- In August, the US services sector surprisingly picked up momentum.

- Better-than-anticipated domestic jobs data increased the likelihood of a BOC rate hike.

- Investors are eager to receive the US consumer inflation report.

The USD/CAD weekly forecast is slightly bearish as Canada’s employment report has increased bets of a BOC rate hike.

Ups and downs of USD/CAD

USD/CAD had a bullish week as the dollar soared. However, it ended the week well below its highs after Canada’s jobs report. The week started with data from the US, including the ISM non-manufacturing PMI and the initial jobless claims.

-Are you looking for automated trading? Check our detailed guide-

In August, the US services sector surprisingly picked up momentum. Additionally, last week, jobless claims reached their lowest point since February.

Meanwhile, the Canadian dollar gained strength against the US dollar on Friday. This happened because better-than-anticipated domestic jobs data increased the likelihood of Canada’s Central Bank raising interest rates.

Next week’s key events for USD/CAD

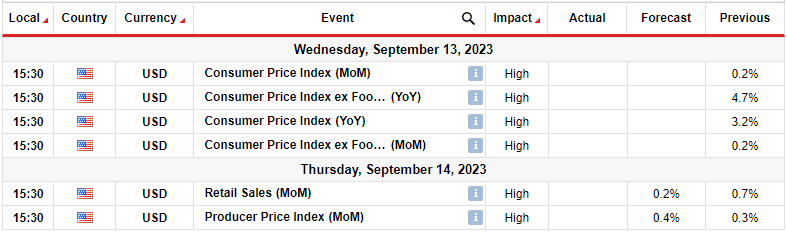

Investors will focus on data from the US next week as Canada will not release any essential data. The all-important consumer inflation report, retail sales, and producer prices report will come from the US. Investors are particularly eager to receive the US consumer inflation report as it will determine whether the Fed will hold high rates for long.

Meanwhile, the retail sales report will show the state of consumer spending in the US. Consumer spending plays a big part in driving the economy. Therefore, a higher reading could indicate a robust economy needing more work from the Fed.

Finally, the producer prices report is important as it will show inflation at the producer level.

USD/CAD weekly technical forecast: RSI signals weakness in a bullish trend.

The bias for USD/CAD on the daily chart is bullish. After making a higher low at the 1.3501 key level, the price has made a higher high. Moreover, it has respected the 30-SMA as support, confirming the bullish bias.

-If you are interested in forex day trading then have a read of our guide to getting started-

Meanwhile, the RSI supports bullish momentum as it is nearly overbought. However, it has formed a slight bearish divergence with the price, which indicates some weakness in the bullish trend. Currently, the price has paused at the 1.3701 resistance level. Since the RSI shows that bulls have weakened, there might be a pullback or reversal from this level. A pullback would pause at the 30-SMA support, while a reversal would break below to retest the 1.3501 support.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.