- The dollar reached a one-week low against the yen due to declining Treasury yields.

- Japan’s finance minister gave no clear indication of intervening in the market.

- The weaker yen attracts more foreign tourists, boosting Japan’s services sector.

Today’s USD/JPY outlook is bearish. The dollar reached a one-week low against the yen due to declining Treasury yields. This occurred after a turbulent week in which weak economic data raised doubts about the prospects of additional Fed interest rate increases.

–Are you interested to learn about forex bonuses? Check our detailed guide-

Moreover, the dollar was set to end a six-week winning streak against major currencies. A crucial monthly US jobs report is approaching that will likely influence Federal Reserve policy in the short term.

Elsewhere, Japanese Finance Minister Shunichi Suzuki stated that markets should determine currency values, even though abrupt fluctuations are undesirable. However, he gave no clear indication of intervening in the market to support the weakening yen.

Notably, Suzuki emphasized, “Currency values should mirror economic fundamentals. I am closely monitoring currency movements,” adhering to the established official stance. Some market participants expressed surprise at the lack of resolve to prevent the yen from dropping below 145 yen per dollar. A breach of this level in September triggered Japan’s first yen-buying intervention in 24 years.

Meanwhile, speculation lingers in currency markets that Japanese authorities may shift their approach to the weak yen. They might focus on fiscal measures like maintaining a gasoline subsidy to mitigate the impact of price increases on consumers.

Additionally, authorities contend that the weaker yen attracts more foreign tourists, boosting the services sector. Another possibility is that Japan may struggle to gain US approval for a dollar-selling intervention.

USD/JPY key events today

The important US nonfarm payroll day is finally here. Investors will get data on US employment numbers and the unemployment rate. Moreover, there will be an ISM Purchasing Managers Index report.

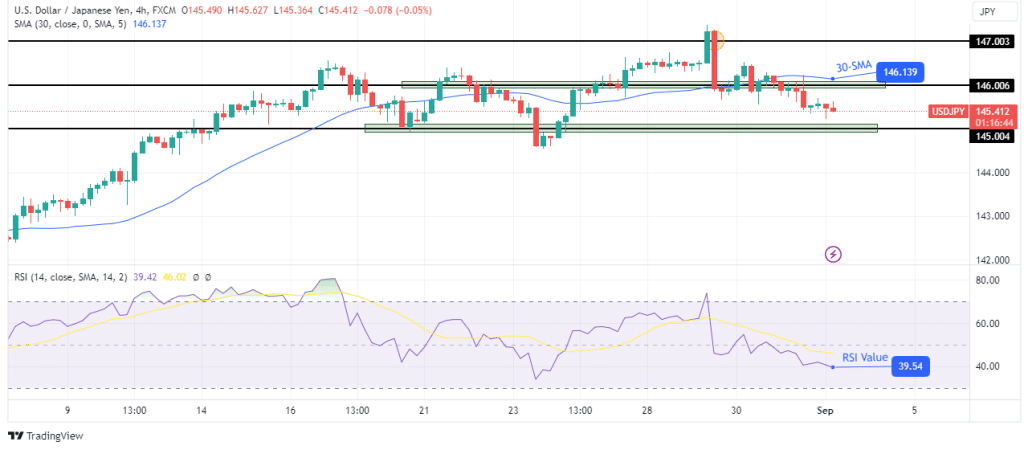

USD/JPY technical outlook: Price shifts gears as bears take charge.

On the technical side, USD/JPY has gone from bullish to bearish. This shift in bias came after the price broke below the 30-SMA and the RSI fell into bearish territory below 50. Moreover, the price fell below the 146.00 key support level.

–Are you interested to learn more about forex options trading? Check our detailed guide-

Currently, bears are heading for the next support at 145.00. A break below this level would further confirm the new bearish bias. However, if the level holds, bulls might return to retest the 146.00 level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.