- The US and Canadian data should move the rate today.

- A new higher high activates further growth.

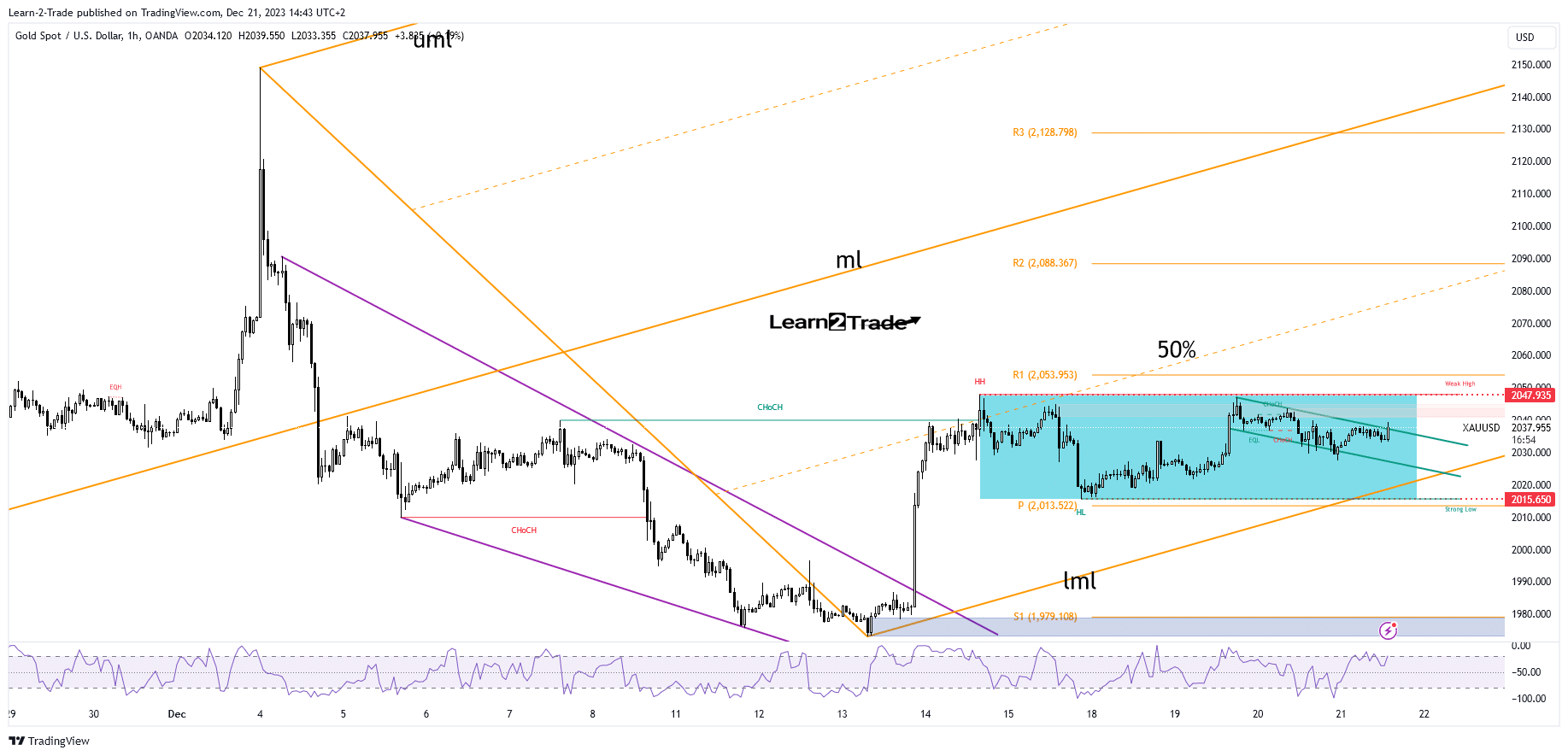

- The bias remains bullish as long as it stays above the lower median line (LML).

The gold price is trading in the green at $2,037 at the time of writing. The precious metal tries to resume its upside movement. The US dollar remains bearish, so a deeper drop can be expected.

–Are you interested to learn more about forex options trading? Check our detailed guide-

This scenario helps the XAU/USD buyers to take it higher. Still, the fundamentals could shake the price today. In the short term, the yellow metal dropped a little only because the US CB Consumer Confidence and Existing Home Sales came in better than expected in the last trading session.

Today, the US is to release high-impact data, such as the Final GDP, which may announce a 5.2% growth again, and the Unemployment Claims indicator, which is expected at 214K in the last week, above 202K in the previous reporting period. Also, the Final GDP Price Index, Philly Fed Manufacturing Index, and CB Leading Index data will be released.

The yellow metal remains under strong upside pressure despite temporary retreats. The Canadian retail sales data could significantly impact the XAU/USD later.

Tomorrow, the US publishes the Revised UoM Consumer Sentiment, New Home Sales, Durable Goods Orders, Core Durable Goods Orders, and the Core PCE Price Index.

Gold Price Technical Analysis: Flag Pattern

From a technical point of view, the XAU/USD retreated a little after failing to reach the $2,047 mark on the last attempt. Still, the short-term correction seems over. The price developed a flag pattern, seen as an upside continuation formation.

–Are you interested to learn more about forex tools? Check our detailed guide-

It challenges the flag’s resistance, so we must wait for confirmation before taking action. Also, from my previous analysis, you knew that the yellow metal is trapped between $2,015 and $2,047 levels.

The bias remains bullish as long as it stays above the lower median line (LML). Activating the flag formation and making a new higher high, a valid breakout through 2,047 validates further growth.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.