- Canada’s economy expanded at an annual rate of 1.0% in the fourth quarter.

- The Bank of Canada will likely pause rates next week.

- US inflation data came in line with expectations.

Friday’s USD/CAD outlook took a mildly bearish turn, influenced by the Canadian dollar’s strength following encouraging economic data from Canada. Particularly noteworthy was Canada’s economic expansion of 1.0% in the fourth quarter, which beat forecasts. As a result, there was a decline in rate cut expectations.

–Are you interested to learn more about automated forex trading? Check our detailed guide-

The Bank of Canada had expected zero growth while economists had forecast 0.8% growth in Q4. Unlike Japan and the UK which slipped into a recession at the end of 2023, Canada’s economy is slowly expanding. Therefore, there is little pressure on the Bank of Canada to cut interest rates.

Investors are eagerly awaiting the next BoC policy meeting next week, to get insight into the outlook for interest rates in Canada. The central bank will likely pause rates as they have done for the last few meetings. However, high interest rates have gradually slowed both inflation and growth. Therefore, pressure has been mounting on the central bank to cut interest rates. Markets currently place an 80% chance of a rate cut in June.

Inflation in Canada has gradually fallen from a high of 8.1% to 2.9%. However, policymakers are still not convinced that it is under control.

Meanwhile, the dollar was weaker a day after inflation data came in line with expectations. The PCE price index showed an increase in the monthly figure. However, a decline in the annual figure reinforced expectations of a Fed rate cut in June.

USD/CAD key events today

- US ISM manufacturing PMI

- US consumer sentiment

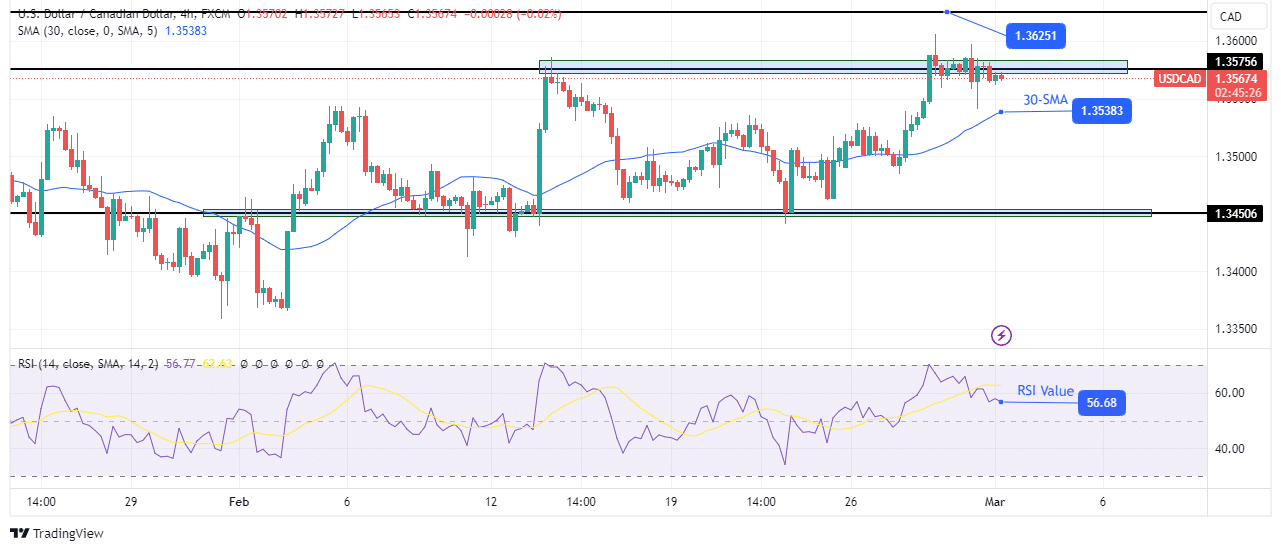

USD/CAD technical outlook: Price takes a breather at 1.3575 resistance

On the technical side, the USD/CAD price has paused near the 1.3575 key resistance level. The pause comes after a bullish move starting at the 1.3450 support level that pushed above the 30-SMA resistance line. Therefore, the bias is bullish. Moreover, the RSI sits above 50, showing solid bullish momentum.

–Are you interested to learn more about forex signals? Check our detailed guide-

Consequently, bulls might be waiting at the nearest support level to resume the uptrend. At the moment, the nearest support is at the 30-SMA. Therefore, the price might consolidate or fall, as the SMA catches up. When it does, bulls might reemerge to push the price to the 1.3625 key level.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.