- The annual US PCE figure indicated a gradual decline in inflation.

- Fed rate-cut bets for June rose above 65%.

- Inflation data in countries like Germany, France, and Spain eased in January.

The EUR/USD weekly forecast leans slightly bearish as Eurozone inflation takes a dip, exerting pressure on the ECB to consider interest rate cuts.

Ups and downs of EUR/USD

EUR/USD had a slightly bearish week amid inflation data from the US and the Eurozone. It was a mostly calm week, with few high-impact reports on the calendar. Notably, the US personal consumption expenditures report revealed a mixed picture of inflation in the US. While the monthly figure rose, the annual figure indicated a gradual decline in inflation. Consequently, rate-cut bets for June rose above 65%.

–Are you interested in learning more about CFD brokers? Check our detailed guide-

Meanwhile, inflation in countries like Germany, France, and Spain eased in January, increasing pressure on the ECB to cut interest rates. Moreover, estimates for Eurozone inflation revealed a decline that saw the pair fall.

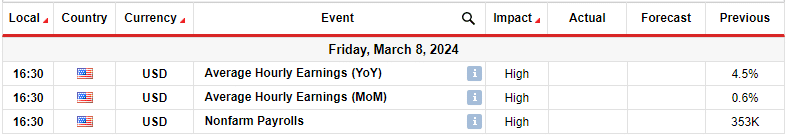

Next week’s key events for EUR/USD

Next week, traders will analyze employment figures from the US for clues on the timing of Fed interest rate cuts. In January, the country recorded 353K jobs, an impressive surge from the previous month. Moreover, it was well above estimates, leading to a decline in the pair and a drop in rate-cut expectations.

The labor market and the economy at large have continued to show resilience despite higher interest rates. As a result, Fed speakers have pushed back expectations of Fed interest rate cuts. Markets now believe the first cut will come in June.

Therefore, a higher-than-expected reading on employment could lead to further delays in interest rate cuts. On the other hand, a decrease would increase bets for a cut in June.

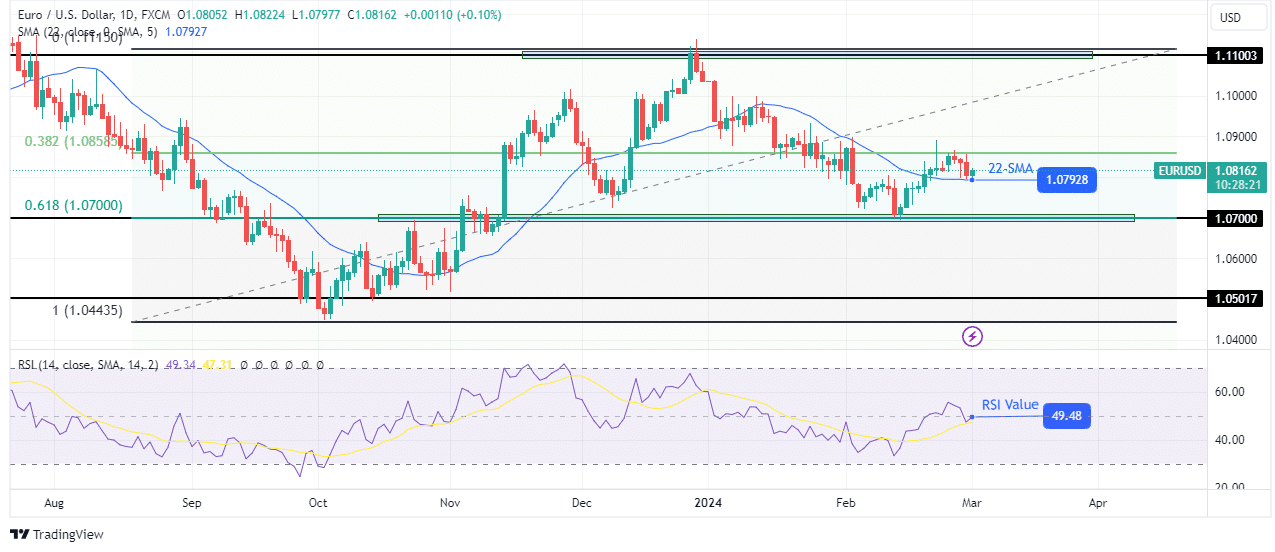

EUR/USD weekly technical forecast: Bulls eyeing opportunity above 22-SMA

On the technical side, EUR/USD has gone above the 22-SMA, a sign that bulls might be ready to take over. The previous decline paused at a solid support zone comprising the 1.0700 key psychological level and the 0.618 Fib retracement level.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

The bullish move paused to retest the recently broken SMA before likely continuing higher. If the SMA holds firm as support, the price will get a chance to retest the 1.1100 resistance level. However, if bears are still strong, the price might break below the SMA and the 1.0700 support level. This would allow the price to target the 1.0501 support level.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.