- In November, Australia’s employment exceeded expectations for the second consecutive month.

- The Reserve Bank of Australia may have concluded its tightening cycle.

- Following the Federal Reserve’s latest economic projections, the dollar hit a fresh four-month low.

Thursday saw a bullish AUD/USD forecast as the Australian dollar catapulted to an almost five-month peak, fueled by robust employment data. However, the excitement in the air is met with a twist. Futures markets currently indicate a prevailing sentiment: the Reserve Bank of Australia may have concluded its tightening cycle. Moreover, expectations now include more than 50 basis points of easing for 2024.

–Are you interested to learn more about ECN brokers? Check our detailed guide-

In November, Australia’s employment exceeded expectations for the second consecutive month. Notably, there was an increase of 61,500 jobs compared to a revised 42,700 in October, surpassing the anticipated rise of around 11,000. However, the unemployment rate rose to 3.9%, the highest since last May. More individuals actively sought employment, contributing to signs of a loosening labor market. Meanwhile, the participation rate reached a record high of 67.2%.

Last week, the RBA maintained interest rates at a 12-year high of 4.35%. Furthermore, to curb inflation, the RBA has undertaken an aggressive tightening campaign, raising interest rates by 425 basis points—the most substantial in the bank’s history.

Meanwhile, the dollar hit a fresh four-month low following the Federal Reserve’s latest economic projections. The Fed signaled the conclusion of the interest-rate hike cycle. Moreover, policymakers expect lower borrowing costs in 2024.

AUD/USD key events today

- US core retail sales

- US unemployment claims

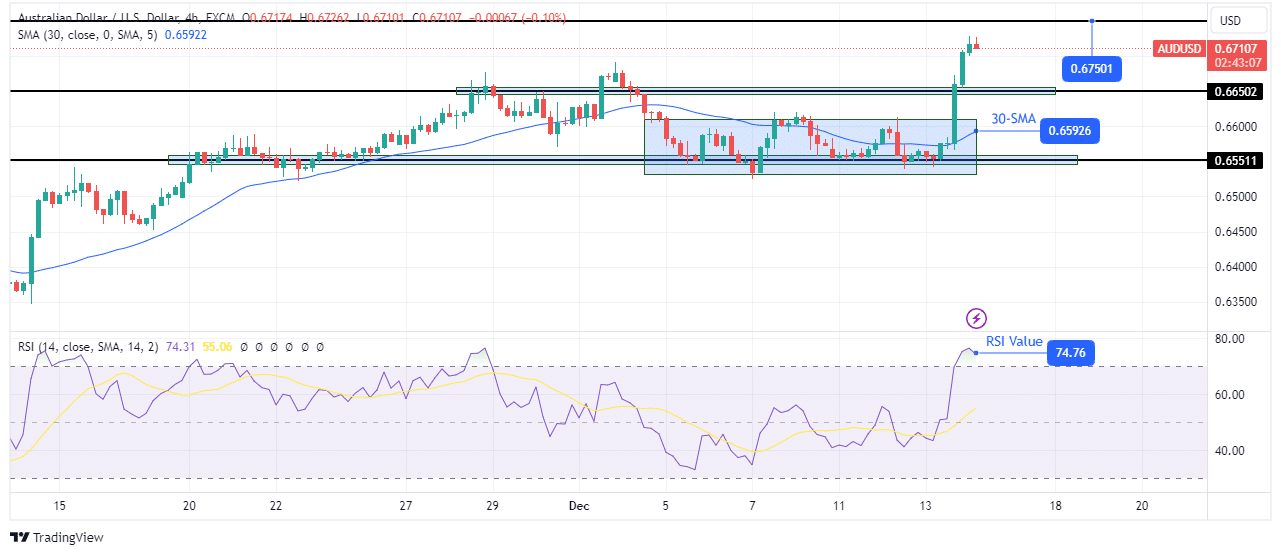

AUD/USD technical forecast: Bulls break free from consolidation

AUD/USD bulls have broken out of consolidation with a sharp move on the charts. The previous bullish move paused when bullish momentum weakened at the 0.6650 key resistance level.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

Consequently, bears pushed the price below the 30-SMA, leading to a bearish sentiment shift. However, this new direction was short-lived as the price failed to trade below the 0.6551 key support level.

As a result, the price entered a period of consolidation, with bears and bulls battling for control. Eventually, bulls took control with a break above the range area resistance and the 0.6650 key level. At the same time, the RSI rose to the overbought level, indicating strong bullish momentum. The next hurdle for the pair is at the 0.6750 key level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.