- Statistics Canada revealed that employment rose by nearly twice what analysts had expected.

- Investors dialed back bets on early rate cuts by the Bank of Canada.

- US data revealed a downward revision to December’s inflation figure.

The USD/CAD forecast pointed down on Monday as investors continued to absorb Canada’s positive jobs report. On Friday, Statistics Canada revealed that employment rose nearly twice as much as analysts had expected.

–Are you interested in learning more about copy trading platforms? Check our detailed guide-

Meanwhile, wage growth and unemployment experienced slight declines. Still, the overall picture was of a resilient labor market. As a result, investors dialed back bets for early rate cuts by the Bank of Canada. At the moment, markets expect the first rate cut in June.

This has also been the case in the US, where policymakers are waiting patiently to see that inflation is reaching the 2% target. Notably, the dollar weakened on Friday after data revealed a downward revision to December’s inflation figure.

However, the outlook for Fed rate cuts remained the same, with nearly no chance they will start in March. At the same time, bets for March have gradually fallen and are now showing a 60% chance of a rate cut.

Elsewhere, oil prices paused their recent rally after gaining about 6% last week. The pause on Monday came after Israel said it was done with strikes on Southern Gaza. As a result, this eased concerns of supply disruptions in the Middle East. Notably, reduced tensions in the area might lead to further declines in oil, which would hurt the Canadian dollar.

USD/CAD key events today

Investors do not expect any major releases from the US or Canada today. Therefore, it could be a slow day for the pair.

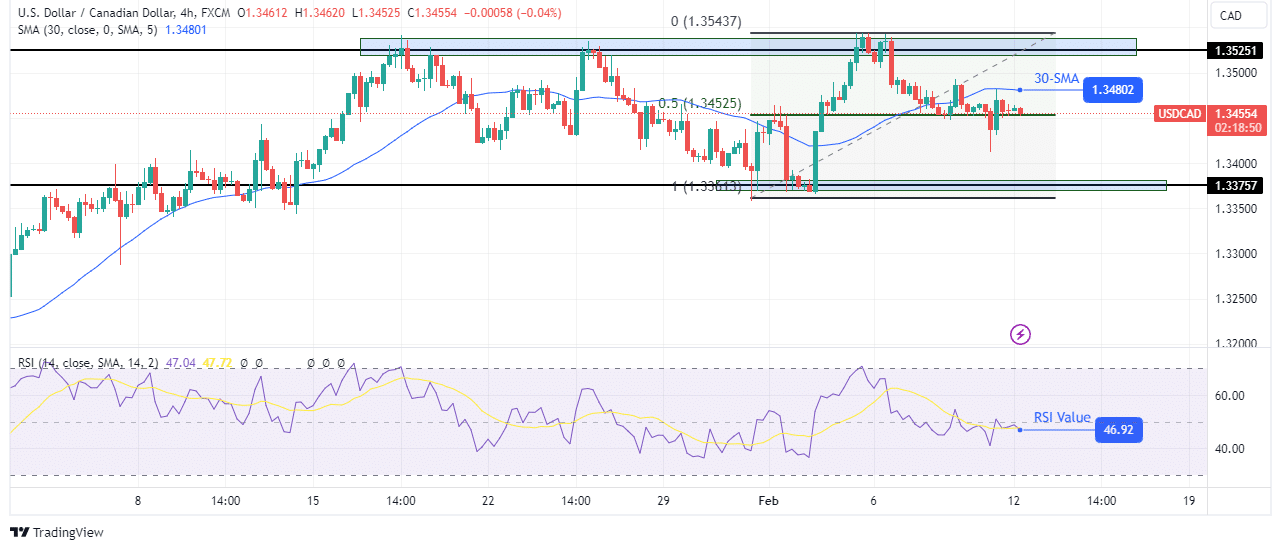

USD/CAD technical forecast: Bears eye break below 0.5 fib support

On the technical side, the USD/CAD pair has paused near the 0.5 Fib retracement level. Moreover, the price trades with the nearest support at 1.3375 and the nearest resistance at 1.3525. Meanwhile, the indicators on the chart show that bears have the upper hand as the price trades below the 30-SMA with the RSI slightly below 50.

–Are you interested in learning more about scalping forex brokers? Check our detailed guide-

Therefore, there is a high chance bears will soon break below the 0.5 fib support. Afterward, the price will likely drop to the 1.3375 support level. However, the price must break below 1.3375 and start making lower lows for the price to trend lower.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money