- The dollar weakened after Powell confirmed the likelihood of a rate cut.

- The ECB held rates on Thursday, with markets expecting the first rate cut in June.

- A mixed US employment report revealed some cracks in the US labor market.

The EUR/USD weekly forecast shows upside potential for the pair as investors gain more confidence in a Fed rate cut by June.

Ups and downs of EUR/USD

EUR/USD ended last week in the green as investors got a clearer picture of the Fed’s policy outlook. Notably, the dollar weakened after Powell confirmed the likelihood of a rate cut before the year ends. Still, he stated that the Fed would keep assessing incoming data for evidence that inflation is heading for the 2% target.

–Are you interested in learning more about making money with forex? Check our detailed guide-

Meanwhile, the ECB held rates on Thursday, with markets expecting the first rate cut in June. However, dollar weakness kept the euro up. Moreover, a mixed US employment report revealed some cracks in the US labor market, further weakening the dollar. The unemployment rate beat forecasts, rising to 3.9%.

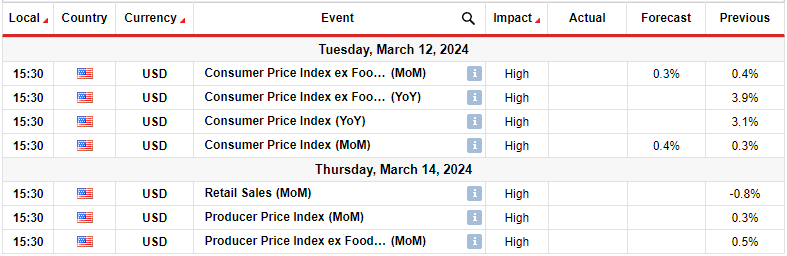

Next week’s key events for EUR/USD

Next week, traders will assess consumer and producer inflation reports from the US. Moreover, there will be a report on retail sales. Markets have been speculating on the possible timing of the first rate cut. Last week, Powell said they are waiting for more evidence that inflation is on a downtrend.

Therefore, investors will watch for signs that headline and core inflation are descending. A decline in inflation will push up bets that the Fed will cut rates in June. On the other hand, if inflation remains persistent, the dollar might recover as rate-cut bets drop.

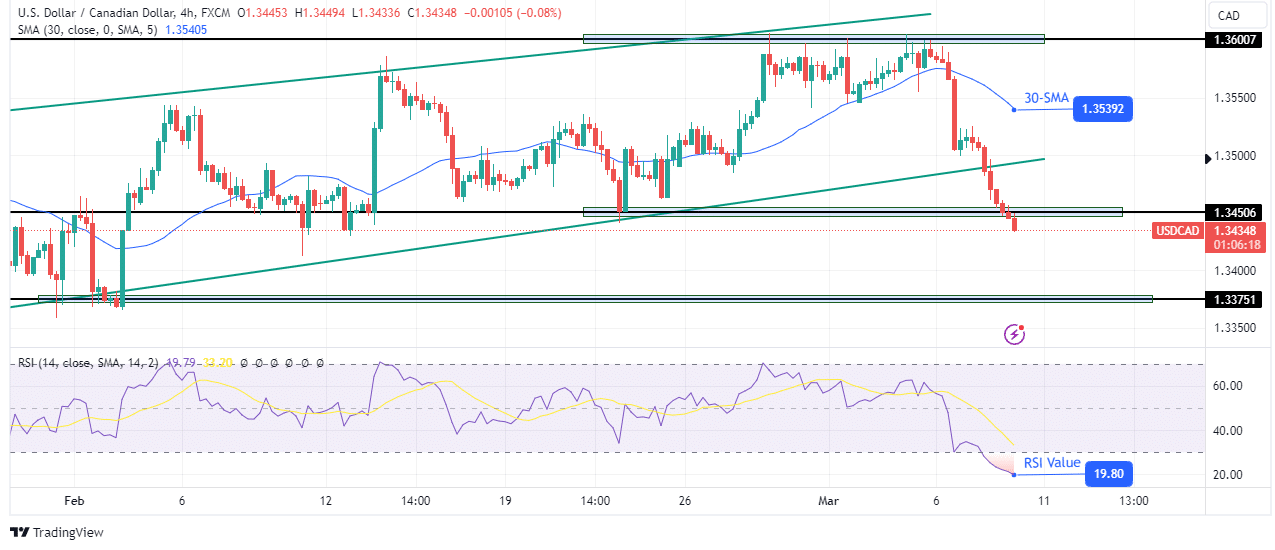

EUR/USD weekly technical forecast: Price rises strongly from 0.618 Fib support

On the technical side, EUR/USD is climbing after finding support at the 0.618 Fib retracement level. Bears managed to retrace 61.8% of the previous bullish move before bulls took back control by breaking above the 22-SMA.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

Initially, the bullish trend paused at the 1.1100 key resistance level. This allowed the bears to take control. However, the bearish move was temporary. Therefore, bulls will likely retarget the 1.1100 resistance level. Moreover, a break above this solid resistance would confirm a continuation of the previous bullish move. The bullish trend will continue as long as the price stays above the 22-SMA and the RSI stays in bullish territory above 50.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.