue to weigh on the metal.

-If you are interested in social trading apps, check our detailed guide-

For the first two trading days of the week, gold moved in a tight range above $1,750. However, US Treasury bond yields fell sharply on Wednesday, causing the price of the XAU/USD to advance nearly 2% before climbing even more to a new monthly high of over $1,800 on Thursday. As a result, gold reversed again before the weekend, losing most of its weekly gains and hitting around $1,770 as Treasury yields rose.

According to data released on Thursday, the annual producer price index (PPI) for the US rose from 8.3% to 8.6% in September. In addition, the US Department of Labor announced a total of 293,000 initial claims for unemployment compensation in the week ending October 9. The S&P 500 index rose 1.7% on Thursday, reflecting a positive market environment for risk, and gold hit $1,800 for the first time since mid-September.

In the wake of strong US data, gold prices fell on Friday due to a decisive rise in US 10-year Treasury yields. Despite a 0.2% decline predicted by analysts, US retail sales rose 0.7% m/m in September to $ 625.4 billion. The consumer sentiment index fell from 72.8 in September to 71.4 in October, but market participants barely took note.

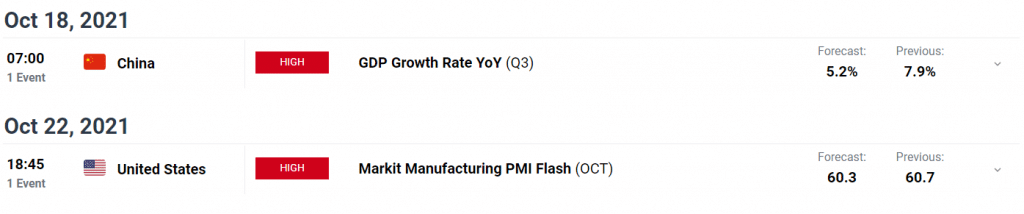

Key data/events for gold next week

In the earlier part of the coming week, China will release its third-quarter gross domestic product (GDP) data. Compared to the second quarter, analysts predict China’s economy will grow by 5.2% year over year. A summary of China’s economic data includes data on retail sales and industrial production for September. These figures may indicate that the growth rate in China has slowed significantly, and safe havens would likely dominate markets and help maintain the strength of the dollar.

On Wednesday, the CPI data for the euro area and the United Kingdom will be important. However, it is unlikely that these numbers will have a direct impact on XAU/USD.

IHS Markit will publish PMI manufacturing, and service briefings for Britain, Germany, the Eurozone, and the US after the October Federal Reserve Bank of Philadelphia Manufacturing Survey and weekly US initial jobless claims are released.

-If you are interested in brokers with Nasdaq, check our detailed guide-

Gold weekly technical forecast: Bears to dominate under $1,800

The gold price found a hard rejection at the $1,800 mark. The psychological level coincides with the 100-day and 200-day moving averages. The price closed the week just above the 20-day moving average. If the price breaks the $1,760 level, we may see a test of $1,720 swing low ahead of $1,700. On the upside, any rally will see a pause around $1,800 ahead of the quadruple top at $1,834.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.