- US retail sales came in weaker than expected, indicating lower consumer spending.

- Continuing claims in the US reached new highs, showing increased unemployment.

- Canada will release inflation and GDP data, showing the economy’s state and giving clues about the Bank of Canada’s rate cut outlook.

The USD/CAD weekly forecast points south as market participants expect the Fed to cut rates starting in September of this year.

Ups and downs of USD/CAD

The USD/CAD pair had a red week, ending lower as the dollar fell after a mix of data. Markets focused on retail sales, employment and PMI data. Retail sales came in weaker than expected, indicating lower consumer spending. Consequently, Fed rate cut expectations rose. Furthermore, although initial jobless claims fell, continuing claims reached new highs, showing increased unemployment.

–Are you interested in learning more about forex tools? Check our detailed guide-

However, PMI data showed robust business activity in the US as the manufacturing and services sectors expanded more than expected.

Next week’s key events for USD/CAD

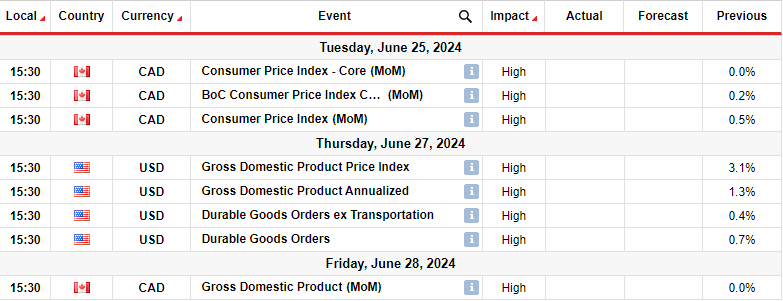

Next week, Canada will release inflation and GDP data, showing the economy’s state and giving clues on the Bank of Canada’s rate cut outlook. Meanwhile, the US will release data on GDP and durable goods orders.

Last week, the Bank of Canada became the first major central bank to cut interest rates. Investors are now keen to see whether this cycle will continue. A bigger-than-expected easing in inflation could give policymakers more confidence to lower borrowing costs. However, a spike could lead to a pause as the central bank adjusts accordingly.

In the US, the GDP report could further pressure the Fed to start cutting interest rates since the last report showed a massive drop from 3.4% to 1.3% growth.

USD/CAD weekly technical forecast: Bears struggle to reverse trend

On the technical side, the USD/CAD price is on the verge of breaking below the 22-SMA. Such an outcome would indicate a shift in sentiment. At the same time, the RSI is about to dip into bearish territory below 50.

–Are you interested in learning more about next crypto to explode? Check our detailed guide-

The price recently made a choppy break below its bullish trendline, indicating that bears were ready to reverse the trend. However, to confirm a reversal, the price must break below the 1.3605 support level to make a lower low. If this happens, the path for bears to retest the 1.3400 support level will be clear.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.