- The euro rose following figures showing a decline in US inflation.

- Investors are hoping the Federal Reserve will scale back its rate hikes.

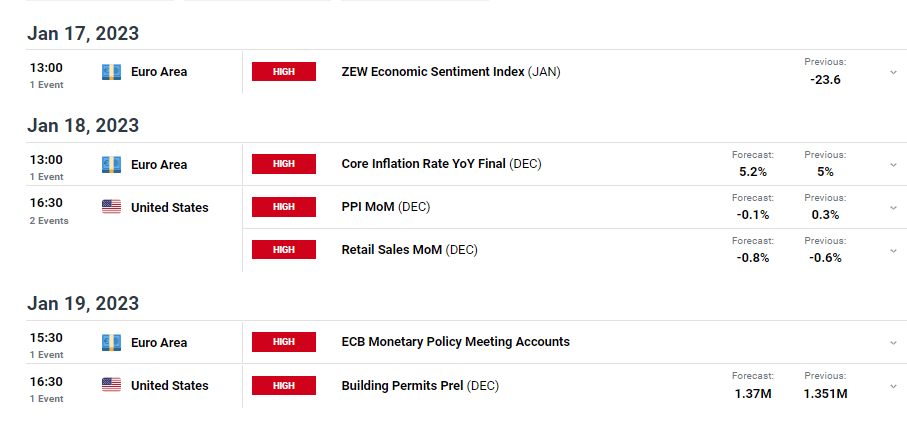

- Investors are awaiting eurozone inflation data.

The EUR/USD weekly forecast is bullish as easing US inflation could mean smaller Fed hikes. Improving risk sentiment may further weigh on the greenback.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

Ups and downs of EUR/USD

The US inflation report dominated market sentiment in the past week. Investors waited anxiously from the start of the week, and when the report came out, there was a lot of volatility.

On Thursday, the dollar fell to an almost nine-month low against the euro following figures showing a decline in US inflation, fueling speculation that the Federal Reserve will scale back its rate hikes.

Consumer price index (CPI) statistics from the United States revealed a 0.1% reduction last month, the first drop since May 2020, when the economy was in disarray due to the first wave of COVID-19 infections.

Price pressures are easing as demand slows due to the US central bank’s quickest monetary policy tightening campaign since the 1980s.

The dollar fell as much as 1% against the euro after the CPI report, its worst performance against the euro since April 21.

Next week’s key events for EUR/USD

Next week will be important for the euro as there will be inflation data from both the US and the eurozone. Investors expect an increase in the eurozone’s core inflation rate from 5% to 5.2%. The US will release PPI data showing inflation in the production level.

EUR/USD weekly technical forecast: Bulls are weak above the 1.0701 key level

On the daily chart, we see EUR/USD trading above the 22-SMA after bears failed to keep it below the SMA. Although the pair is in an uptrend, the move has been choppy, with the price mostly staying close to the 22-SMA. This is a sign that bulls are struggling to push the price higher.

–Are you interested to learn more about forex signals? Check our detailed guide-

Bears tried to take over when the price paused at the 1.0701 resistance level by pushing it below the 22-SMA. However, bulls held on to control and broke above the resistance. Although the price made a new high, the RSI barely exceeded the previous high.

If the bulls do not get stronger in the coming week, we might see bears attempt another break below the 22-SMA. Success would see the price retest the 1.0403 key level.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.