- The gold price bias remains bullish in the short term as the US dollar is bearish.

- Taking out the pivot point activates further growth.

- The US economic data should bring sharp movements.

The gold price seems undecided in the short term. The precious metal is trading at $2,041, below yesterday’s high of $2,047.

The upside pressure remains high as the US dollar maintains a bearish bias. The XAU/USD stays higher even though the US Retail Sales, Core Retail Sales, and Unemployment Claims came in better than expected in the last session. As you already know, the yellow metal rallied as the markets expect the Federal Reserve to deliver a 75-bps rate cut next year.

–Are you interested to learn more about ECN brokers? Check our detailed guide-

Today, the Chinese, Eurozone, and UK data came in mixed. The traders are waiting for the US data before taking action. The Flash Services PMI could be reported at 50.7 versus 50.8 in the previous reporting period, while the Flash Manufacturing PMI could jump from 49.4 points to 49.5 points.

Furthermore, the Empire State Manufacturing Index is expected at 2.0 points, the Capacity Utilization Rate could jump to 79.1% to 78.9%, while Industrial Production could report a 0.3% growth after the 0.6% drop in the previous reporting period.

Gold Price Technical Analysis: Attractive for Buyers

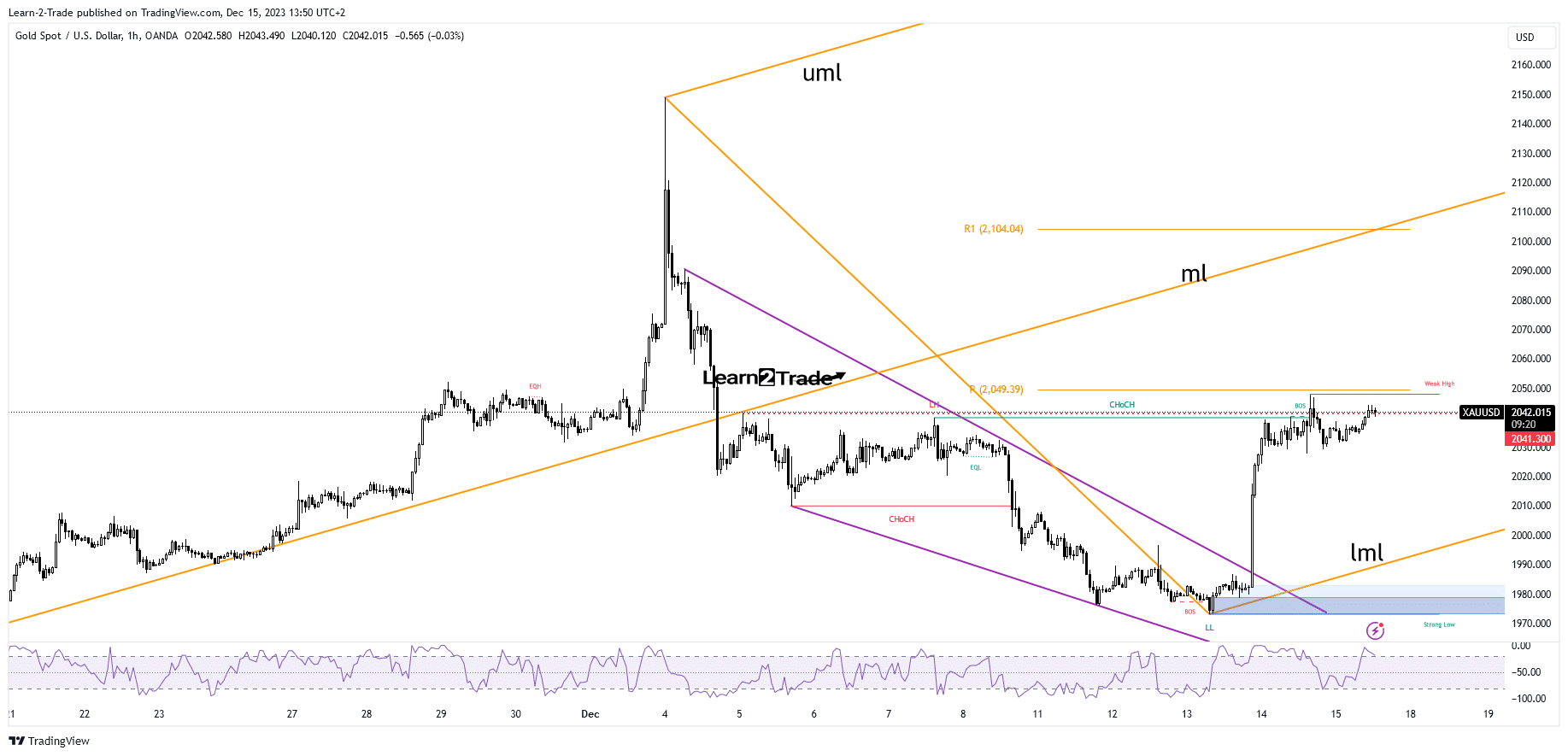

From the technical point of view, the price continues to challenge the static resistance of $2,041. The minor sideways movement could represent an upside continuation pattern. The price tried to attract more buyers before extending its gains.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

The weekly pivot point of $2,049 represents a static resistance as well. It remains to see how it reacts around these upside obstacles. False breakouts followed by a new lower low may announce a potential sell-off. On the contrary, taking out the pivot point may announce further growth. The median line (ml) represents a major upside target.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.