- The dollar rose amid increased expectations of a Fed rate hike next week.

- The Bank of Japan (BoJ) is inclined to maintain its current key yield control policy.

- Markets are expecting a 25bps rate hike from the Fed on Wednesday.

The USD/JPY weekly outlook is bullish as the rate differentials between the US and Japan will likely grow next week.

Ups and downs of USD/JPY

USD/JPY had a very bullish week, where the dollar recovered, and the yen weakened. The dollar rose amid increased expectations of a Fed rate hike next week. This came as employment data showed a resilient US labor market.

–Are you interested in learning more about Canadian forex brokers? Check our detailed guide-

Conversely, the yen weakened. It weakened following a Reuters report stating that the Bank of Japan (BoJ) is inclined to maintain its current key yield control policy in the upcoming week.

Moreover, according to five sources familiar with the matter, BoJ policymakers prefer to analyze additional data. Policymakers want to ensure a continued rise in wages and inflation.

Next week’s key events for USD/JPY

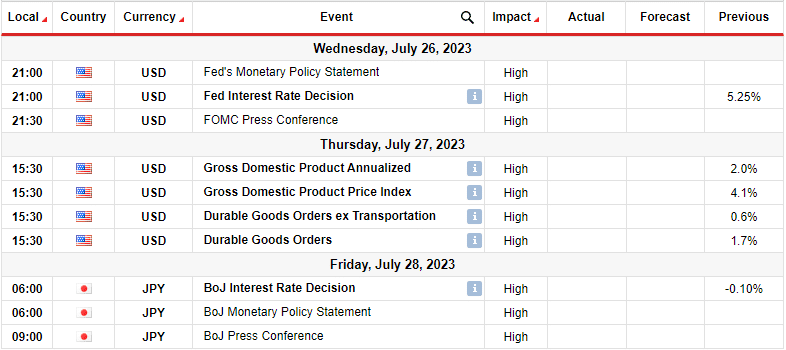

Next week will have significant events in the US and Japan, including central bank policy meetings. Investors will watch the Fed’s and BOJ’s policy meetings, which will no doubt cause a lot of volatility.

Notably, markets expect a 25bps rate hike from the Fed on Wednesday. On the other hand, there is a high chance the BOJ will maintain its current policy. Consequently, the rate differentials between the US and Japan will likely grow. This policy divergence is bound to weigh on the yen.

USD/JPY weekly technical outlook: Imminent shift in sentiment to bullish.

The bias for USD/JPY might change in the coming week as bulls are challenging the 22-SMA resistance. At the same time, the RSI has crossed above 50, a sign that bullish momentum is strong. Bears had initially taken over, pushing the price below the 22-SMA. Although they broke below the 140.01 level, they failed to go below the 138.05 support.

–Are you interested in learning more about high leveraged brokers? Check our detailed guide-

Bulls then took over, taking the price back to the SMA. The bulls might break above the SMA in the coming week and take control. This would mean a retest of the 144.25 resistance level. A break above 144.25 would make a higher high, confirming the continuation of the previous bullish trend.

However, if the 22-SMA holds firm as resistance, the price will likely drop to retest the 138.05 support level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money