- Gold gained momentum and broke its two-week losing streak with its first weekly close above $2,000.

- The US dollar weakened due to ISM’s monthly PMI report, and gold prices gained momentum on Tuesday and were corrected on Thursday.

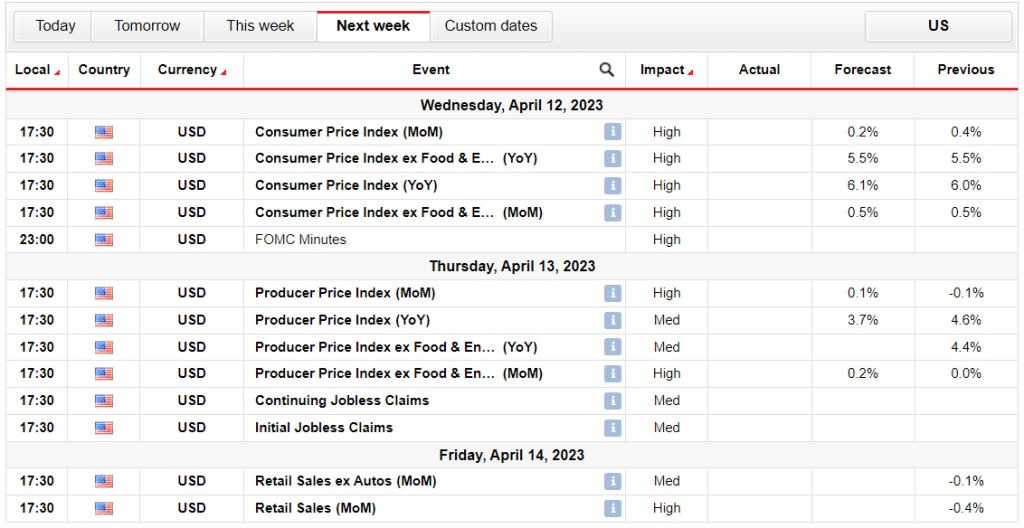

- Next week, gold’s value could be impacted by the March US jobs report, March CPI data, and China’s trade balance data.

The gold’s weekly forecast is bullish as the weaker US dollar and global recession worry fuel the demand for gold being a safe haven asset.

Gold had a good week, gaining momentum and breaking its two-week losing streak. It reached a high of over $2,030 but retreated slightly towards the end of the week.

–Are you interested in learning more about managed forex accounts? Check our detailed guide-

However, the week ended with its first weekly close above $2,000. Next week, March’s inflation data from the US and trade balance data from China could affect gold’s value.

Ups and downs of gold this week

On Tuesday, gold prices gained bullish momentum and surpassed $2,000 due to tech buyers’ interest and a decline in benchmark 10-year Treasury yields. However, on Wednesday, gold prices struggled to maintain bullish momentum due to the US dollar finding a foothold in risk aversion. On Thursday, gold prices underwent a technical correction as the US 10-year Treasury yield rose.

On Friday, the BLS reported that the number of Non-Farm Payrolls (NFPs) rose by 236,000 in March, and the unemployment rate fell to 3.5%, while the labor force participation rate rose to 62.6%. However, wage inflation fell to 4.2% y/y from 4.6% in February.

Key events for gold next week

Next week, the March US jobs report, March Consumer Price Index (CPI) data, and China’s trade balance data could affect gold’s value. A delayed reaction to the US jobs report could lower US yields and give gold prices momentum, but a sustained recovery in yields could limit the upside for XAU/USD.

Hot monthly core inflation could make investors bet 25 basis points higher and have the opposite effect on the pair’s behavior. Markets forecast a contraction in China’s trade surplus, which could affect gold’s value.

Finally, Friday’s March Retail Sales and April Consumer Sentiment Index could affect the US dollar’s value, but it would be surprising to see data having a long-term impact.

Gold weekly technical forecast:

The daily chart of gold shows a strong bullish momentum. The price lies above the key $2,000 mark and the strong support of a 30-day SMA. Moreover, the daily RSI is below the overbought zone, which shows further potential for the upside.

–Are you interested in learning more about crypto brokers? Check our detailed guide-

Contrarily, if the price breaks below $1,990, then we may expect a bearish turnaround. Looking into the short-term horizon, we see a pattern ranging between $1,930 and $2,030. The probability of breaking the lower range is quite low. However, we can expect a solid upside leading to fresh all-time highs.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money