- The dollar rallied on upbeat inflation data.

- Core US inflation rose to 0.4% in January, beating forecasts.

- The probability of a cut in May has dropped below 50%.

Wednesday’s USD/CAD price analysis painted a bullish picture, with the pair lingering near the highs hit on Tuesday.

–Are you interested to learn more about forex options trading? Check our detailed guide-

The surge was fueled by the dollar’s remarkable rally, spurred by upbeat inflation data. Notably, the currency experienced its most significant move in nearly a year.

The headline inflation figure fell from 3.4% in December to 3.1% in January, continuing the downtrend. However, this figure was much higher than what economists had expected. Moreover, core inflation rose to 0.4% in January, beating forecasts.

As the Fed highlighted at the last policy meeting, the economy is still resilient, particularly in the labor sector. Consequently, the decline in inflation has slowed to a crawl and might not convince policymakers to start cutting interest rates soon.

Additionally, markets have eliminated the chances of a cut in March. Meanwhile, the probability of a cut in May has dropped below 50%. The earliest possible time for the first Fed rate cut might be June.

The Canadian dollar fell despite a surge in oil prices. Usually, rising oil prices support the currency as Canada is a net oil exporter. However, the rise in the dollar after the inflation report was broad, weakening most major currency pairs.

Elsewhere, the Bank of Canada is also pushing back on rate cut expectations, saying inflation is still too high. Investors will wait for Canada’s inflation report next Tuesday to get insight into the possible timing for rate cuts in Canada.

USD/CAD key events today

Traders will keep digesting the US inflation reports and adjusting rate-cut bets as today’s event calendar is free of high-impact releases.

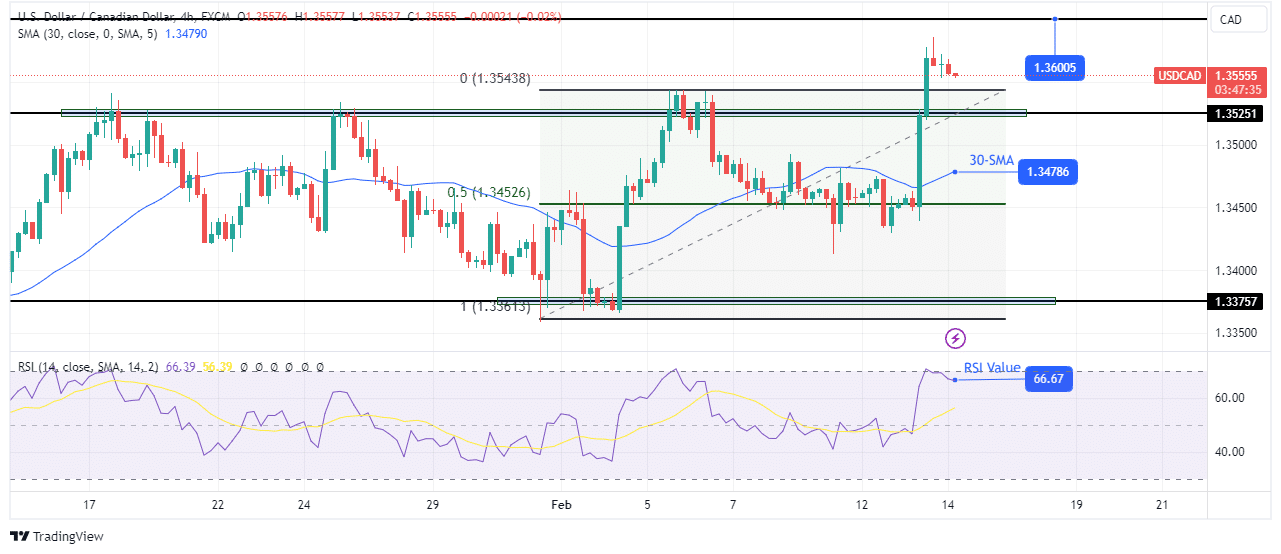

USD/CAD technical price analysis: Bullish momentum surges, making a new high

On the technical side, the USD/CAD price finally broke above the 30-SMA after consolidating around the 0.5 Fib retracement level. Moreover, such strong bullish momentum pushed the price beyond the 1.3525 resistance. As a result, there is a new high, showing bulls are in control. The price now sits well above the 30-SMA with the RSI near the overbought region, indicating solid bullish momentum.

-If you are interested in knowing about scalping forex brokers, then read our guidelines to get started-

However, there might be a pause or a pullback to retest the recently broken 1.3525 level before the price continues rising. If it finds support at 1.3525, it will likely climb to the 1.3600 key resistance level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.