- Gold could jump higher as long as it stays above the lower median line.

- A new higher high activates further growth.

- The US CB Consumer Confidence should bring high action.

The gold price is trading in the red at $2,036 at the time of writing. However, the outlook is neutral in the short-term canvas. The precious metal has changed slightly despite the high-impact data release.

–Are you interested to learn more about scalping brokers? Check our detailed guide-

It has retreated a little from the yesterday’s top of $2,047 but the upside pressure remains high. The US Housing Starts came in at 1.56M versus 1.36M expected. However, the Building Permits were disappointing in the last session. Furthermore, Canada revealed higher than expected inflation, while the BoJ maintained the monetary policy.

Today, the United Kingdom Consumer Price Index reported 3.9% growth, less compared to the 4.3% growth estimated and versus the 4.6% growth in the previous reporting period.

In addition, the Core CPI increased only by 5.1% versus 5.6% growth forecasted, while HPI reported a 1.2% drop compared to the 0.0% growth estimated.

Later, the US data should impact the markets. The CB Consumer Confidence represents a high-impact event and is expected at 104.6 points above 102.0 points in the previous reporting period. Moreover, the Existing Home Sales and Current Account data should be released as well.

Gold Price Technical Analysis: Strong Upside Pressure

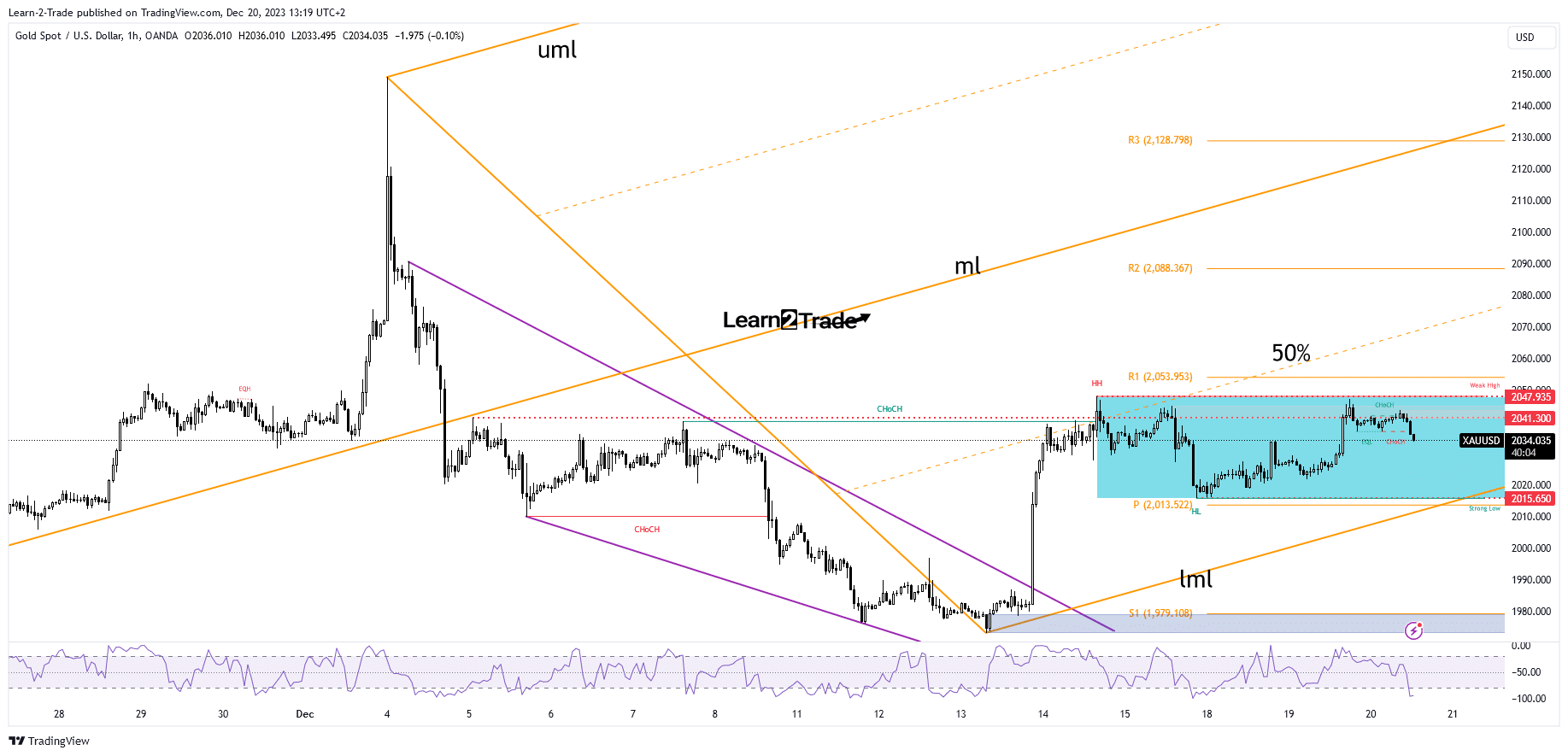

Gold price is trapped between the $2,047 and $2,015 in the short-term. Its failure to reach the range resistance triggered buyers’ exhaustion. As indicated in the previous analysis that the XAU/USD could extend its growth if it stays above the lower median line (lml) of the ascending pitchfork.

–Are you interested to learn about forex robots? Check our detailed guide-

Still, only a new higher high, a valid breakout through the range’s resistance of $2,047 can activate an upside continuation. Coming back to test the lower median line (lml) and the $2,015 could bring us new long opportunities.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.