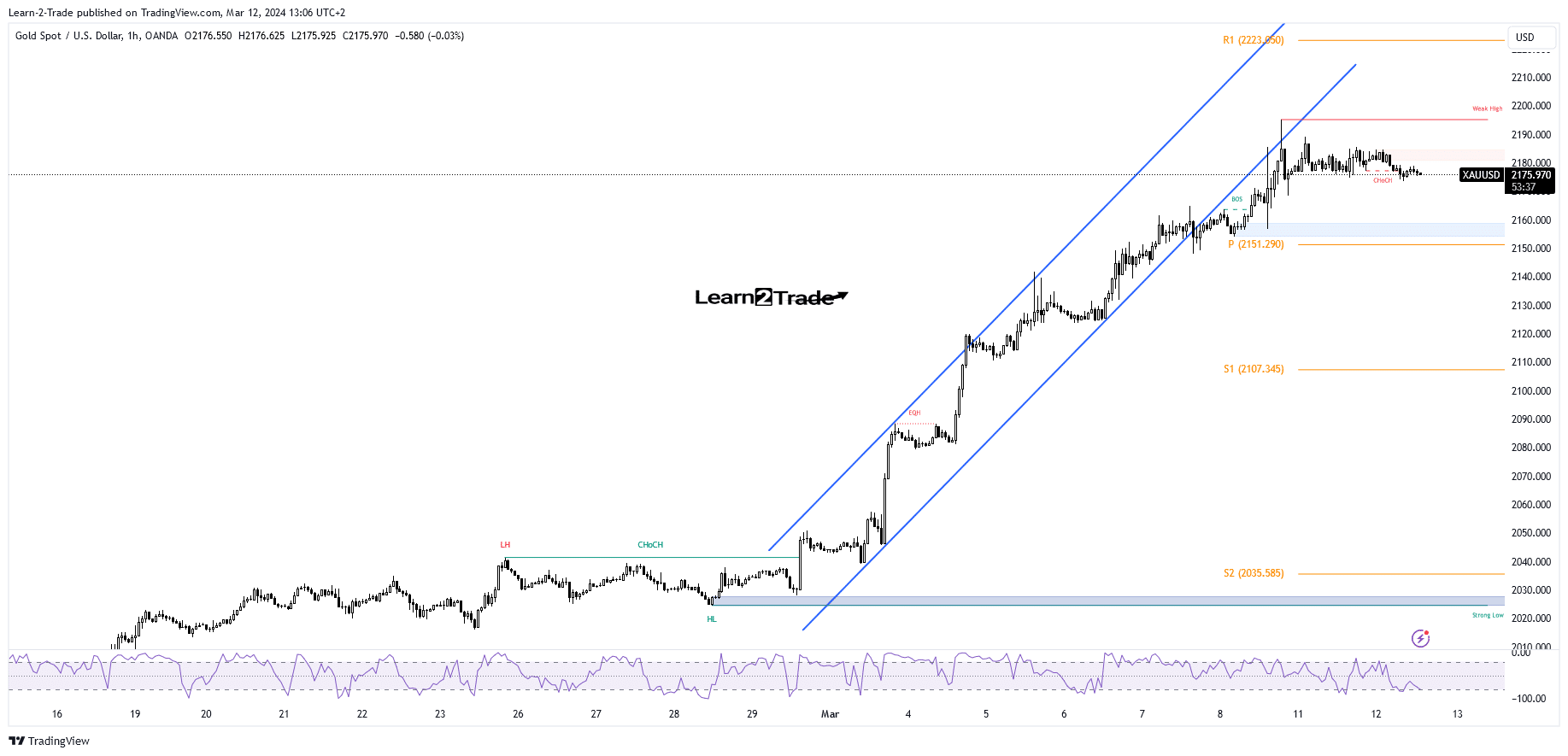

- XAU/USD escaped from an up channel, signaling an overbought situation.

- Taking out the pivot point activates more declines.

- The US inflation figures should shake the markets.

The gold price climbed to $2,195 on Friday, registering a new all-time high. Now, the metal has retreated a little and is trading at $2,175 at the time of writing.

–Are you interested in learning more about making money with forex? Check our detailed guide-

The fundamentals should move today’s prices as the US releases the inflation figures. The Consumer Price Index is expected to report a 0.4% growth in February versus the estimated 0.3% growth so that CPI y/y could announce a 3.1% growth for the second month in February. Meanwhile, the Core CPI is expected to register a 0.3% growth after a 0.4% growth in January. Higher inflation should boost the greenback, as the FED should postpone a first rate cut.

The Federal Reserve is expected to deliver a 75-bps cut this year. On the contrary, lower inflation should weaken the USD. Still, it remains to see how the yellow metal reacts as the price action signaled an overbought situation.

XAU/USD turned to the downside ahead of the US figures. These should bring high volatility and sharp movements.

Earlier, the UK reported mixed data. The Unemployment Rate jumped from 3.8% to 3.9% even if the specialists expected the rate to stay at 3.8%, Average Hourly Earnings reported a 5.6% growth, less versus the 5.7% growth estimated, while Claimant Count Change came in at 16.8K points, above the 20.3K forecasts.

Gold Price Technical Analysis: Ranging After Fresh All-time High

The XAU/USD climbed toward new highs within an up-channel pattern. The price dropped below the uptrend line, signaling exhausted buyers and an overbought. The yellow metal tested the broken uptrend line (channel’s support) and seems determined to print a corrective phase.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

The weekly pivot point of $2,151 is a potential downside target and obstacle. A larger downside movement could be activated only after making a valid breakdown through this support.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money