- The dollar mainly rose due to hawkish remarks from Fed Chair Jerome Powell.

- Powell indicated that additional rate hikes might be necessary to control inflation.

- A series of global rate hikes spooked investors, leading to a scramble for safety in the dollar.

The AUD/USD weekly outlook is bearish as the dollar will keep rising on a hawkish Federal Reserve. Fed Chair has hinted of two more hikes.

Ups and downs of AUD/USD

AUD/USD had a bearish week, with the stronger dollar being the major catalyst. Aussie was at the mercy of the dollar as there were no key economic releases from Australia. The dollar mainly rose due to hawkish remarks from Fed Chair Jerome Powell during his testimony to Congress.

–Are you interested in learning more about Canada forex brokers? Check our detailed guide-

The US dollar and Treasury yields rose following Federal Reserve Chair Jerome Powell’s indication that additional US interest rate hikes might be necessary to control inflation.

Furthermore, a series of global rate hikes spooked investors, leading to a scramble for safety in the dollar. There were concerns these hikes would lead to a recession.

Next week’s key events for AUD/USD

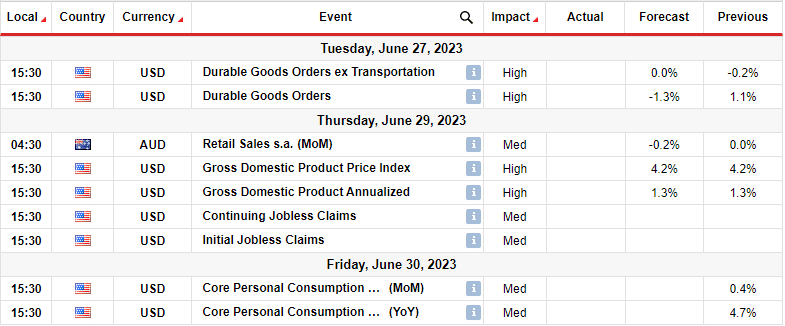

Next week, the US and Australia will issue several crucial reports that might result in some volatility in the pair. The more important reports include GDP and core PCE data from the US and retail sales data from Australia.

Notably, the GDP data will reveal the presence or absence of economic growth in the US and assess the effects of high-interest rates on the economy. On the other hand, the core PCE report plays a significant role as a key measure employed by the Fed to assess inflation.

Lastly, retail sales data from Australia will show the state of consumer spending in the country. Additionally, it will inform the RBA of the next policy move.

AUD/USD weekly technical outlook: 22-SMA puncture could lead to a bearish takeover.

After sellers made a sharp move, AUD/USD punctured the 22-SMA and the 0.6700 support on the daily chart. This comes after the price reversed at the 0.6900 resistance level. At the same time, the RSI has gone below 50, showing a possible shift in sentiment to bearish.

–Are you interested in learning more about social trading platforms? Check our detailed guide-

In the coming week, the price will bounce higher if it is rejected below these support levels. However, the bearish move will continue with the next target at the 0.6502 support level if bears are still strong. Bears must break below 0.6502 to start making lower lows and highs to confirm a bearish trend.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money