- Elevated geopolitical tensions in the Middle East dampened risk sentiment.

- Recent data indicated a moderate increase in US prices for December.

- The US Federal Reserve will most likely keep rates unchanged on Tuesday.

Today’s EUR/USD forecast revealed a subtle bearish tilt. The dollar held steady as investors carefully evaluated crucial US economic data ahead of the eagerly anticipated Fed policy meeting. At the same time, an undercurrent of elevated geopolitical tensions in the Middle East dampened risk sentiment, further supporting the dollar.

–Are you interested in learning more about ETF brokers? Check our detailed guide-

Recent data indicated a moderate increase in US prices for December, keeping the annual inflation rise below 3% for a third consecutive month. As a result, it reinforced the prevailing anticipation of potential rate cuts later in the year. Meanwhile, this week, investors will focus on the Fed’s two-day policy meeting starting on Tuesday. The central bank will most likely keep rates unchanged. Therefore, the focus will be on the comments of Fed Chair Jerome Powell.

Elsewhere, traders bet heavily on Thursday that the ECB would start cutting rates in April. They believe policymakers are more comfortable with the inflation outlook. Notably, the ECB failed to mention that domestic price pressures remain elevated. As a result of this omission, markets believe that the ECB is increasingly convinced that inflation is slowing down.

Meanwhile, a survey on Friday revealed that there will be a downturn in German consumer sentiment for February, as households remain concerned amid the economic uncertainty. This setback dashed any hopes of a recovery for Europe’s largest economy following a slight rebound at the beginning of the year.

EUR/USD key events today

It will likely be a slow day for the pair as no high-impact events are scheduled for today.

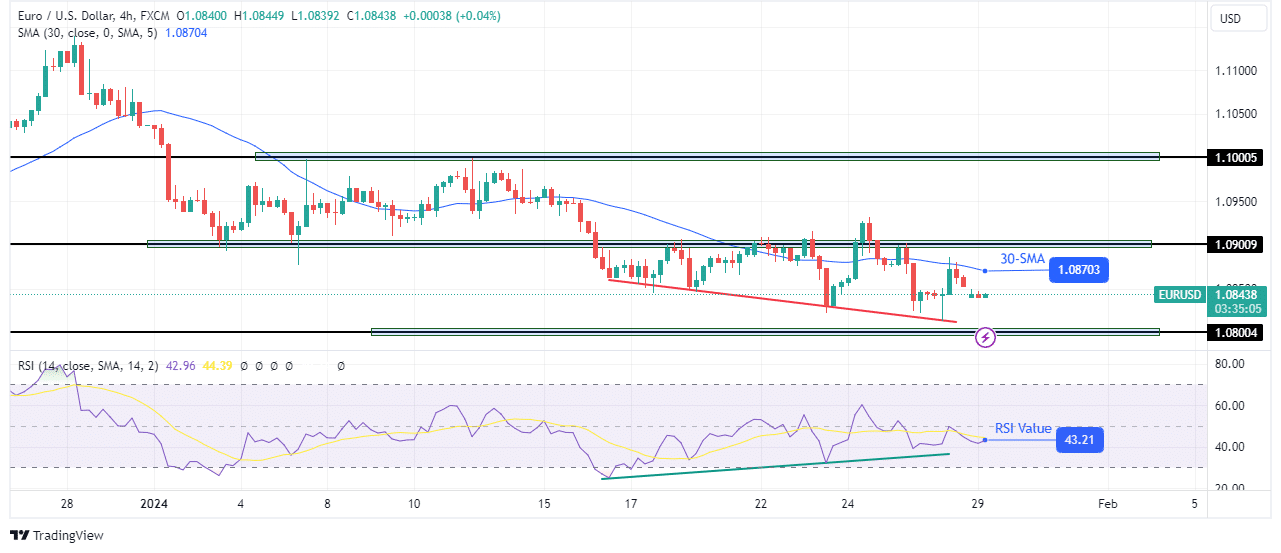

EUR/USD technical forecast: RSI bullish divergence

On the technical side, the bias for EUR/USD is bearish. The price has made lower lows and highs and is trading below the 30-SMA. At the same time, the RSI is below 50, indicating strong bearish momentum.

–Are you interested in learning more about Canada forex brokers? Check our detailed guide-

Moreover, the price currently trades with the nearest resistance at 1.0900 and the nearest support at 1.0800. However, the current bearish move might be nearing its end as the RSI has made a bullish divergence. Therefore, the trend might reverse if bulls break above the 30-SMA and the 1.0900 resistance.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money