- Fed policymakers said there was no urgency to start cutting interest rates.

- The likelihood of a March cut has dropped to 18.5%.

- Uchida was less hawkish when he said the BoJ would not hike rates aggressively.

Thursday’s USD/JPY forecast brightened with a bullish tone as the dollar strengthened following mildly hawkish comments from Fed policymakers. At the same time, the yen found itself on shaky ground as the BoJ’s deputy governor dismissed the likelihood of rapid rate hikes.

–Are you interested in learning more about ETF brokers? Check our detailed guide-

Fed policymakers continued to push back on rate cut expectations, saying there was no urgency to start cutting interest rates. Moreover, when the Fed does start easing monetary policy, there will be no need to do it quickly.

Consequently, bets for rate cuts continued dropping. The most recent figures show that the likelihood of a March cut has dropped to 18.5%. Meanwhile, there is a 60% chance that the Fed will cut rates by 25bps in May.

On the other hand, the outlook on monetary policy in Japan is different. While traders expect cuts in the US, they expect rate hikes in Japan. However, BoJ deputy governor Shinichi Uchida was less hawkish when he said they would not hike rates aggressively.

Still, this is a big shift from the central bank’s dovish tone. There is more hope in the market that Japan will move from negative interest rates. Moreover, the central bank is set to start easing its massive stimulus.

Furthermore, Uchida said the conditions for moving out of negative interest rates were aligning. Companies in Japan are hiking wages and pushing up service sector prices. As a result, markets expect the BoJ to start hiking interest rates in March or April.

USD/JPY key events today

- US unemployment claims

USD/JPY technical forecast: Bulls are poised to surpass the 148.51 barrier

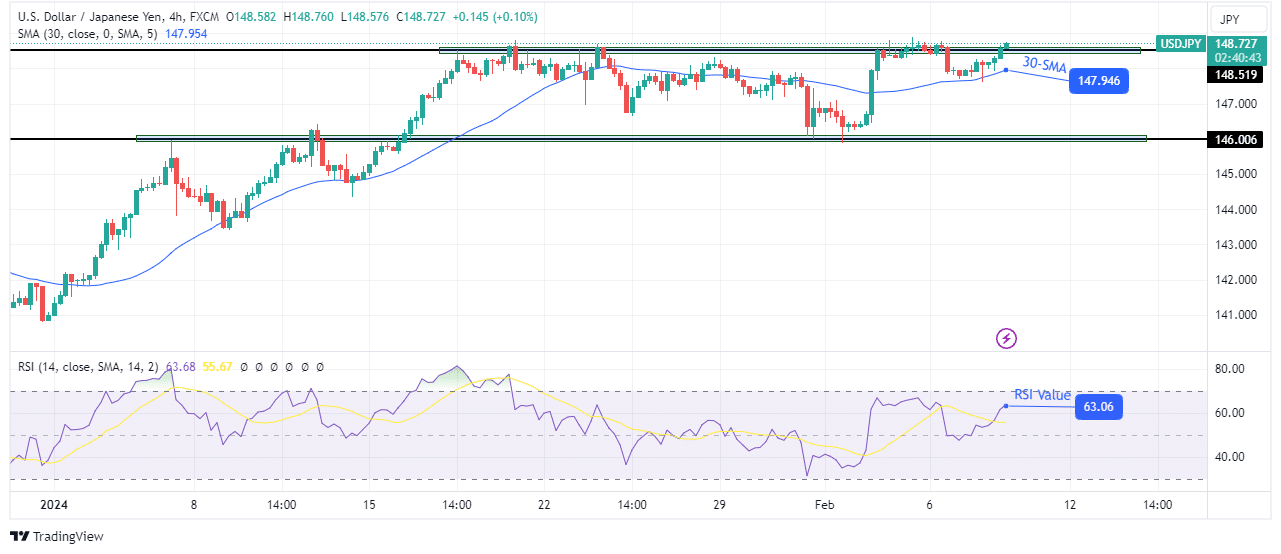

On the technical side, USD/JPY is on the brink of pushing beyond the 148.51 resistance level. Initially, this level led to a pause in the bullish move, allowing bears to take over. However, the retracement was short-lived as the price found solid support at the 146.00 key level.

–Are you interested in learning more about Canada forex brokers? Check our detailed guide-

At this level, bulls returned stronger, pushing the price above the 30-SMA to retest the 148.51 resistance. The first attempt failed, leading to a retest of the 30-SMA support. However, the bullish bias remained strong as the price stayed above the SMA. At the same time, the RSI stayed above 50 in bullish territory.

Therefore, there is a high chance that the price will break above the 148.51 resistance this time.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money